- Brazil

- /

- Healthcare Services

- /

- BOVESPA:AALR3

Reflecting on Centro de Imagem Diagnósticos' (BVMF:AALR3) Share Price Returns Over The Last Three Years

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term Centro de Imagem Diagnósticos S.A. (BVMF:AALR3) shareholders, since the share price is down 49% in the last three years, falling well short of the market return of around 40%. The more recent news is of little comfort, with the share price down 46% in a year. Furthermore, it's down 28% in about a quarter. That's not much fun for holders.

See our latest analysis for Centro de Imagem Diagnósticos

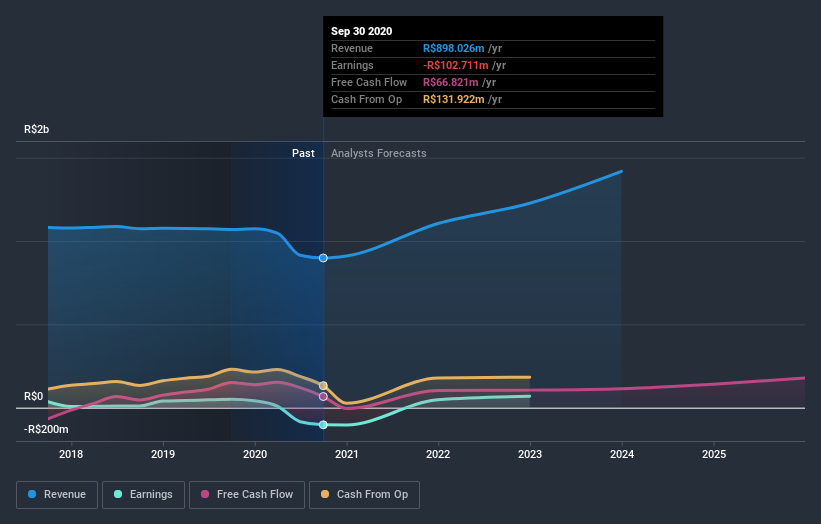

Because Centro de Imagem Diagnósticos made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, Centro de Imagem Diagnósticos' revenue dropped 4.4% per year. That's not what investors generally want to see. The stock has disappointed holders over the last three years, falling 14%, annualized. That makes sense given the lack of either profits or revenue growth. However, in this kind of situation you can sometimes find opportunity, where sentiment is negative but the company is actually making good progress.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Centro de Imagem Diagnósticos' financial health with this free report on its balance sheet.

A Different Perspective

The last twelve months weren't great for Centro de Imagem Diagnósticos shares, which cost holders 45%, including dividends, while the market was up about 21%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 14% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Centro de Imagem Diagnósticos better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Centro de Imagem Diagnósticos you should be aware of, and 1 of them is potentially serious.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BR exchanges.

If you decide to trade Centro de Imagem Diagnósticos, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:AALR3

Alliança Saúde e Participações

Provides diagnostic medicine services in Brazil.

Mediocre balance sheet very low.

Market Insights

Community Narratives