Três Tentos Agroindustrial S/A (BVMF:TTEN3) Has A Somewhat Strained Balance Sheet

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Três Tentos Agroindustrial S/A (BVMF:TTEN3) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Três Tentos Agroindustrial S/A

What Is Três Tentos Agroindustrial S/A's Net Debt?

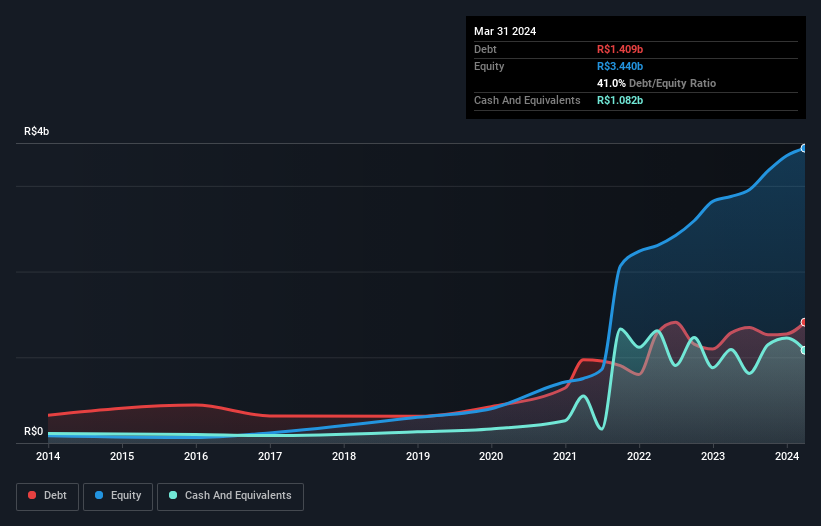

You can click the graphic below for the historical numbers, but it shows that as of March 2024 Três Tentos Agroindustrial S/A had R$1.41b of debt, an increase on R$1.28b, over one year. However, because it has a cash reserve of R$1.08b, its net debt is less, at about R$327.8m.

How Healthy Is Três Tentos Agroindustrial S/A's Balance Sheet?

The latest balance sheet data shows that Três Tentos Agroindustrial S/A had liabilities of R$3.16b due within a year, and liabilities of R$838.5m falling due after that. On the other hand, it had cash of R$1.08b and R$1.83b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by R$1.09b.

While this might seem like a lot, it is not so bad since Três Tentos Agroindustrial S/A has a market capitalization of R$5.18b, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Três Tentos Agroindustrial S/A's net debt is only 0.57 times its EBITDA. And its EBIT easily covers its interest expense, being 13.2 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. On the other hand, Três Tentos Agroindustrial S/A's EBIT dived 14%, over the last year. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Três Tentos Agroindustrial S/A's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Três Tentos Agroindustrial S/A saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Neither Três Tentos Agroindustrial S/A's ability to convert EBIT to free cash flow nor its EBIT growth rate gave us confidence in its ability to take on more debt. But its interest cover tells a very different story, and suggests some resilience. When we consider all the factors discussed, it seems to us that Três Tentos Agroindustrial S/A is taking some risks with its use of debt. While that debt can boost returns, we think the company has enough leverage now. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Três Tentos Agroindustrial S/A's earnings per share history for free.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Três Tentos Agroindustrial S/A might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BOVESPA:TTEN3

Três Tentos Agroindustrial S/A

Operates in the agribusiness sector in Brazil.

Very undervalued with solid track record.

Market Insights

Community Narratives