Marfrig Global Foods S.A. (BVMF:MRFG3) Surges 26% Yet Its Low P/S Is No Reason For Excitement

Marfrig Global Foods S.A. (BVMF:MRFG3) shareholders have had their patience rewarded with a 26% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 100% in the last year.

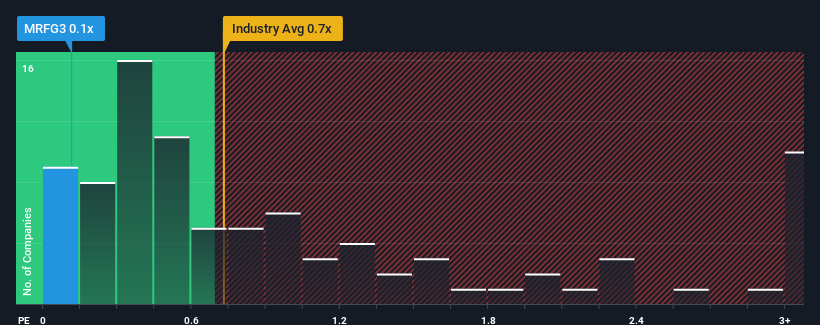

Even after such a large jump in price, given about half the companies operating in Brazil's Food industry have price-to-sales ratios (or "P/S") above 0.8x, you may still consider Marfrig Global Foods as an attractive investment with its 0.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Marfrig Global Foods

How Has Marfrig Global Foods Performed Recently?

Recent times haven't been great for Marfrig Global Foods as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Marfrig Global Foods.Is There Any Revenue Growth Forecasted For Marfrig Global Foods?

The only time you'd be truly comfortable seeing a P/S as low as Marfrig Global Foods' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 7.1% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 78% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 2.3% during the coming year according to the nine analysts following the company. With the industry predicted to deliver 7.3% growth, the company is positioned for a weaker revenue result.

With this information, we can see why Marfrig Global Foods is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Marfrig Global Foods' P/S

Marfrig Global Foods' stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Marfrig Global Foods maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Marfrig Global Foods (2 are a bit unpleasant!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:MRFG3

Marfrig Global Foods

Through its subsidiaries, operates in the food industry in Brazil and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives