Further Upside For Marfrig Global Foods S.A. (BVMF:MRFG3) Shares Could Introduce Price Risks After 27% Bounce

Despite an already strong run, Marfrig Global Foods S.A. (BVMF:MRFG3) shares have been powering on, with a gain of 27% in the last thirty days. The annual gain comes to 122% following the latest surge, making investors sit up and take notice.

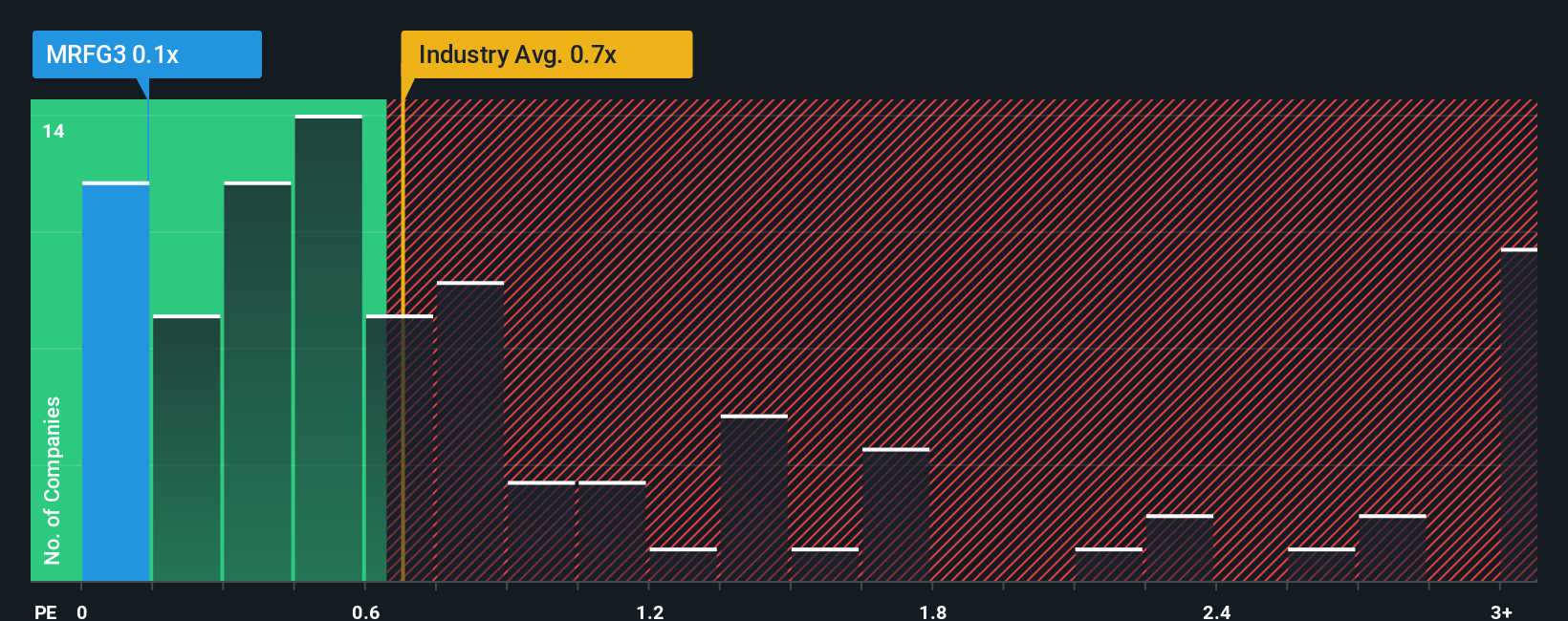

In spite of the firm bounce in price, given about half the companies operating in Brazil's Food industry have price-to-sales ratios (or "P/S") above 0.7x, you may still consider Marfrig Global Foods as an attractive investment with its 0.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Marfrig Global Foods

What Does Marfrig Global Foods' Recent Performance Look Like?

Marfrig Global Foods' revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. Those who are bullish on Marfrig Global Foods will be hoping that this isn't the case.

Want the full picture on analyst estimates for the company? Then our free report on Marfrig Global Foods will help you uncover what's on the horizon.How Is Marfrig Global Foods' Revenue Growth Trending?

Marfrig Global Foods' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 18%. The latest three year period has also seen an excellent 73% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 6.9% during the coming year according to the eight analysts following the company. That's shaping up to be similar to the 7.9% growth forecast for the broader industry.

With this information, we find it odd that Marfrig Global Foods is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Marfrig Global Foods' P/S Mean For Investors?

Despite Marfrig Global Foods' share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It looks to us like the P/S figures for Marfrig Global Foods remain low despite growth that is expected to be in line with other companies in the industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Before you take the next step, you should know about the 3 warning signs for Marfrig Global Foods (1 is a bit unpleasant!) that we have uncovered.

If you're unsure about the strength of Marfrig Global Foods' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:MRFG3

Marfrig Global Foods

Through its subsidiaries, operates in the food industry in Brazil and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives