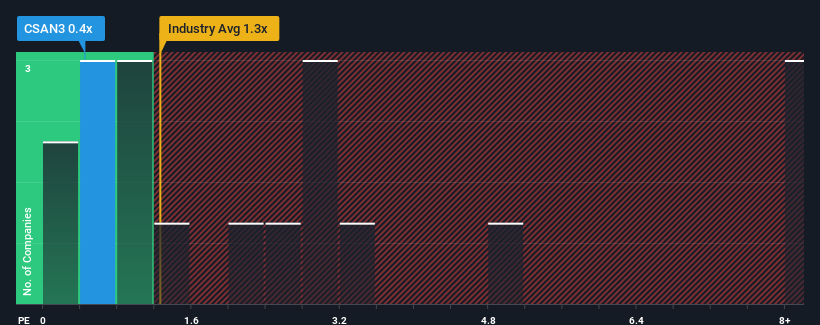

Cosan S.A.'s (BVMF:CSAN3) price-to-sales (or "P/S") ratio of 0.4x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Oil and Gas industry in Brazil have P/S ratios greater than 1x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Cosan

What Does Cosan's P/S Mean For Shareholders?

Cosan certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. One possibility is that the P/S ratio is low because investors think the company's revenue is going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Cosan will help you uncover what's on the horizon.How Is Cosan's Revenue Growth Trending?

In order to justify its P/S ratio, Cosan would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 3.4%. This was backed up an excellent period prior to see revenue up by 89% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 58% per annum over the next three years. With the industry only predicted to deliver 3.7% per annum, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Cosan's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Cosan's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A look at Cosan's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Cosan (at least 1 which is concerning), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Cosan, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:CSAN3

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives