- Brazil

- /

- Oil and Gas

- /

- BOVESPA:BRAV3

Slammed 26% Brava Energia S.A. (BVMF:BRAV3) Screens Well Here But There Might Be A Catch

The Brava Energia S.A. (BVMF:BRAV3) share price has fared very poorly over the last month, falling by a substantial 26%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 41% in that time.

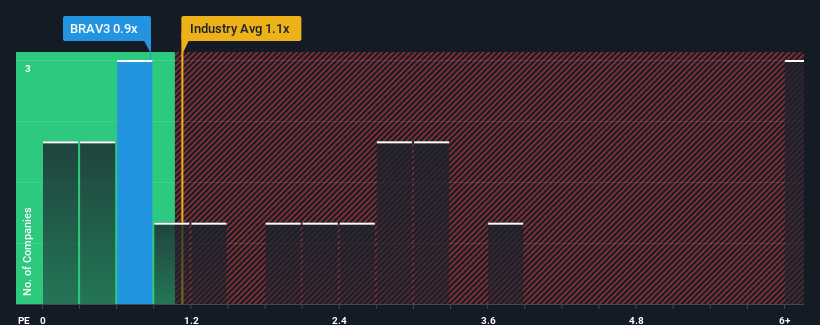

Although its price has dipped substantially, there still wouldn't be many who think Brava Energia's price-to-sales (or "P/S") ratio of 0.9x is worth a mention when it essentially matches the median P/S in Brazil's Oil and Gas industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Brava Energia

How Brava Energia Has Been Performing

With revenue growth that's superior to most other companies of late, Brava Energia has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Brava Energia will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Brava Energia's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 105% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 22% per year as estimated by the eleven analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 5.7% per year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Brava Energia's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Brava Energia's P/S?

With its share price dropping off a cliff, the P/S for Brava Energia looks to be in line with the rest of the Oil and Gas industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, Brava Energia's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Brava Energia (2 shouldn't be ignored) you should be aware of.

If you're unsure about the strength of Brava Energia's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Brava Energia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:BRAV3

Brava Energia

Engages in the exploration and production of oil and natural gas in Brazil.

Good value with moderate growth potential.

Market Insights

Community Narratives