- Brazil

- /

- Capital Markets

- /

- BOVESPA:BIED3

Market Cool On Bahema Educação S.A.'s (BVMF:BAHI3) Revenues Pushing Shares 28% Lower

The Bahema Educação S.A. (BVMF:BAHI3) share price has fared very poorly over the last month, falling by a substantial 28%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 42% share price drop.

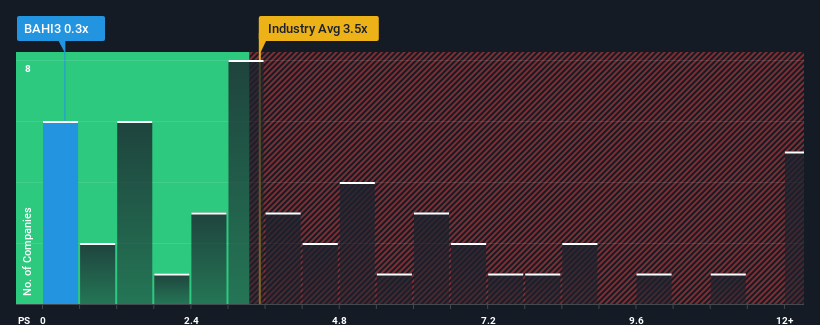

After such a large drop in price, considering about half the companies operating in Brazil's Capital Markets industry have price-to-sales ratios (or "P/S") above 3.3x, you may consider Bahema Educação as an great investment opportunity with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Bahema Educação

How Bahema Educação Has Been Performing

For example, consider that Bahema Educação's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Bahema Educação will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Bahema Educação's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Bahema Educação?

The only time you'd be truly comfortable seeing a P/S as depressed as Bahema Educação's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 2.8% decrease to the company's top line. Still, the latest three year period has seen an excellent 57% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 10% shows it's a great look while it lasts.

With this information, we find it very odd that Bahema Educação is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Bahema Educação's P/S

Having almost fallen off a cliff, Bahema Educação's share price has pulled its P/S way down as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Upon analysing the past data, we see it is unexpected that Bahema Educação is currently trading at a lower P/S than the rest of the industry given that its revenue growth in the past three-year years is exceeding expectations in a challenging industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching this positive performance. Amidst challenging industry conditions, perhaps a key concern is whether the company can sustain its superior revenue growth trajectory. It appears many are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Bahema Educação (at least 2 which are significant), and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Bahema Educação might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:BIED3

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives