- Brazil

- /

- Capital Markets

- /

- BOVESPA:B3SA3

Shareholders in B3 - Brasil Bolsa Balcão (BVMF:B3SA3) are in the red if they invested five years ago

While it may not be enough for some shareholders, we think it is good to see the B3 S.A. - Brasil, Bolsa, Balcão (BVMF:B3SA3) share price up 14% in a single quarter. But if you look at the last five years the returns have not been good. After all, the share price is down 19% in that time, significantly under-performing the market.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

View our latest analysis for B3 - Brasil Bolsa Balcão

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

While the share price declined over five years, B3 - Brasil Bolsa Balcão actually managed to increase EPS by an average of 15% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or possibly, the market was previously very optimistic, so the stock has disappointed, despite improving EPS.

It is unusual to see such modest share price growth in the face of sustained EPS improvements. We can look to other metrics to try to understand the situation better.

In contrast to the share price, revenue has actually increased by 8.1% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

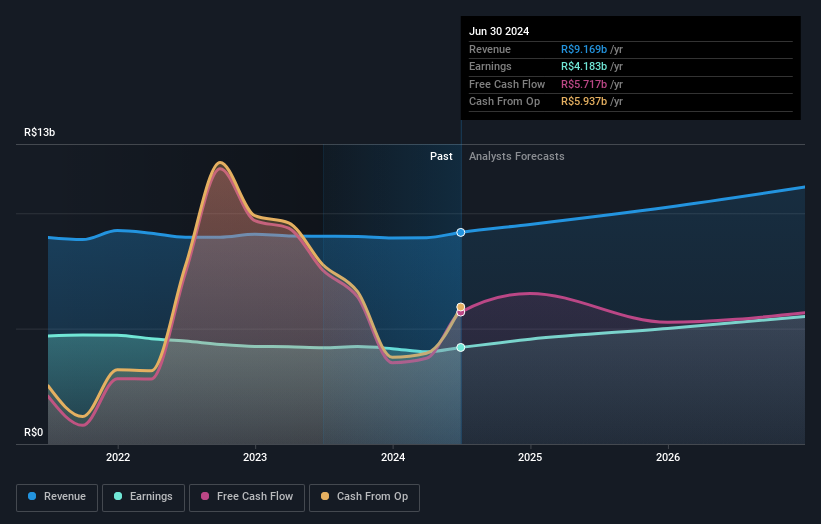

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

B3 - Brasil Bolsa Balcão is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling B3 - Brasil Bolsa Balcão stock, you should check out this free report showing analyst consensus estimates for future profits.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for B3 - Brasil Bolsa Balcão the TSR over the last 5 years was -1.1%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market gained around 15% in the last year, B3 - Brasil Bolsa Balcão shareholders lost 4.4% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 0.2% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand B3 - Brasil Bolsa Balcão better, we need to consider many other factors. Even so, be aware that B3 - Brasil Bolsa Balcão is showing 1 warning sign in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if B3 - Brasil Bolsa Balcão might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:B3SA3

B3 - Brasil Bolsa Balcão

A financial market infrastructure company, provides trading services in an exchange and OTC environment.

Adequate balance sheet average dividend payer.