- Brazil

- /

- Consumer Services

- /

- BOVESPA:COGN3

These 4 Measures Indicate That Cogna Educação (BVMF:COGN3) Is Using Debt Extensively

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Cogna Educação S.A. (BVMF:COGN3) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Cogna Educação

What Is Cogna Educação's Net Debt?

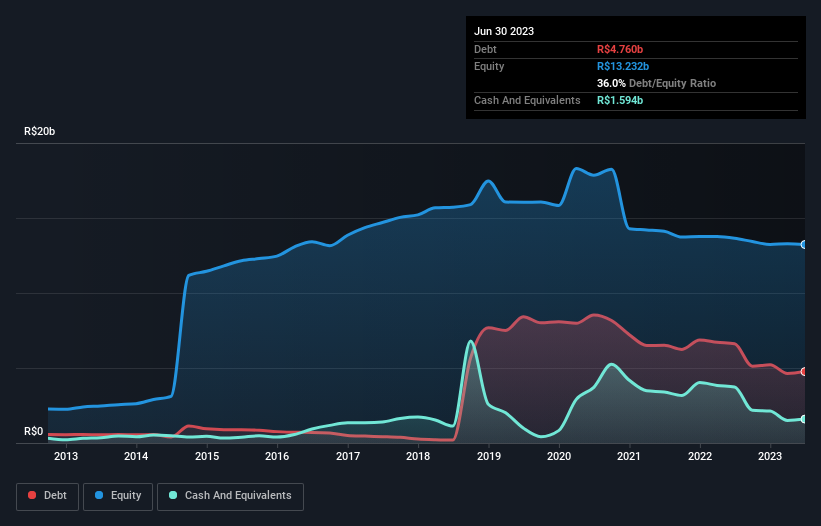

The image below, which you can click on for greater detail, shows that Cogna Educação had debt of R$4.76b at the end of June 2023, a reduction from R$6.61b over a year. However, it does have R$1.59b in cash offsetting this, leading to net debt of about R$3.17b.

How Strong Is Cogna Educação's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Cogna Educação had liabilities of R$3.29b due within 12 months and liabilities of R$9.09b due beyond that. Offsetting this, it had R$1.59b in cash and R$2.43b in receivables that were due within 12 months. So its liabilities total R$8.35b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the R$5.17b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Cogna Educação would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While we wouldn't worry about Cogna Educação's net debt to EBITDA ratio of 3.6, we think its super-low interest cover of 0.95 times is a sign of high leverage. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. However, it should be some comfort for shareholders to recall that Cogna Educação actually grew its EBIT by a hefty 177%, over the last 12 months. If that earnings trend continues it will make its debt load much more manageable in the future. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Cogna Educação's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last two years, Cogna Educação saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both Cogna Educação's conversion of EBIT to free cash flow and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But on the bright side, its EBIT growth rate is a good sign, and makes us more optimistic. Overall, it seems to us that Cogna Educação's balance sheet is really quite a risk to the business. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. Even though Cogna Educação lost money on the bottom line, its positive EBIT suggests the business itself has potential. So you might want to check out how earnings have been trending over the last few years.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:COGN3

Cogna Educação

Operates as an educational organization in Brazil and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives