- Brazil

- /

- Consumer Services

- /

- BOVESPA:COGN3

Cogna Educação S.A. (BVMF:COGN3) Could Be Riskier Than It Looks

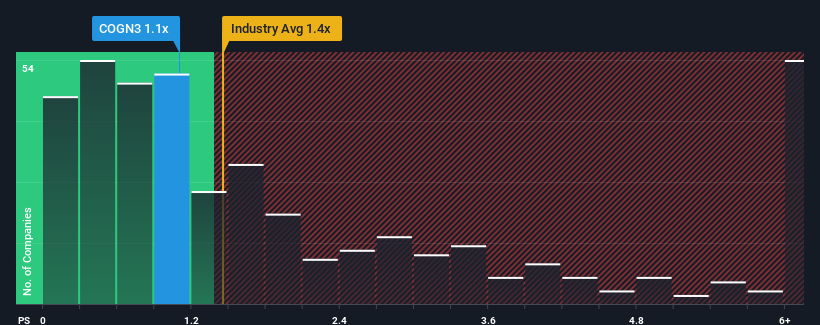

There wouldn't be many who think Cogna Educação S.A.'s (BVMF:COGN3) price-to-sales (or "P/S") ratio of 1.1x is worth a mention when the median P/S for the Consumer Services industry in Brazil is similar at about 0.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Cogna Educação

What Does Cogna Educação's Recent Performance Look Like?

Recent times have been advantageous for Cogna Educação as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Cogna Educação.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Cogna Educação's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. Revenue has also lifted 13% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 13% over the next year. With the industry only predicted to deliver 11%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Cogna Educação's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, Cogna Educação's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Cogna Educação with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:COGN3

Cogna Educação

Operates as an educational organization in Brazil and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives