- Brazil

- /

- Consumer Services

- /

- BOVESPA:ANIM3

Ânima Holding S.A. (BVMF:ANIM3) Looks Just Right With A 34% Price Jump

Despite an already strong run, Ânima Holding S.A. (BVMF:ANIM3) shares have been powering on, with a gain of 34% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 49% over that time.

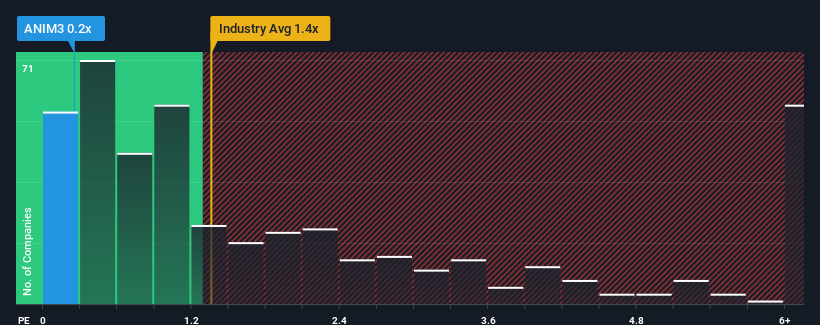

Although its price has surged higher, you could still be forgiven for feeling indifferent about Ânima Holding's P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Consumer Services industry in Brazil is also close to 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Ânima Holding

What Does Ânima Holding's P/S Mean For Shareholders?

Ânima Holding could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Ânima Holding will help you uncover what's on the horizon.How Is Ânima Holding's Revenue Growth Trending?

Ânima Holding's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow revenue by an impressive 43% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Turning to the outlook, the next three years should generate growth of 4.8% each year as estimated by the ten analysts watching the company. That's shaping up to be similar to the 5.9% per annum growth forecast for the broader industry.

With this in mind, it makes sense that Ânima Holding's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Ânima Holding's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that Ânima Holding maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Ânima Holding (2 don't sit too well with us!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:ANIM3

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives