- Brazil

- /

- Food and Staples Retail

- /

- BOVESPA:RADL3

Earnings Not Telling The Story For Raia Drogasil S.A. (BVMF:RADL3) After Shares Rise 27%

Raia Drogasil S.A. (BVMF:RADL3) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 40% in the last twelve months.

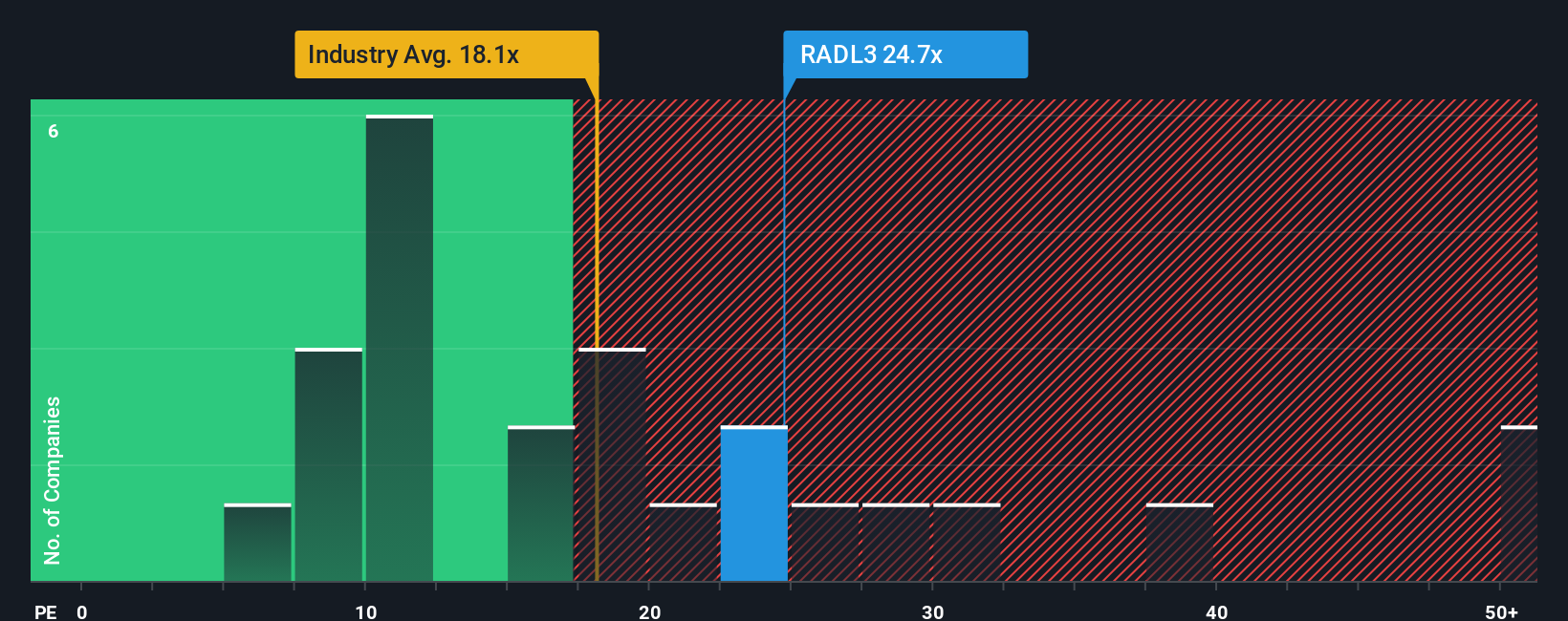

Following the firm bounce in price, given close to half the companies in Brazil have price-to-earnings ratios (or "P/E's") below 8x, you may consider Raia Drogasil as a stock to avoid entirely with its 24.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Raia Drogasil certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Raia Drogasil

How Is Raia Drogasil's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Raia Drogasil's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 74% gain to the company's bottom line. The latest three year period has also seen an excellent 49% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 5.8% per annum over the next three years. That's shaping up to be materially lower than the 18% per year growth forecast for the broader market.

With this information, we find it concerning that Raia Drogasil is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Raia Drogasil's P/E?

Shares in Raia Drogasil have built up some good momentum lately, which has really inflated its P/E. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Raia Drogasil's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 2 warning signs for Raia Drogasil (1 doesn't sit too well with us!) that you need to take into consideration.

If you're unsure about the strength of Raia Drogasil's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:RADL3

Raia Drogasil

Engages in the retail sale of medicines, perfumes, personal hygiene and beauty products, cosmetics, dermocosmetics, and specialty medicines in Brazil.

High growth potential with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026