We Think Vivara Participações (BVMF:VIVA3) Can Stay On Top Of Its Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Vivara Participações S.A. (BVMF:VIVA3) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Vivara Participações

What Is Vivara Participações's Net Debt?

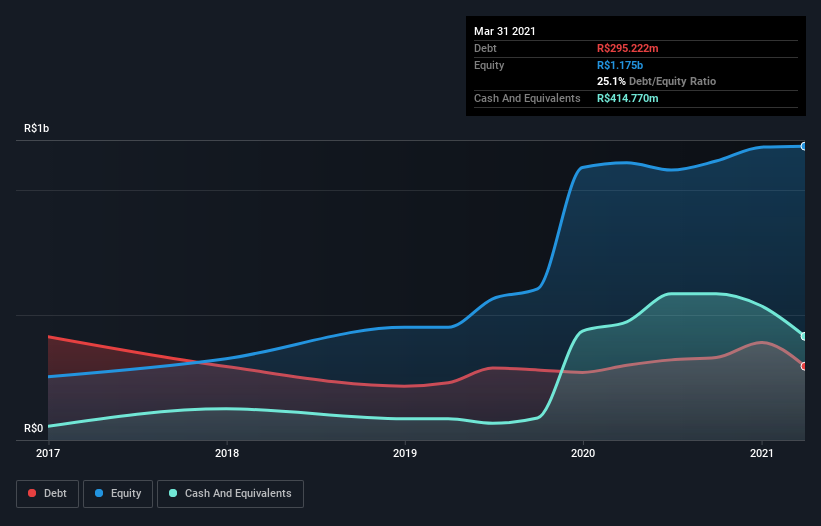

The chart below, which you can click on for greater detail, shows that Vivara Participações had R$295.2m in debt in March 2021; about the same as the year before. However, it does have R$414.8m in cash offsetting this, leading to net cash of R$119.5m.

How Strong Is Vivara Participações' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Vivara Participações had liabilities of R$302.0m due within 12 months and liabilities of R$509.0m due beyond that. Offsetting these obligations, it had cash of R$414.8m as well as receivables valued at R$366.6m due within 12 months. So its liabilities total R$29.6m more than the combination of its cash and short-term receivables.

Having regard to Vivara Participações' size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the R$7.20b company is struggling for cash, we still think it's worth monitoring its balance sheet. While it does have liabilities worth noting, Vivara Participações also has more cash than debt, so we're pretty confident it can manage its debt safely.

The modesty of its debt load may become crucial for Vivara Participações if management cannot prevent a repeat of the 62% cut to EBIT over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Vivara Participações can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Vivara Participações has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last three years, Vivara Participações's free cash flow amounted to 45% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Summing up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Vivara Participações has R$119.5m in net cash. So we don't have any problem with Vivara Participações's use of debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Vivara Participações is showing 1 warning sign in our investment analysis , you should know about...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:VIVA3

Vivara Participações

Engages in the manufacture and sale of jewelry and other articles in Latin America.

Undervalued with solid track record.

Market Insights

Community Narratives