Vivara Participações S.A.'s (BVMF:VIVA3) Share Price Is Still Matching Investor Opinion Despite 25% Slump

The Vivara Participações S.A. (BVMF:VIVA3) share price has fared very poorly over the last month, falling by a substantial 25%. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 14%.

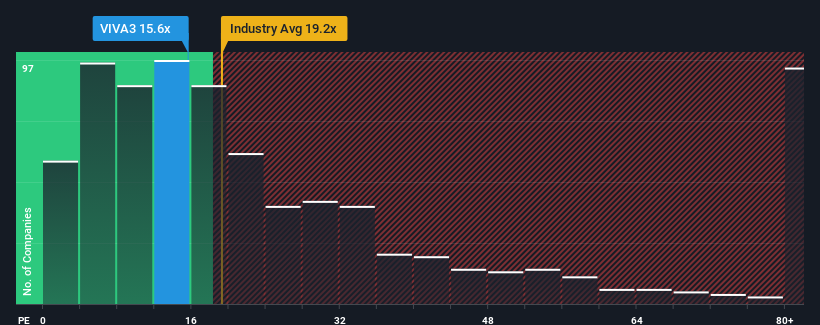

Although its price has dipped substantially, given close to half the companies in Brazil have price-to-earnings ratios (or "P/E's") below 10x, you may still consider Vivara Participações as a stock to avoid entirely with its 15.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's inferior to most other companies of late, Vivara Participações has been relatively sluggish. It might be that many expect the uninspiring earnings performance to recover significantly, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for Vivara Participações

How Is Vivara Participações' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Vivara Participações' is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 2.6% last year. Pleasingly, EPS has also lifted 153% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 26% per year during the coming three years according to the seven analysts following the company. That's shaping up to be materially higher than the 16% each year growth forecast for the broader market.

In light of this, it's understandable that Vivara Participações' P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Even after such a strong price drop, Vivara Participações' P/E still exceeds the rest of the market significantly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Vivara Participações maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Vivara Participações that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:VIVA3

Vivara Participações

Engages in the manufacture and sale of jewelry and other articles in Latin America.

Undervalued with solid track record.

Market Insights

Community Narratives