Why We're Not Concerned About Guararapes Confecções S.A.'s (BVMF:GUAR3) Share Price

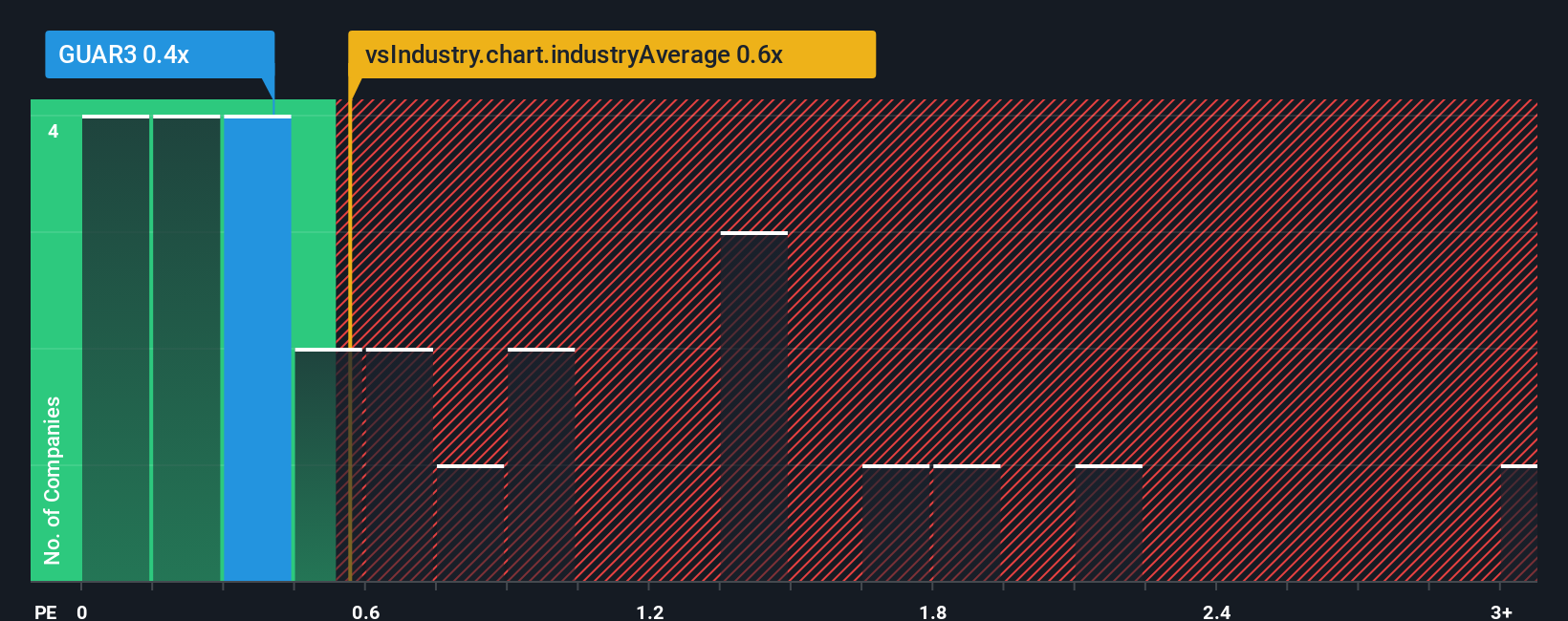

With a median price-to-sales (or "P/S") ratio of close to 0.8x in the Luxury industry in Brazil, you could be forgiven for feeling indifferent about Guararapes Confecções S.A.'s (BVMF:GUAR3) P/S ratio of 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Guararapes Confecções

What Does Guararapes Confecções' P/S Mean For Shareholders?

Guararapes Confecções could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Guararapes Confecções.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Guararapes Confecções would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 9.9%. The solid recent performance means it was also able to grow revenue by 28% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 6.9% per annum over the next three years. With the industry predicted to deliver 8.4% growth each year, the company is positioned for a comparable revenue result.

With this information, we can see why Guararapes Confecções is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Guararapes Confecções' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A Guararapes Confecções' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Luxury industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Guararapes Confecções with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Guararapes Confecções' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:GUAR3

Guararapes Confecções

Engages in the manufacture, distribution, and sale of clothes, articles for personal use, and other related items in Brazil.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.