- Brazil

- /

- Commercial Services

- /

- BOVESPA:ORVR3

Even though Orizon Valorização de Resíduos (BVMF:ORVR3) has lost R$216m market cap in last 7 days, shareholders are still up 19% over 1 year

Orizon Valorização de Resíduos S.A. (BVMF:ORVR3) shareholders might be concerned after seeing the share price drop 13% in the last month. But that doesn't change the reality that over twelve months the stock has done really well. To wit, it had solidly beat the market, up 19%.

While the stock has fallen 11% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

Check out our latest analysis for Orizon Valorização de Resíduos

Orizon Valorização de Resíduos isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Orizon Valorização de Resíduos saw its revenue shrink by 0.09%. Despite the lack of revenue growth, the stock has returned a solid 19% the last twelve months. We can correlate the share price rise with revenue or profit growth, but it seems the market had previously expected weaker results, and sentiment around the stock is improving.

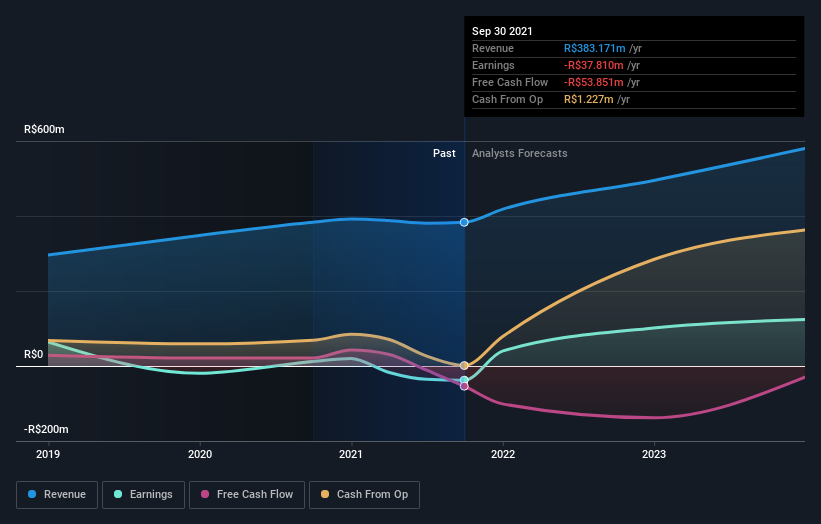

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Orizon Valorização de Resíduos' financial health with this free report on its balance sheet.

A Different Perspective

Orizon Valorização de Resíduos shareholders should be happy with the total gain of 19% over the last twelve months. A substantial portion of that gain has come in the last three months, with the stock up 9.1% in that time. This suggests the company is continuing to win over new investors. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BR exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:ORVR3

Orizon Valorização de Resíduos

Operates as a waste recovery process company.

Exceptional growth potential with low risk.

Market Insights

Community Narratives