- Brazil

- /

- Professional Services

- /

- BOVESPA:IFCM3

Is Infracommerce CXaaS (BVMF:IFCM3) Using Debt In A Risky Way?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Infracommerce CXaaS S.A. (BVMF:IFCM3) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Infracommerce CXaaS

How Much Debt Does Infracommerce CXaaS Carry?

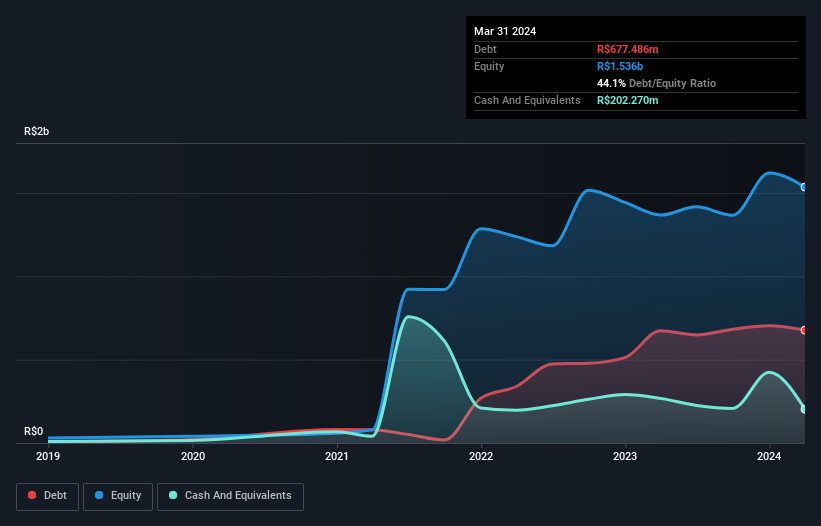

As you can see below, Infracommerce CXaaS had R$677.5m of debt, at March 2024, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of R$202.3m, its net debt is less, at about R$475.2m.

How Healthy Is Infracommerce CXaaS' Balance Sheet?

We can see from the most recent balance sheet that Infracommerce CXaaS had liabilities of R$814.3m falling due within a year, and liabilities of R$845.5m due beyond that. On the other hand, it had cash of R$202.3m and R$578.4m worth of receivables due within a year. So its liabilities total R$879.1m more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the R$261.4m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Infracommerce CXaaS would probably need a major re-capitalization if its creditors were to demand repayment. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Infracommerce CXaaS's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Infracommerce CXaaS wasn't profitable at an EBIT level, but managed to grow its revenue by 18%, to R$1.1b. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Importantly, Infracommerce CXaaS had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost a very considerable R$55m at the EBIT level. Combining this information with the significant liabilities we already touched on makes us very hesitant about this stock, to say the least. Of course, it may be able to improve its situation with a bit of luck and good execution. Nevertheless, we would not bet on it given that it lost R$305m in just last twelve months, and it doesn't have much by way of liquid assets. So while it's not wise to assume the company will fail, we do think it's risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that Infracommerce CXaaS is showing 3 warning signs in our investment analysis , and 2 of those are a bit concerning...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:IFCM3

Infracommerce CXaaS

Provides digital solutions for various brands and industries in Brazil, Mexico, Colombia, Peru, Chile, Argentina, Uruguay, and Latin America.

Medium-low risk and undervalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion