- Brazil

- /

- Commercial Services

- /

- BOVESPA:AMBP3

Some Confidence Is Lacking In Ambipar Participações e Empreendimentos S.A. (BVMF:AMBP3) As Shares Slide 25%

Ambipar Participações e Empreendimentos S.A. (BVMF:AMBP3) shares have had a horrible month, losing 25% after a relatively good period beforehand. Nonetheless, the last 30 days have barely left a scratch on the stock's annual performance, which is up a whopping 686%.

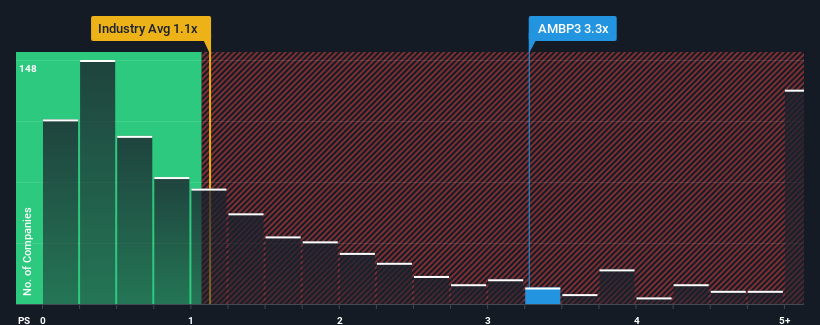

Although its price has dipped substantially, given around half the companies in Brazil's Commercial Services industry have price-to-sales ratios (or "P/S") below 0.7x, you may still consider Ambipar Participações e Empreendimentos as a stock to avoid entirely with its 3.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Ambipar Participações e Empreendimentos

What Does Ambipar Participações e Empreendimentos' Recent Performance Look Like?

Ambipar Participações e Empreendimentos certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Ambipar Participações e Empreendimentos will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Ambipar Participações e Empreendimentos?

In order to justify its P/S ratio, Ambipar Participações e Empreendimentos would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 30%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 3.3% as estimated by the dual analysts watching the company. With the industry predicted to deliver 8.4% growth, that's a disappointing outcome.

In light of this, it's alarming that Ambipar Participações e Empreendimentos' P/S sits above the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What We Can Learn From Ambipar Participações e Empreendimentos' P/S?

Ambipar Participações e Empreendimentos' shares may have suffered, but its P/S remains high. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Ambipar Participações e Empreendimentos' analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. Unless these conditions improve markedly, it'll be a challenging time for shareholders.

You always need to take note of risks, for example - Ambipar Participações e Empreendimentos has 2 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on Ambipar Participações e Empreendimentos, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:AMBP3

Ambipar Participações e Empreendimentos

Ambipar Participações e Empreendimentos S.A.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives