- Brazil

- /

- Commercial Services

- /

- BOVESPA:AMBP3

Ambipar Participações e Empreendimentos S.A. (BVMF:AMBP3) May Have Run Too Fast Too Soon With Recent 32% Price Plummet

The Ambipar Participações e Empreendimentos S.A. (BVMF:AMBP3) share price has softened a substantial 32% over the previous 30 days, handing back much of the gains the stock has made lately. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 208% in the last twelve months.

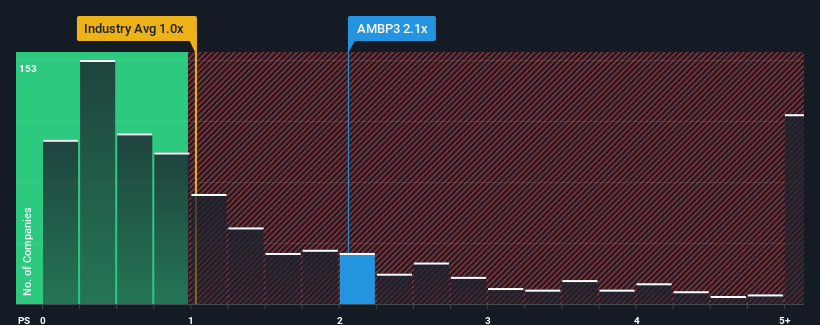

Although its price has dipped substantially, when almost half of the companies in Brazil's Commercial Services industry have price-to-sales ratios (or "P/S") below 0.8x, you may still consider Ambipar Participações e Empreendimentos as a stock probably not worth researching with its 2.1x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Ambipar Participações e Empreendimentos

What Does Ambipar Participações e Empreendimentos' Recent Performance Look Like?

Recent revenue growth for Ambipar Participações e Empreendimentos has been in line with the industry. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ambipar Participações e Empreendimentos.How Is Ambipar Participações e Empreendimentos' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Ambipar Participações e Empreendimentos' is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 15%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 9.1% as estimated by the three analysts watching the company. That's shaping up to be materially lower than the 23% growth forecast for the broader industry.

With this information, we find it concerning that Ambipar Participações e Empreendimentos is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

Ambipar Participações e Empreendimentos' P/S remain high even after its stock plunged. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've concluded that Ambipar Participações e Empreendimentos currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Ambipar Participações e Empreendimentos (2 are potentially serious!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:AMBP3

Ambipar Participações e Empreendimentos

Ambipar Participações e Empreendimentos S.A.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives