The 16% return this week takes Metalfrio Solutions' (BVMF:FRIO3) shareholders one-year gains to 633%

For many, the main point of investing in the stock market is to achieve spectacular returns. When an investor finds a multi-bagger (a stock that goes up over 200%), it makes a big difference to their portfolio. In the case of Metalfrio Solutions S.A. (BVMF:FRIO3), the share price is up an incredible 633% in the last year alone. And in the last week the share price has popped 16%. Also impressive, the stock is up 408% over three years, making long term shareholders happy, too. Anyone who held for that rewarding ride would probably be keen to talk about it.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Check out our latest analysis for Metalfrio Solutions

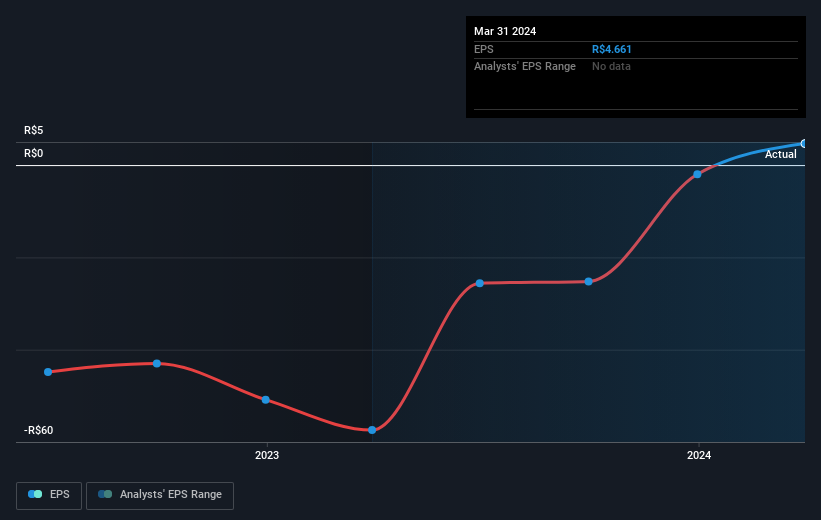

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Metalfrio Solutions went from making a loss to reporting a profit, in the last year.

We think the growth looks very prospective, so we're not surprised the market liked it too. Generally speaking the profitability inflection point is a great time to research a company closely, lest you miss an opportunity to profit.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on Metalfrio Solutions' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Metalfrio Solutions has rewarded shareholders with a total shareholder return of 633% in the last twelve months. That's better than the annualised return of 46% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Metalfrio Solutions better, we need to consider many other factors. Take risks, for example - Metalfrio Solutions has 4 warning signs (and 3 which don't sit too well with us) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BOVESPA:FRIO3

Metalfrio Solutions

Manufactures, imports, and sells domestic and commercial refrigerators and freezers in Brazil and internationally.

Excellent balance sheet slight.