- Brazil

- /

- Aerospace & Defense

- /

- BOVESPA:EMBR3

These 4 Measures Indicate That Embraer (BVMF:EMBR3) Is Using Debt Extensively

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Embraer S.A. (BVMF:EMBR3) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Embraer

What Is Embraer's Debt?

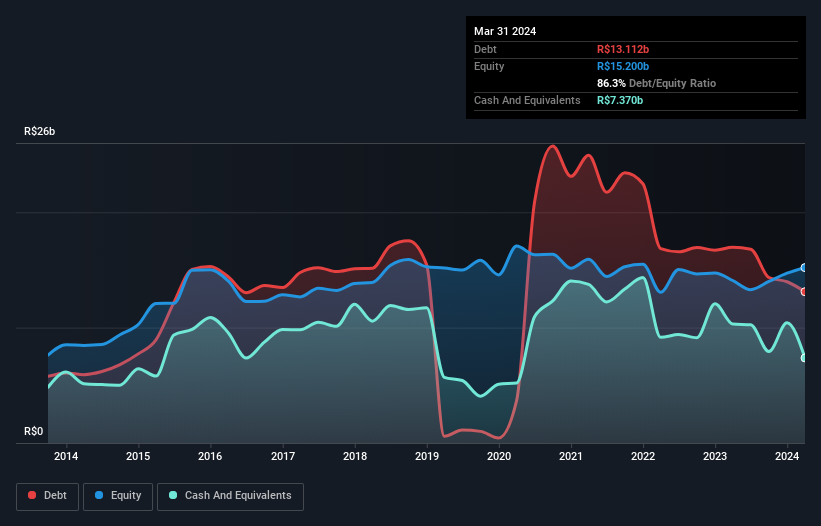

You can click the graphic below for the historical numbers, but it shows that Embraer had R$13.1b of debt in March 2024, down from R$17.0b, one year before. However, it also had R$7.37b in cash, and so its net debt is R$5.74b.

How Strong Is Embraer's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Embraer had liabilities of R$19.3b due within 12 months and liabilities of R$19.3b due beyond that. Offsetting these obligations, it had cash of R$7.37b as well as receivables valued at R$5.20b due within 12 months. So its liabilities total R$26.1b more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of R$29.8b, so it does suggest shareholders should keep an eye on Embraer's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Embraer's debt is 2.7 times its EBITDA, and its EBIT cover its interest expense 3.5 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. One redeeming factor for Embraer is that it turned last year's EBIT loss into a gain of R$1.7b, over the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Embraer can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Happily for any shareholders, Embraer actually produced more free cash flow than EBIT over the last year. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Embraer's level of total liabilities and interest cover definitely weigh on it, in our esteem. But the good news is it seems to be able to convert EBIT to free cash flow with ease. Looking at all the angles mentioned above, it does seem to us that Embraer is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Embraer's earnings per share history for free.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Embraer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BOVESPA:EMBR3

Embraer

Designs, develops, manufactures, and sells aircraft and systems in North America, Latin America, the Asia Pacific, Brazil, Europe, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives