- Brazil

- /

- Aerospace & Defense

- /

- BOVESPA:EMBJ3

Returns On Capital Are Showing Encouraging Signs At Embraer (BVMF:EMBR3)

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So when we looked at Embraer (BVMF:EMBR3) and its trend of ROCE, we really liked what we saw.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Embraer is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.053 = R$2.2b ÷ (R$64b - R$23b) (Based on the trailing twelve months to September 2024).

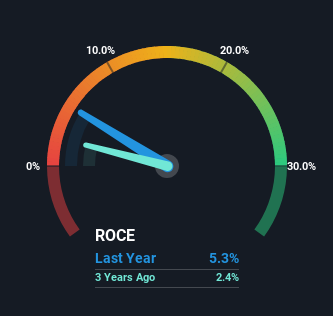

Therefore, Embraer has an ROCE of 5.3%. In absolute terms, that's a low return and it also under-performs the Aerospace & Defense industry average of 9.4%.

Check out our latest analysis for Embraer

In the above chart we have measured Embraer's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Embraer for free.

What Does the ROCE Trend For Embraer Tell Us?

The fact that Embraer is now generating some pre-tax profits from its prior investments is very encouraging. About five years ago the company was generating losses but things have turned around because it's now earning 5.3% on its capital. Not only that, but the company is utilizing 125% more capital than before, but that's to be expected from a company trying to break into profitability. This can tell us that the company has plenty of reinvestment opportunities that are able to generate higher returns.

In another part of our analysis, we noticed that the company's ratio of current liabilities to total assets decreased to 36%, which broadly means the business is relying less on its suppliers or short-term creditors to fund its operations. This tells us that Embraer has grown its returns without a reliance on increasing their current liabilities, which we're very happy with.

What We Can Learn From Embraer's ROCE

In summary, it's great to see that Embraer has managed to break into profitability and is continuing to reinvest in its business. And a remarkable 222% total return over the last five years tells us that investors are expecting more good things to come in the future. Therefore, we think it would be worth your time to check if these trends are going to continue.

Embraer does have some risks though, and we've spotted 1 warning sign for Embraer that you might be interested in.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if Embraer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:EMBJ3

Embraer

Designs, develops, manufactures, and sells aircraft and systems worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success