- Bulgaria

- /

- Electric Utilities

- /

- BUL:TPLR

Health Check: How Prudently Does Toplofikatsia-Ruse AD (BUL:TPLR) Use Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Toplofikatsia-Ruse AD (BUL:TPLR) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Toplofikatsia-Ruse AD

What Is Toplofikatsia-Ruse AD's Debt?

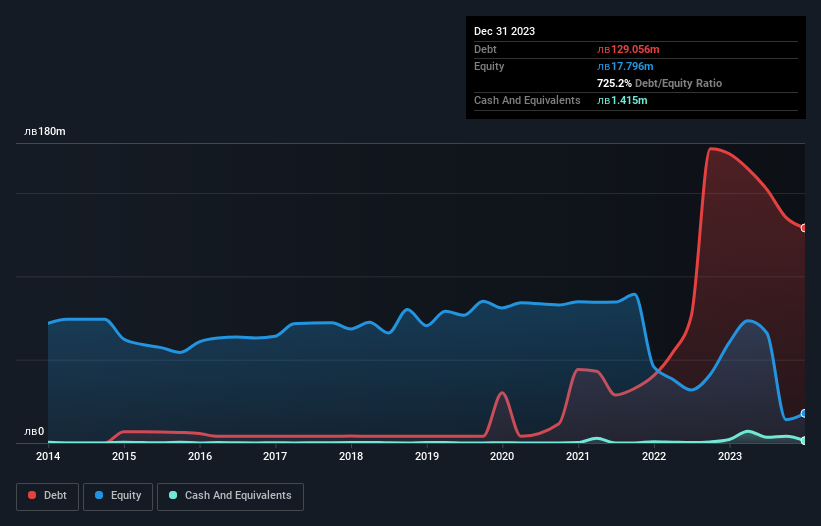

The image below, which you can click on for greater detail, shows that Toplofikatsia-Ruse AD had debt of лв129.1m at the end of December 2023, a reduction from лв173.5m over a year. And it doesn't have much cash, so its net debt is about the same.

How Strong Is Toplofikatsia-Ruse AD's Balance Sheet?

The latest balance sheet data shows that Toplofikatsia-Ruse AD had liabilities of лв209.0m due within a year, and liabilities of лв236.6m falling due after that. Offsetting these obligations, it had cash of лв1.42m as well as receivables valued at лв99.6m due within 12 months. So it has liabilities totalling лв344.7m more than its cash and near-term receivables, combined.

This deficit casts a shadow over the лв141.7m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Toplofikatsia-Ruse AD would likely require a major re-capitalisation if it had to pay its creditors today. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Toplofikatsia-Ruse AD's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Toplofikatsia-Ruse AD reported revenue of лв166m, which is a gain of 23%, although it did not report any earnings before interest and tax. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

Despite the top line growth, Toplofikatsia-Ruse AD still had an earnings before interest and tax (EBIT) loss over the last year. Its EBIT loss was a whopping лв104m. When we look at that alongside the significant liabilities, we're not particularly confident about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. For example, we would not want to see a repeat of last year's loss of лв42m. And until that time we think this is a risky stock. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Toplofikatsia-Ruse AD has 3 warning signs (and 2 which shouldn't be ignored) we think you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Toplofikatsia-Ruse AD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BUL:TPLR

Toplofikatsia-Ruse AD

Produces and sells electricity and thermal energy in Bulgaria.

Good value with adequate balance sheet.

Market Insights

Community Narratives