Can Bianor Holding AD's (BUL:5BI) Decent Financials Help Push Its Stock Prices Higher?

It is easy to overlook Bianor Holding AD's (BUL:5BI) given its unimpressive and roughly flat price performance over the past three months. However, attentive investors would probably give more consideration to the stock as the company's fundamentals could add more to the story, given how long-term financials are usually what drive market prices. Specifically, we decided to study Bianor Holding AD's ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for Bianor Holding AD

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Bianor Holding AD is:

8.7% = лв283k ÷ лв3.3m (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. One way to conceptualize this is that for each BGN1 of shareholders' capital it has, the company made BGN0.09 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Bianor Holding AD's Earnings Growth And 8.7% ROE

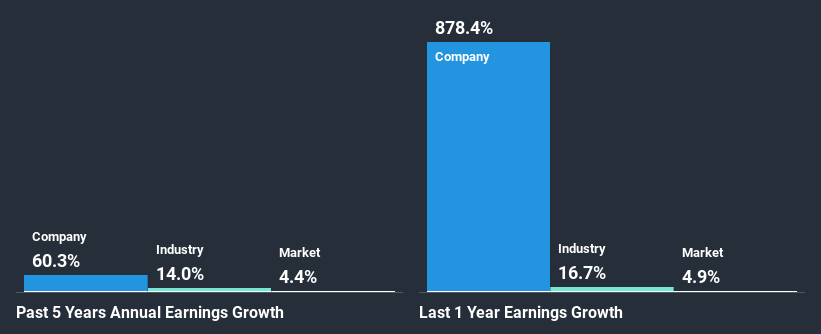

When you first look at it, Bianor Holding AD's ROE doesn't look that attractive. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 13% either. However, we we're pleasantly surprised to see that Bianor Holding AD grew its net income at a significant rate of 60% in the last five years. So, there might be other aspects that are positively influencing the company's earnings growth. For instance, the company has a low payout ratio or is being managed efficiently.

We then compared Bianor Holding AD's net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 15% in the same period.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. Is Bianor Holding AD fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Bianor Holding AD Using Its Retained Earnings Effectively?

Given that Bianor Holding AD doesn't pay any dividend to its shareholders, we infer that the company has been reinvesting all of its profits to grow its business.

Conclusion

In total, it does look like Bianor Holding AD has some positive aspects to its business. Despite its low rate of return, the fact that the company reinvests a very high portion of its profits into its business, no doubt contributed to its high earnings growth. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. Our risks dashboard would have the 2 risks we have identified for Bianor Holding AD.

When trading Bianor Holding AD or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wiser Technology AD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BUL:WISR

Wiser Technology AD

Designs and develops software solutions for defense, telecommunications, technology, media, financial, and public sectors.

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026