Tchaikapharma High Quality Medicines AD (BUL:THQM) May Have Run Too Fast Too Soon With Recent 27% Price Plummet

The Tchaikapharma High Quality Medicines AD (BUL:THQM) share price has fared very poorly over the last month, falling by a substantial 27%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 24% share price drop.

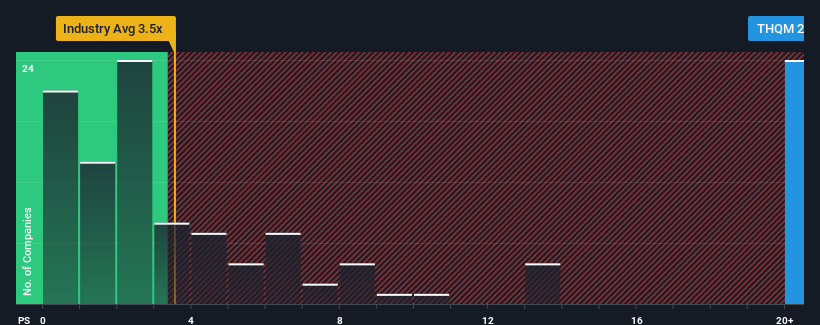

Even after such a large drop in price, you could still be forgiven for thinking Tchaikapharma High Quality Medicines AD is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 22.5x, considering almost half the companies in Bulgaria's Pharmaceuticals industry have P/S ratios below 3.5x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Tchaikapharma High Quality Medicines AD

How Tchaikapharma High Quality Medicines AD Has Been Performing

Tchaikapharma High Quality Medicines AD has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Tchaikapharma High Quality Medicines AD's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Tchaikapharma High Quality Medicines AD would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.5% last year. Revenue has also lifted 25% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 9.5% shows it's about the same on an annualised basis.

With this in mind, we find it intriguing that Tchaikapharma High Quality Medicines AD's P/S exceeds that of its industry peers. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

What Does Tchaikapharma High Quality Medicines AD's P/S Mean For Investors?

A significant share price dive has done very little to deflate Tchaikapharma High Quality Medicines AD's very lofty P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Tchaikapharma High Quality Medicines AD has shown that it currently trades on a higher than expected P/S since its recent three-year growth is only in line with the wider industry forecast. When we see average revenue with industry-like growth combined with a high P/S, we suspect the share price is at risk of declining, bringing the P/S back in line with the industry too. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Tchaikapharma High Quality Medicines AD with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Tchaikapharma High Quality Medicines AD's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Tchaikapharma High Quality Medicines AD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BUL:THQM

Tchaikapharma High Quality Medicines AD

Develops, manufactures, and sells medicines in Bulgaria.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives