Sopharma AD's (BUL:SFA) Stock's Been Going Strong: Could Weak Financials Mean The Market Will Correct Its Share Price?

Sopharma AD's (BUL:SFA) stock is up by a considerable 12% over the past month. However, we decided to pay close attention to its weak financials as we are doubtful that the current momentum will keep up, given the scenario. Particularly, we will be paying attention to Sopharma AD's ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Sopharma AD is:

9.7% = лв82m ÷ лв849m (Based on the trailing twelve months to December 2024).

The 'return' is the yearly profit. So, this means that for every BGN1 of its shareholder's investments, the company generates a profit of BGN0.10.

Check out our latest analysis for Sopharma AD

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Sopharma AD's Earnings Growth And 9.7% ROE

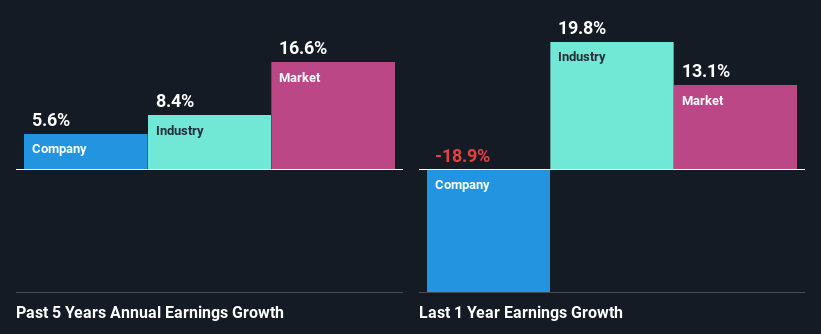

At first glance, Sopharma AD's ROE doesn't look very promising. However, given that the company's ROE is similar to the average industry ROE of 11%, we may spare it some thought. Even so, Sopharma AD has shown a fairly decent growth in its net income which grew at a rate of 5.6%. Given the slightly low ROE, it is likely that there could be some other aspects that are driving this growth. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

We then compared Sopharma AD's net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 8.4% in the same 5-year period, which is a bit concerning.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Sopharma AD is trading on a high P/E or a low P/E, relative to its industry.

Is Sopharma AD Using Its Retained Earnings Effectively?

The really high three-year median payout ratio of 102% for Sopharma AD suggests that the company is paying its shareholders more than what it is earning. However, this hasn't really hampered its ability to grow as we saw earlier. Although, the high payout ratio is certainly something we would keep an eye on if the company is not able to keep up its growth, or if business deteriorates.

Moreover, Sopharma AD is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years.

Summary

On the whole, Sopharma AD's performance is quite a big let-down. Although the company has shown a fair bit of growth in earnings, yet the low ROE and the low rate of reinvestment makes us skeptical about the continuity of that growth, especially when or if the business comes to face any threats. Up till now, we've only made a short study of the company's growth data. You can do your own research on Sopharma AD and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

If you're looking to trade Sopharma AD, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BUL:SFA

Sopharma AD

Produces, distributes, and exports pharmaceutical products in Europe, Bulgaria, and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives