The subdued market reaction suggests that Sopharma AD's (BUL:SFA) recent earnings didn't contain any surprises. Our analysis suggests that along with soft profit numbers, investors should be aware of some other underlying weaknesses in the numbers.

View our latest analysis for Sopharma AD

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, Sopharma AD issued 37% more new shares over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Sopharma AD's EPS by clicking here.

A Look At The Impact Of Sopharma AD's Dilution On Its Earnings Per Share (EPS)

Sopharma AD has improved its profit over the last three years, with an annualized gain of 88% in that time. But EPS was only up 53% per year, in the exact same period. Net profit actually dropped by 15% in the last year. Unfortunately for shareholders, though, the earnings per share result was even worse, declining 32%. Therefore, one can observe that the dilution is having a fairly profound effect on shareholder returns.

In the long term, if Sopharma AD's earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Sopharma AD.

Our Take On Sopharma AD's Profit Performance

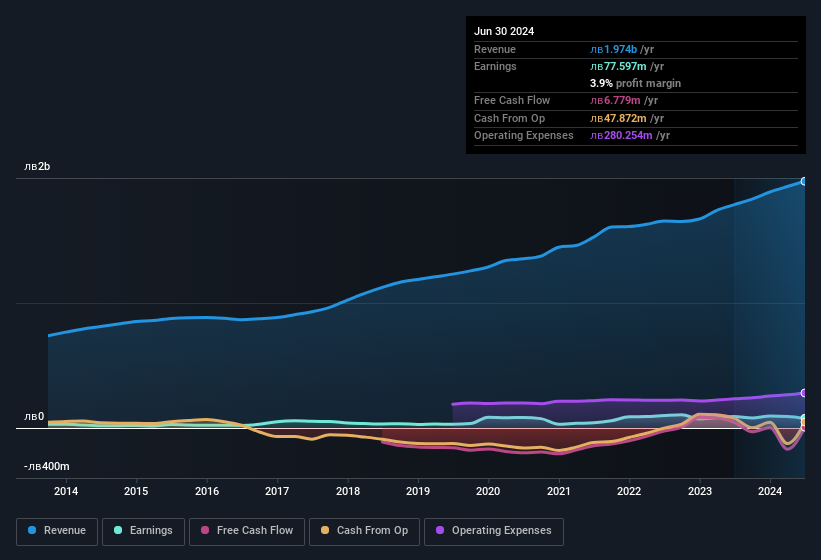

Over the last year Sopharma AD issued new shares and so, there's a noteworthy divergence between EPS and net income growth. For this reason, we think that Sopharma AD's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. Nonetheless, it's still worth noting that its earnings per share have grown at 53% over the last three years. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you'd like to know more about Sopharma AD as a business, it's important to be aware of any risks it's facing. At Simply Wall St, we found 2 warning signs for Sopharma AD and we think they deserve your attention.

This note has only looked at a single factor that sheds light on the nature of Sopharma AD's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BUL:SFA

Sopharma AD

Produces, distributes, and exports pharmaceutical products in Europe, Bulgaria, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026