Can You Imagine How Elated Tchaikapharma High Quality Medicines AD's (BUL:7TH) Shareholders Feel About Its 317% Share Price Gain?

For many, the main point of investing in the stock market is to achieve spectacular returns. While not every stock performs well, when investors win, they can win big. For example, the Tchaikapharma High Quality Medicines AD (BUL:7TH) share price is up a whopping 317% in the last half decade, a handsome return for long term holders. This just goes to show the value creation that some businesses can achieve.

Check out our latest analysis for Tchaikapharma High Quality Medicines AD

While Tchaikapharma High Quality Medicines AD made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

For the last half decade, Tchaikapharma High Quality Medicines AD can boast revenue growth at a rate of 4.6% per year. Put simply, that growth rate fails to impress. So shareholders should be pretty elated with the 33% increase per year, in that time. We'll tip our hats to that, any day, but the top-line growth isn't particularly impressive when you compare it to other pre-profit companies. It's not immediately obvious to us why the market has been so enthusiastic about the stock, but a more detailed look at revenue and profit trends might reveal why shareholders are optimistic.

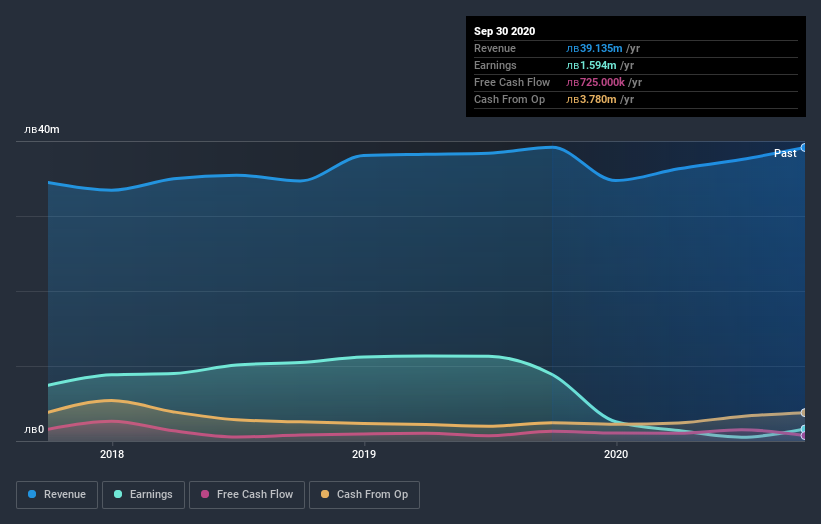

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Tchaikapharma High Quality Medicines AD's financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that Tchaikapharma High Quality Medicines AD has rewarded shareholders with a total shareholder return of 26% in the last twelve months. However, the TSR over five years, coming in at 33% per year, is even more impressive. It's always interesting to track share price performance over the longer term. But to understand Tchaikapharma High Quality Medicines AD better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Tchaikapharma High Quality Medicines AD you should be aware of, and 1 of them is concerning.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BG exchanges.

When trading Tchaikapharma High Quality Medicines AD or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Tchaikapharma High Quality Medicines AD, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tchaikapharma High Quality Medicines AD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BUL:THQM

Tchaikapharma High Quality Medicines AD

Engages in the development and manufacture of generic and in-licensed medicines in Bulgaria.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives