Hydraulic Elements and Systems AD (BUL:HES) Is Doing The Right Things To Multiply Its Share Price

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Speaking of which, we noticed some great changes in Hydraulic Elements and Systems AD's (BUL:HES) returns on capital, so let's have a look.

Return On Capital Employed (ROCE): What is it?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Hydraulic Elements and Systems AD, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.15 = лв6.7m ÷ (лв52m - лв8.4m) (Based on the trailing twelve months to March 2021).

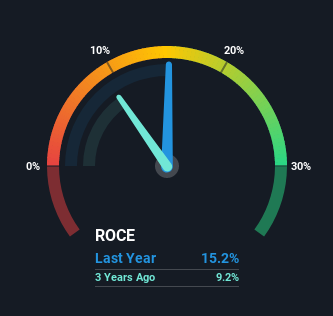

Thus, Hydraulic Elements and Systems AD has an ROCE of 15%. In absolute terms, that's a satisfactory return, but compared to the Machinery industry average of 8.9% it's much better.

View our latest analysis for Hydraulic Elements and Systems AD

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of Hydraulic Elements and Systems AD, check out these free graphs here.

How Are Returns Trending?

Hydraulic Elements and Systems AD is displaying some positive trends. Over the last five years, returns on capital employed have risen substantially to 15%. The amount of capital employed has increased too, by 34%. So we're very much inspired by what we're seeing at Hydraulic Elements and Systems AD thanks to its ability to profitably reinvest capital.

What We Can Learn From Hydraulic Elements and Systems AD's ROCE

To sum it up, Hydraulic Elements and Systems AD has proven it can reinvest in the business and generate higher returns on that capital employed, which is terrific. Since the stock has returned a staggering 124% to shareholders over the last five years, it looks like investors are recognizing these changes. Therefore, we think it would be worth your time to check if these trends are going to continue.

One more thing to note, we've identified 1 warning sign with Hydraulic Elements and Systems AD and understanding it should be part of your investment process.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you’re looking to trade Hydraulic Elements and Systems AD, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hydraulic Elements and Systems AD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BUL:HES

Hydraulic Elements and Systems AD

Designs, manufactures, and sells hydraulic cylinders in Europe, North America, and Asia.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives