- Belgium

- /

- Electric Utilities

- /

- ENXTBR:ELI

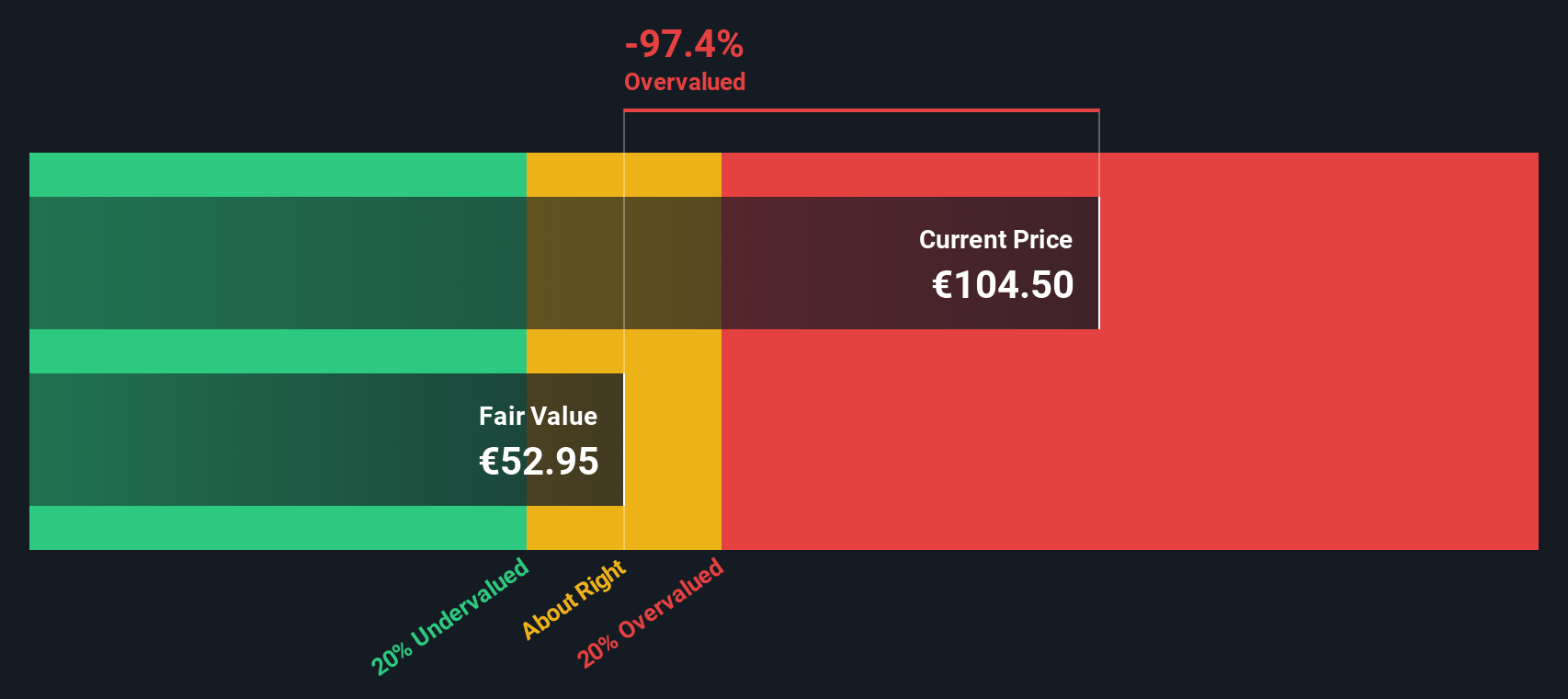

Elia Group (ENXTBR:ELI): A Fresh Look at Valuation After Recent Share Price Moves

Reviewed by Simply Wall St

Price-to-Earnings of 20.2x: Is it justified?

Elia Group is currently trading at a price-to-earnings (P/E) ratio of 20.2x. This positions it well above the European Electric Utilities industry average of 12.4x. On this basis, the stock appears overvalued relative to its sector peers.

The price-to-earnings ratio is a widely used measure that tells investors how much they are paying for each euro of earnings generated by the company. For utility companies, P/E ratios often reflect the stability of earnings and growth expectations in a heavily regulated industry.

A higher-than-average P/E can signal that investors expect above-average growth, but it can also mean the market is overestimating future profits or overlooking risks. In this case, Elia Group’s premium multiple suggests the market is pricing in strong continued earnings growth; however, buyers may be paying a significant markup for it.

Result: Fair Value of €94.5 (OVERVALUED)

See our latest analysis for Elia Group.However, slowing revenue growth or regulatory changes could quickly shift sentiment and put pressure on Elia Group’s premium valuation and future returns.

Find out about the key risks to this Elia Group narrative.Another View: What Does the DCF Say?

Multiples paint Elia Group as expensive, but looking through the lens of our SWS DCF model tells a different story. This approach values the company on future cash flows and leads to a very different conclusion about its true worth. Which method tells the real story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Elia Group Narrative

If you see things differently or want to take your own approach, you can dive into the numbers and build a narrative yourself in just a few minutes. Do it your way

A great starting point for your Elia Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors stay a step ahead by keeping an eye on emerging opportunities. The right stock screens can reveal hidden gems you might otherwise miss.

- Capture steady income potential when you assess companies offering attractive yields through our selection of dividend stocks with yields > 3%.

- Uncover the power of healthcare breakthroughs by targeting innovators driving medical technology forward with our focus on healthcare AI stocks.

- Seize potential bargains and outpace the market by identifying businesses that appear undervalued via our tailored list of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Elia Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTBR:ELI

Elia Group

Develops and operates as a transmission system operator in Belgium and Germany.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion