- Belgium

- /

- Communications

- /

- ENXTBR:OPTI

Crescent (EBR:OPTI) Shareholders Have Enjoyed A 22% Share Price Gain

It hasn't been the best quarter for Crescent NV (EBR:OPTI) shareholders, since the share price has fallen 20% in that time. But that doesn't change the reality that over twelve months the stock has done really well. Looking at the full year, the company has easily bested an index fund by gaining 22%.

View our latest analysis for Crescent

Given that Crescent didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Crescent grew its revenue by 3.2% last year. That's not a very high growth rate considering it doesn't make profits. The modest growth is probably largely reflected in the share price, which is up 22%. While not a huge gain tht seems pretty reasonable. Given the market doesn't seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

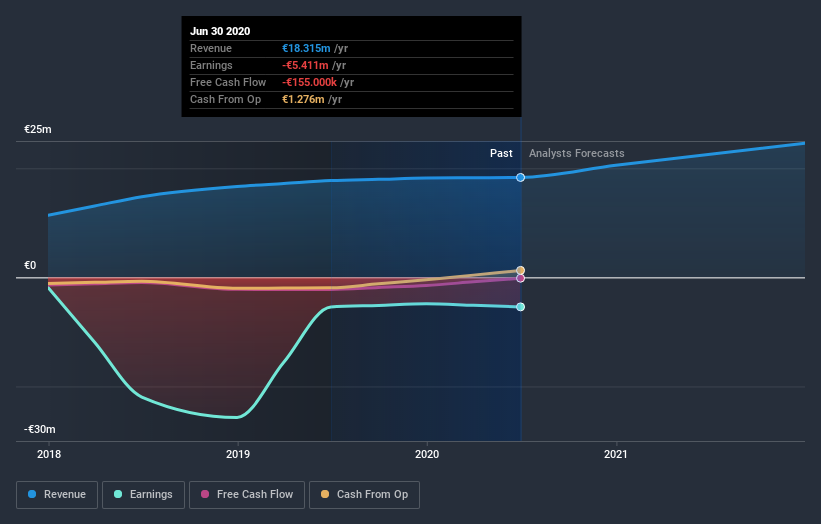

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Crescent stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Crescent shareholders should be happy with the total gain of 22% over the last twelve months. We regret to report that the share price is down 20% over ninety days. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for Crescent you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BE exchanges.

If you’re looking to trade Crescent, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTBR:OPTI

Slight risk and overvalued.

Market Insights

Community Narratives