- Belgium

- /

- Industrial REITs

- /

- ENXTBR:WDP

Should Warehouses De Pauw's Green Bond and Moody’s Upgrade Prompt a Rethink by ENXTBR:WDP Investors?

Reviewed by Sasha Jovanovic

- Warehouses De Pauw (WDP) recently reported earnings for the nine months ended September 30, 2025, posting sales of €335.6 million, up from €284.28 million a year earlier, but net income fell to €246.68 million compared to €306.32 million in the prior period.

- In addition, Clifford Chance announced it advised on WDP’s inaugural €500 million green senior unsecured bond issuance under its EMTN programme, following a Moody’s upgrade of WDP’s long-term issuer rating to A3 with a stable outlook.

- With the company's first green bond issue now complete, we'll assess how this new financing shapes WDP's investment narrative and growth plans.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Warehouses De Pauw Investment Narrative Recap

Investors in Warehouses De Pauw need to believe in the resilience of European logistics real estate and WDP’s ability to maintain high occupancy rates despite a recent drop in net income. The company’s inaugural €500 million green bond issuance is a noteworthy financial milestone, but it does not appear to change the immediate outlook for WDP’s key catalyst, which remains the pace at which it can fill or renew expiring leases amid signs of slowing tenant demand.

The recent green bond issue, completed after Moody’s upgraded WDP’s credit rating to A3, aligns with the company’s commitment to ESG financing and aims to fund its #BLEND2027 growth plan. This move supports future development projects, but efficient tenant retention and new leasing activity are still critical for driving near-term performance.

However, despite positive steps on the funding and credit front, investors should not overlook the risk that if tenant retention trends downward, as forecasted for 2025, then...

Read the full narrative on Warehouses De Pauw (it's free!)

Warehouses De Pauw's outlook is for €480.5 million in revenue and €444.7 million in earnings by 2028. This is based on annual revenue growth of 1.8% and an earnings increase of €164.8 million from the current earnings of €279.9 million.

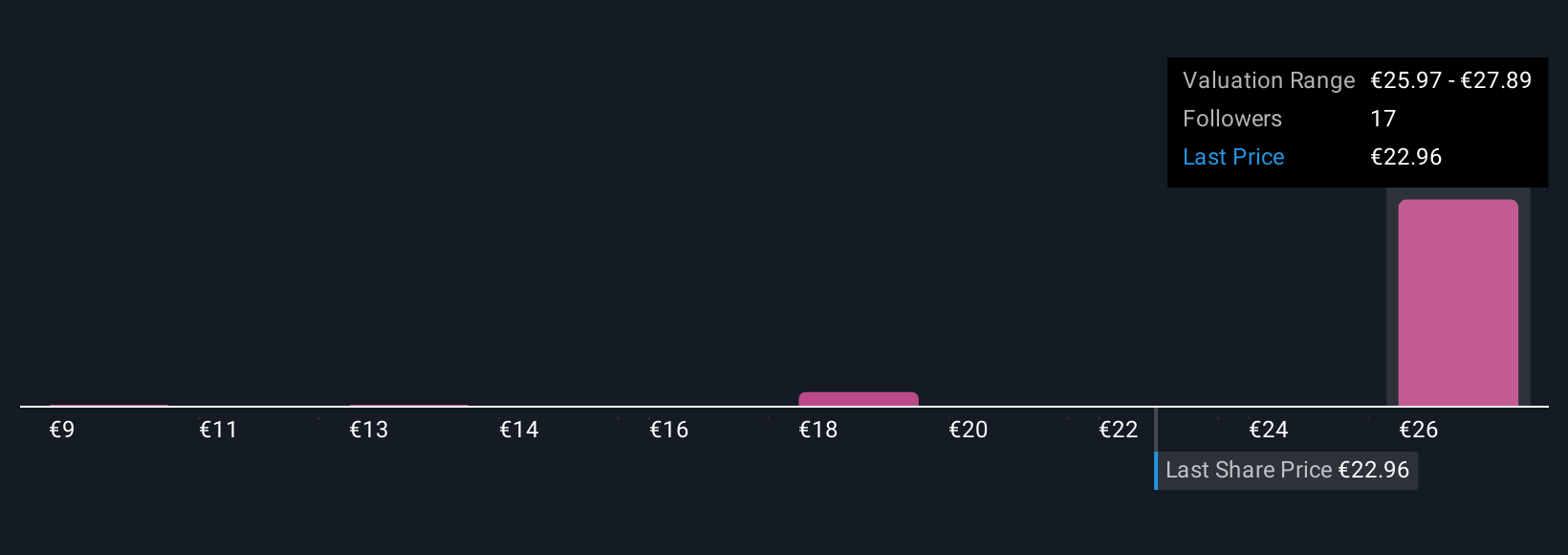

Uncover how Warehouses De Pauw's forecasts yield a €26.99 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community see WDP’s fair value between €8.74 and €27.67, highlighting a wide spectrum of expectations. While opinions vary, attention is focused on whether tenant retention can keep pace with necessary earnings growth for the company’s pipeline.

Explore 6 other fair value estimates on Warehouses De Pauw - why the stock might be worth less than half the current price!

Build Your Own Warehouses De Pauw Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Warehouses De Pauw research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Warehouses De Pauw research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Warehouses De Pauw's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warehouses De Pauw might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:WDP

Warehouses De Pauw

WDP develops and invests in logistics real estate warehouses and offices.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives