- Belgium

- /

- Industrial REITs

- /

- ENXTBR:WDP

Assessing Warehouses De Pauw (ENXTBR:WDP) Valuation After Mixed Nine-Month Earnings Performance

Reviewed by Kshitija Bhandaru

Warehouses De Pauw (ENXTBR:WDP) just posted results for the nine months ending September 2025. Sales climbed compared to last year, while net income and earnings per share slipped during the same stretch.

See our latest analysis for Warehouses De Pauw.

Warehouses De Pauw’s 8.5% share price return over the last 90 days suggests growing optimism, even though the total shareholder return for the past year has been a more modest 2.1%. In the broader context, recent gains appear to reflect renewed confidence following the company’s sales growth, even with softer profits earlier this year.

If you’re weighing how shifting sentiment could shape your next investment, this could be the perfect time to discover fast growing stocks with high insider ownership.

With Warehouses De Pauw trading below analysts’ price targets and still at a discount to intrinsic value, is the market overlooking an opportunity here? Or are investors already pricing in the next leg of growth?

Price-to-Earnings of 14.3x: Is it justified?

Warehouses De Pauw trades at a price-to-earnings (P/E) ratio of 14.3x, slightly above its peer group’s 13.5x average and below the industry average of 16.5x. This puts the current share price of €21.96 in a middle ground, neither deeply undervalued nor excessively expensive against global benchmarks.

The price-to-earnings ratio is a key yardstick for property companies like WDP, reflecting how much investors are willing to pay for each euro of recent earnings. A higher P/E suggests expectations of stronger growth or greater stability, while a lower ratio may signal market caution or sector headwinds.

WDP’s P/E is justified in part by its forecasted earnings growth (16.8% per year) outpacing the Belgian market average. However, the figure is above domestic peers and lags the broader global industry. Notably, its current multiple is also below our calculated fair P/E of 15.6x, which could signal the market may move closer to that level as optimism builds.

Explore the SWS fair ratio for Warehouses De Pauw

Result: Price-to-Earnings of 14.3x (UNDERVALUED)

However, slower revenue growth or shifts in market sentiment could limit further gains and challenge the optimistic valuation story for Warehouses De Pauw.

Find out about the key risks to this Warehouses De Pauw narrative.

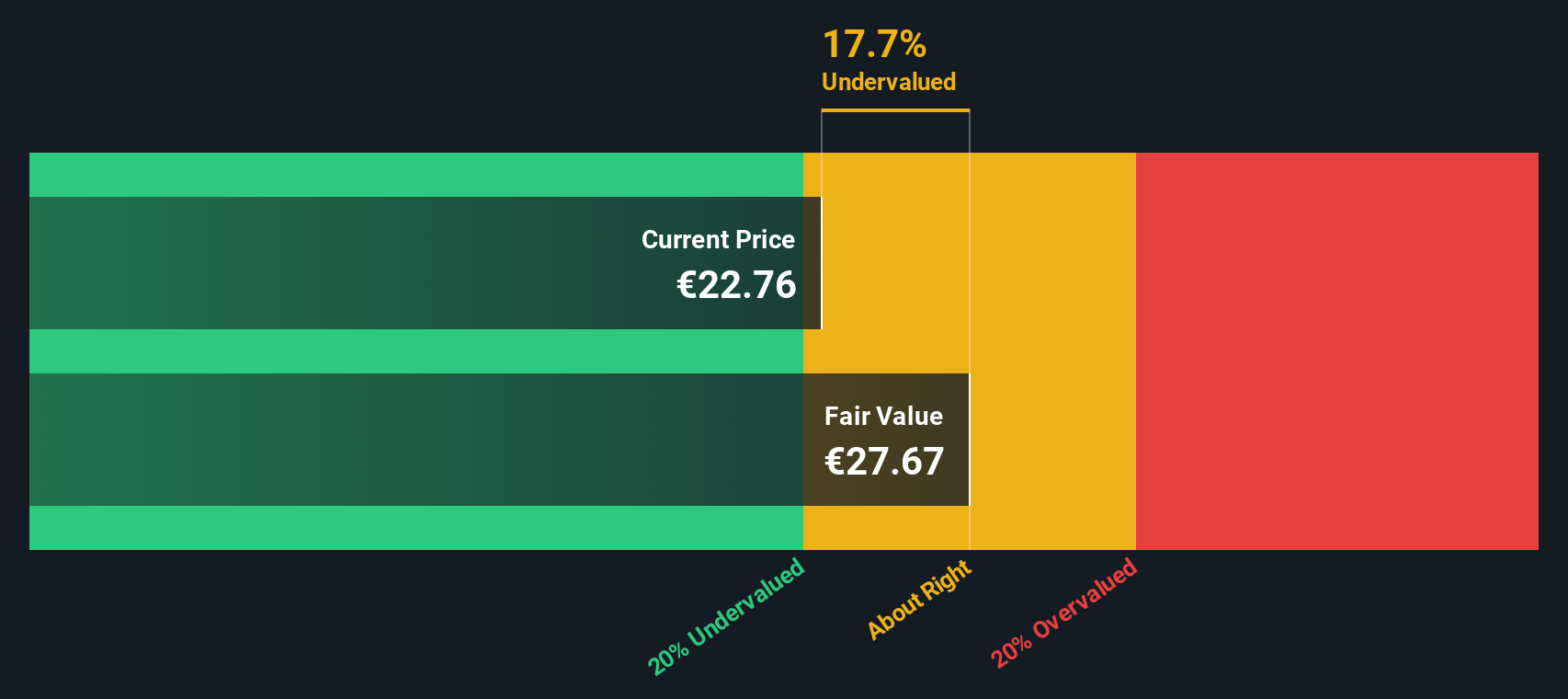

Another View: Discounted Cash Flow Puts WDP in a Different Light

Looking through the lens of our DCF model, Warehouses De Pauw stands out as undervalued. The share price is about 20.5% below the estimated fair value of €27.62. This perspective implies the current optimism may be justified, or perhaps the market has not fully recognized the company’s upside yet. Will the stock catch up, or has it found its level?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Warehouses De Pauw for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Warehouses De Pauw Narrative

If you have a different take on Warehouses De Pauw or want to dig deeper into the numbers, you can easily craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Warehouses De Pauw research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Sharpen your investment strategy by checking out other hand-picked stocks with exceptional potential across high-growth sectors and steady income sources before others notice.

- Capitalize on surging yields by checking out these 18 dividend stocks with yields > 3% to find options that deliver reliable returns and attractive ongoing income.

- Unlock emerging opportunities in medicine and tech with these 33 healthcare AI stocks, featuring companies transforming healthcare with artificial intelligence breakthroughs.

- Seize the explosive upside of disruptive markets by targeting these 79 cryptocurrency and blockchain stocks as they push the boundaries of blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warehouses De Pauw might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:WDP

Warehouses De Pauw

WDP develops and invests in logistics real estate warehouses and offices.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives