- Belgium

- /

- Retail REITs

- /

- ENXTBR:RET

Retail Estates (ENXTBR:RET): Exploring Valuation as Momentum Cools After Recent Gains

Reviewed by Kshitija Bhandaru

Price-to-Earnings of 9.4x: Is it justified?

Retail Estates is currently valued notably below its peers, trading at a price-to-earnings ratio of 9.4 times. This is well beneath both the European Retail REITs sector average and its closest competitors. This suggests the stock is undervalued by conventional valuation standards.

The price-to-earnings (P/E) ratio compares a company’s share price to its earnings per share and is a widely used measure for valuing real estate investment trusts like Retail Estates. It helps investors assess whether a company’s stock is expensive, cheap, or somewhere in between based on profit generation.

Because Retail Estates’ P/E ratio is significantly lower than industry and peer averages, the market may be underestimating its earnings power or discounting its stability versus other REITs. This divergence invites further analysis into the company’s future growth expectations and risk profile relative to competitors.

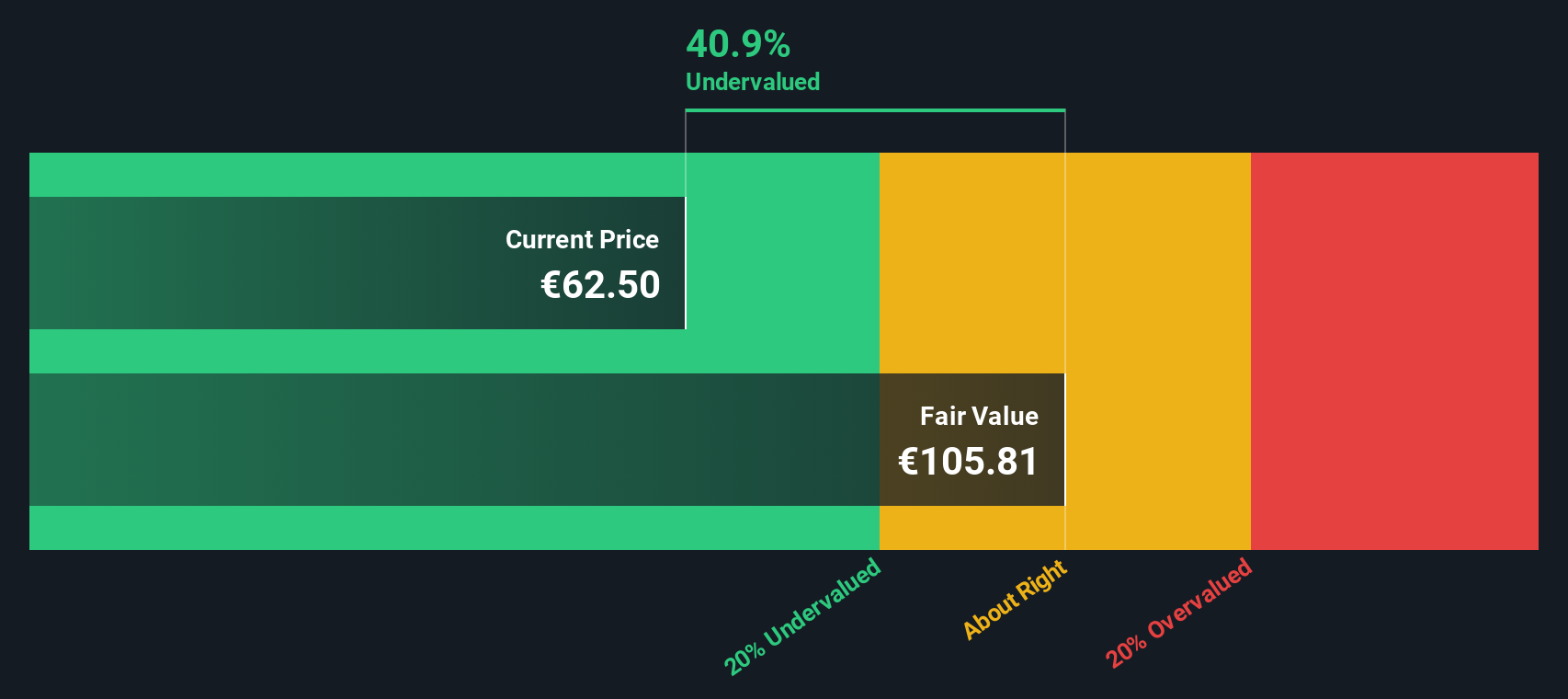

Result: Fair Value of €97.23 (UNDERVALUED)

See our latest analysis for Retail Estates.However, continued weak momentum and any disappointing shifts in revenue growth could prompt investors to reconsider the stock’s value proposition in the future.

Find out about the key risks to this Retail Estates narrative.Another View: What Does the SWS DCF Model Suggest?

Taking a different approach, the SWS DCF model looks at Retail Estates by focusing on future cash flows instead of profits alone. This method also suggests the shares are undervalued. However, can any single model capture the full picture?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Retail Estates Narrative

If you see the numbers differently or like to form your own views, you can put together your own perspective in just a few minutes. Do it your way

A great starting point for your Retail Estates research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Give your investment strategy an edge by targeting stocks with high-growth potential, future-focused technology, or resilient income. Don’t let promising opportunities pass you by. Some of the strongest performers are hiding just beneath the radar.

- Capture reliable income streams and secure your portfolio with dividend stocks with yields > 3% yielding above-market returns.

- Stay ahead of financial megatrends by tapping into AI penny stocks transforming industries through artificial intelligence breakthroughs.

- Boost your search for untapped potential by screening for the most attractively priced stocks using our undervalued stocks based on cash flows tool.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:RET

Retail Estates

Retail Estates NV is a Belgian public real estate investment trust and is a niche player specialised in making out-of-town retail properties located on the periphery of residential areas or along main access roads to urban centres available to users.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives