- Belgium

- /

- Real Estate

- /

- ENXTBR:MLNEU

Update: Compagnie Financière de Neufcour (EBR:NEU) Stock Gained 79% In The Last Three Years

By buying an index fund, investors can approximate the average market return. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. For example, Compagnie Financière de Neufcour S.A. (EBR:NEU) shareholders have seen the share price rise 79% over three years, well in excess of the market return (-10%, not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 14%.

View our latest analysis for Compagnie Financière de Neufcour

We don't think that Compagnie Financière de Neufcour's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 3 years Compagnie Financière de Neufcour saw its revenue shrink by 24% per year. The revenue growth might be lacking but the share price has gained 21% each year in that time. If the company is cutting costs profitability could be on the horizon, but the revenue decline is a prima facie concern.

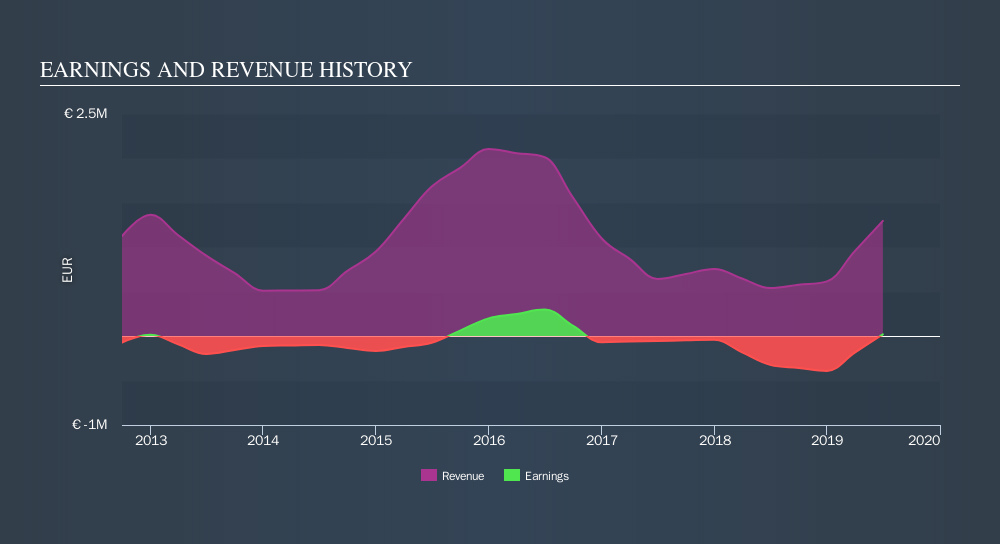

You can see how earnings and revenue have changed over time in the image below.

If you are thinking of buying or selling Compagnie Financière de Neufcour stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Compagnie Financière de Neufcour shareholders have received a total shareholder return of 14% over one year. That's better than the annualised return of 7.8% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

We will like Compagnie Financière de Neufcour better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTBR:MLNEU

Compagnie Financière de Neufcour

Manages real estate assets in the Liège region.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives