- Belgium

- /

- Health Care REITs

- /

- ENXTBR:COFB

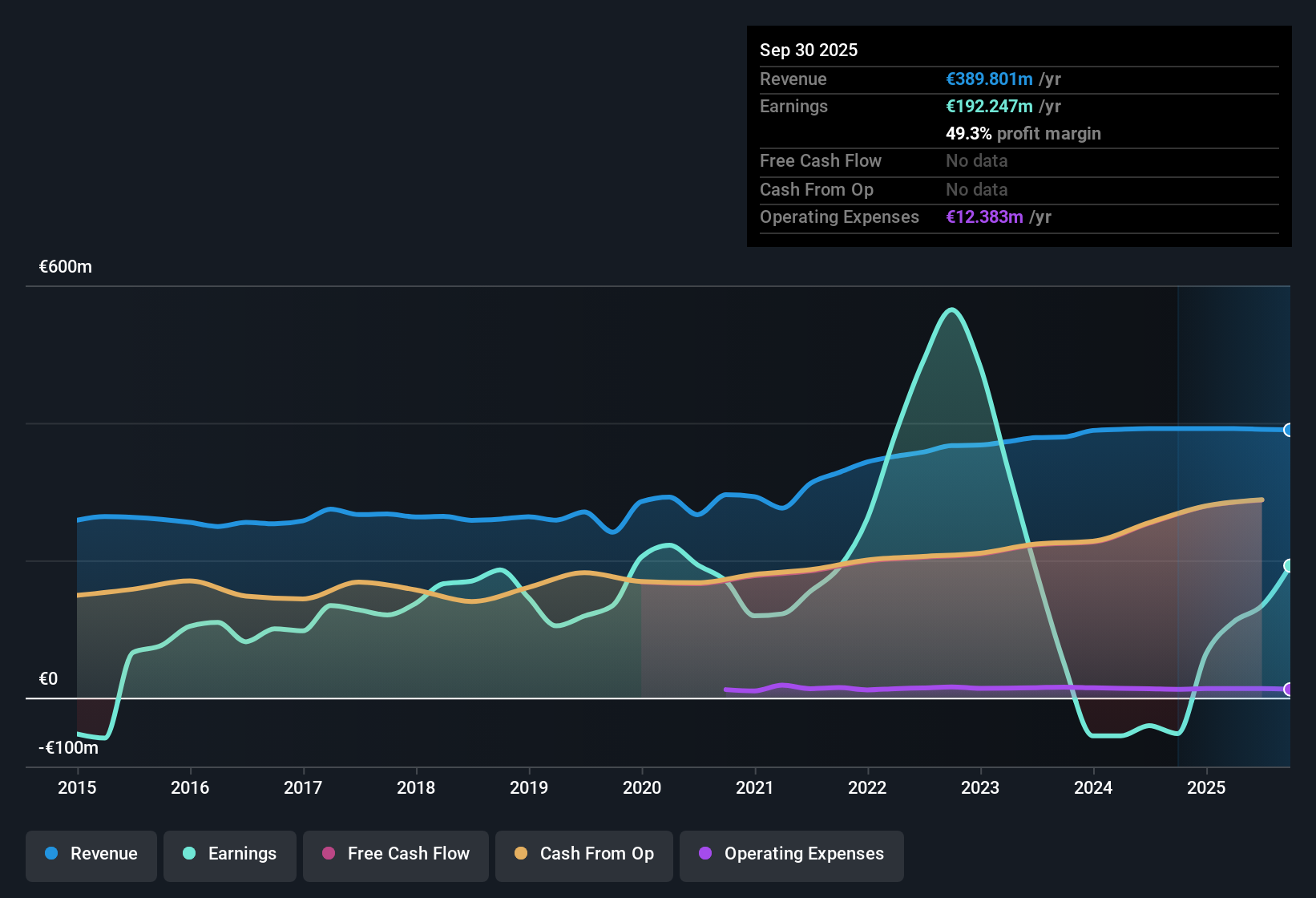

Cofinimmo (ENXTBR:COFB) Returns to Profitability Despite €52.6 Million Non-Recurring Loss

Reviewed by Simply Wall St

Cofinimmo (ENXTBR:COFB) reported a 20.9% annual decline in earnings over the past five years, but has just moved back into profitability despite a significant non-recurring loss of €52.6 million for the 12 months ending September 2025. Looking ahead, company earnings are forecast to grow at 13.1% per year, trailing the Belgian market average of 15.3%, while revenue is expected to decrease at an annual rate of -1.1% over the next three years.

See our full analysis for Cofinimmo.Let’s see how these headline numbers shape up when set against the narratives driving investor sentiment and analyst views for Cofinimmo. The next section will break down where the fundamentals match with market expectations and where they diverge.

See what the community is saying about Cofinimmo

Margins Set to Climb Even as Revenue Slips

- Analysts forecast profit margins will surge from 34.3% today to 89.1% over the next three years, even as revenue is expected to fall by 3.3% annually.

- Analysts' consensus view highlights how Cofinimmo’s focus on healthcare real estate, where 77% of its portfolio now sits, supports stable occupancy and resilient rent growth. These factors are expected to strengthen margins significantly.

- Consensus narrative notes the company’s high 98.6% occupancy rate and long average lease terms (15 years in healthcare), reinforcing the projection for predictably higher margins.

- However, a cautious investment approach and anticipated higher debt costs could offset the benefit, so the pace of margin expansion depends on these risks staying manageable.

See why some investors frame this rapid margin expansion as the pivotal story. Dive into the full consensus narrative for the latest analyst debate. 📊 Read the full Cofinimmo Consensus Narrative.

Debt Costs Rising as Balance Sheet Gets Heavier

- Average debt costs are projected to climb to 2.2% by 2028, while Cofinimmo’s debt-to-asset ratio now exceeds 43%, increasing financial risk at a time of slowing portfolio growth.

- Analysts' consensus view calls out multiple risk factors such as the anticipated rise in interest expense and persistent market illiquidity. Heavier debt loads could pressure net margins and future profitability.

- Consensus narrative flags that delays in property development, especially in Spain, may slow new revenue streams, complicating the ability to offset higher financing costs.

- Meanwhile, regulatory changes like higher fees and stricter ESG requirements in France are raising costs and could further squeeze margins if rental growth stalls.

Trading Below DCF Fair Value, Yet Price Target Shows Little Upside

- With shares priced at €74.20, Cofinimmo trades well below its DCF fair value estimate of €106.83, but analysts’ consensus price target sits much lower at €80.92, only 7.5% above the current market price.

- Analysts' consensus view contends that while Cofinimmo appears undervalued using discounted cash flow, most analysts consider the stock fairly priced based on their assumptions of muted growth and rising risk.

- The gap between DCF value and analyst targets spotlights real tension. Bulls see upside in a discounted asset, but most professionals point to revenue contraction and a conservative investment stance as limiting near-term gains.

- Consensus narrative emphasizes that unless you believe in much stronger-than-forecast earnings, the broader investment community does not see significant re-rating potential from these levels.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Cofinimmo on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the numbers with a fresh perspective? Take a couple of minutes to share your interpretation and shape the story your way with Do it your way.

A great starting point for your Cofinimmo research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Cofinimmo faces rising debt costs, a heavier balance sheet, and limited forecast growth, which raises concerns about its long-term financial stability.

If you value dependable finances, discover companies with stronger balance sheets and low leverage by using our solid balance sheet and fundamentals stocks screener (1987 results) to strengthen your portfolio’s resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:COFB

Cofinimmo

Cofinimmo has been acquiring, developing and managing rental properties for more than 40 years.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives