- Belgium

- /

- Retail REITs

- /

- ENXTBR:ASCE

We Discuss Why Ascencio SCA's (EBR:ASC) CEO May Deserve A Higher Pay Packet

Shareholders will be pleased by the robust performance of Ascencio SCA (EBR:ASC) recently and this will be kept in mind in the upcoming AGM on 31 January 2022. The focus will probably be on the future strategic initiatives that the board and management will put in place to improve the business rather than executive remuneration when they cast their votes on company resolutions. We have prepared some analysis below and we show why we think CEO compensation looks decent with even the possibility for a raise.

See our latest analysis for Ascencio

Comparing Ascencio SCA's CEO Compensation With the industry

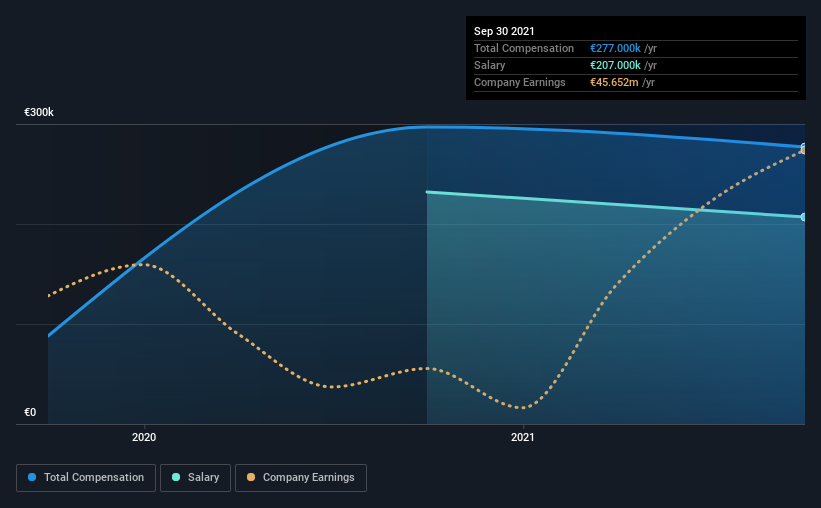

According to our data, Ascencio SCA has a market capitalization of €346m, and paid its CEO total annual compensation worth €277k over the year to September 2021. That's slightly lower by 6.7% over the previous year. We note that the salary portion, which stands at €207.0k constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the industry with market capitalizations between €177m and €707m, we discovered that the median CEO total compensation of that group was €482k. This suggests that Vincent Querton is paid below the industry median. What's more, Vincent Querton holds €105k worth of shares in the company in their own name.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | €207k | €232k | 75% |

| Other | €70k | €65k | 25% |

| Total Compensation | €277k | €297k | 100% |

Speaking on an industry level, nearly 61% of total compensation represents salary, while the remainder of 39% is other remuneration. It's interesting to note that Ascencio pays out a greater portion of remuneration through salary, compared to the industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Ascencio SCA's Growth Numbers

Ascencio SCA's earnings per share (EPS) grew 10% per year over the last three years. It achieved revenue growth of 3.5% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Ascencio SCA Been A Good Investment?

Ascencio SCA has served shareholders reasonably well, with a total return of 18% over three years. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

Overall, the company hasn't done too poorly performance-wise, but we would like to see some improvement. Assuming the business continues to grow at a good clip, few shareholders would raise any objections to the CEO's remuneration. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 3 warning signs for Ascencio (of which 2 don't sit too well with us!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:ASCE

Ascencio

A company incorporated under Belgian law, specialising in commercial property investments, and more specifically, supermarkets and retail parks.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.