- Belgium

- /

- Real Estate

- /

- ENXTBR:VGP

Need To Know: Analysts Are Much More Bullish On VGP NV (EBR:VGP) Revenues

VGP NV (EBR:VGP) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. The consensus estimated revenue numbers rose, with their view now clearly much more bullish on the company's business prospects. Investor sentiment seems to be improving too, with the share price up 7.2% to €95.70 over the past 7 days. It will be interesting to see if this latest upgrade is enough to kickstart further buying interest in the stock.

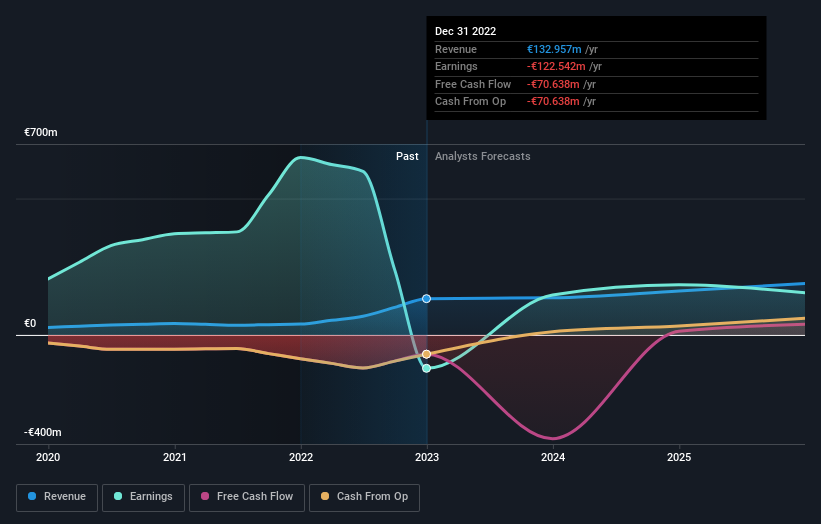

After this upgrade, VGP's three analysts are now forecasting revenues of €136m in 2023. This would be an okay 2.3% improvement in sales compared to the last 12 months. Prior to the latest estimates, the analysts were forecasting revenues of €111m in 2023. The consensus has definitely become more optimistic, showing a chunky increase in revenue forecasts.

Check out our latest analysis for VGP

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that VGP's revenue growth is expected to slow, with the forecast 2.3% annualised growth rate until the end of 2023 being well below the historical 15% p.a. growth over the last five years. Compare this with other companies in the same industry, which are forecast to see a revenue decline of 4.9% annually. So it's clear that despite the slowdown in growth, VGP is still expected to grow meaningfully faster than the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts lifted their revenue estimates for this year. They're also forecasting for revenues to perform better than companies in the wider market. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at VGP.

These earnings upgrades look like a sterling endorsement, but before diving in - you should know that we've spotted 3 potential flag with VGP, including dilutive stock issuance over the past year. For more information, you can click through to our platform to learn more about this and the 1 other flag we've identified .

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:VGP

VGP

Develops, owns, and manages logistics and semi-industrial real estate, and ancillary offices.

Fair value with acceptable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion