Shareholders in Mithra Pharmaceuticals (EBR:MITRA) have lost 90%, as stock drops 12% this past week

As an investor, mistakes are inevitable. But really big losses can really drag down an overall portfolio. So take a moment to sympathize with the long term shareholders of Mithra Pharmaceuticals SA (EBR:MITRA), who have seen the share price tank a massive 90% over a three year period. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And over the last year the share price fell 86%, so we doubt many shareholders are delighted. The falls have accelerated recently, with the share price down 56% in the last three months. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

With the stock having lost 12% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Mithra Pharmaceuticals

Mithra Pharmaceuticals wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years Mithra Pharmaceuticals saw its revenue shrink by 60% per year. That's definitely a weaker result than most pre-profit companies report. The swift share price decline at an annual compound rate of 24%, reflects this weak fundamental performance. We prefer leave it to clowns to try to catch falling knives, like this stock. There is a good reason that investors often describe buying a sharply falling stock price as 'trying to catch a falling knife'. Think about it.

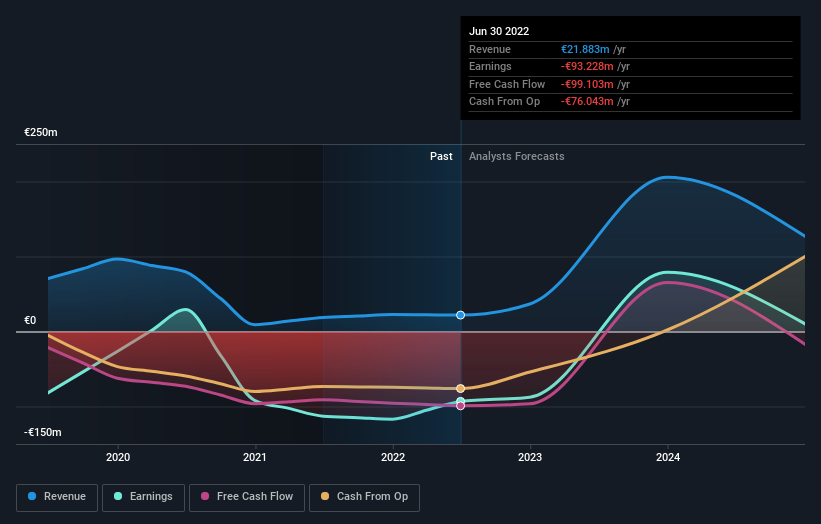

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Mithra Pharmaceuticals' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market lost about 2.5% in the twelve months, Mithra Pharmaceuticals shareholders did even worse, losing 86%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 13% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Mithra Pharmaceuticals is showing 3 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

Of course Mithra Pharmaceuticals may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BE exchanges.

If you're looking to trade Mithra Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:MITRA

Mithra Pharmaceuticals

Develops, manufactures, and markets complex therapeutics in the areas of contraception, menopause, and hormone-dependent cancers in Belgium, Europe and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives