- Hong Kong

- /

- Real Estate

- /

- SEHK:1821

Three Stocks Estimated To Be Undervalued In December 2024

Reviewed by Simply Wall St

As global markets continue to reach record highs, driven by strong gains in major indices like the Dow Jones Industrial Average and S&P 500, investors are navigating a landscape influenced by geopolitical developments and domestic policy shifts. Amidst this environment, identifying undervalued stocks can offer potential opportunities for those looking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY41.22 | TRY82.15 | 49.8% |

| PharmaResearch (KOSDAQ:A214450) | ₩213500.00 | ₩426006.27 | 49.9% |

| Giant Biogene Holding (SEHK:2367) | HK$48.30 | HK$96.27 | 49.8% |

| DAEDUCK ELECTRONICS (KOSE:A353200) | ₩14050.00 | ₩28039.12 | 49.9% |

| Power Root Berhad (KLSE:PWROOT) | MYR1.46 | MYR2.92 | 50% |

| Enento Group Oyj (HLSE:ENENTO) | €18.02 | €35.91 | 49.8% |

| EuroGroup Laminations (BIT:EGLA) | €2.726 | €5.42 | 49.7% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €7.84 | €15.60 | 49.7% |

| First Advantage (NasdaqGS:FA) | US$19.37 | US$38.63 | 49.9% |

| AeroVironment (NasdaqGS:AVAV) | US$203.19 | US$404.34 | 49.7% |

We'll examine a selection from our screener results.

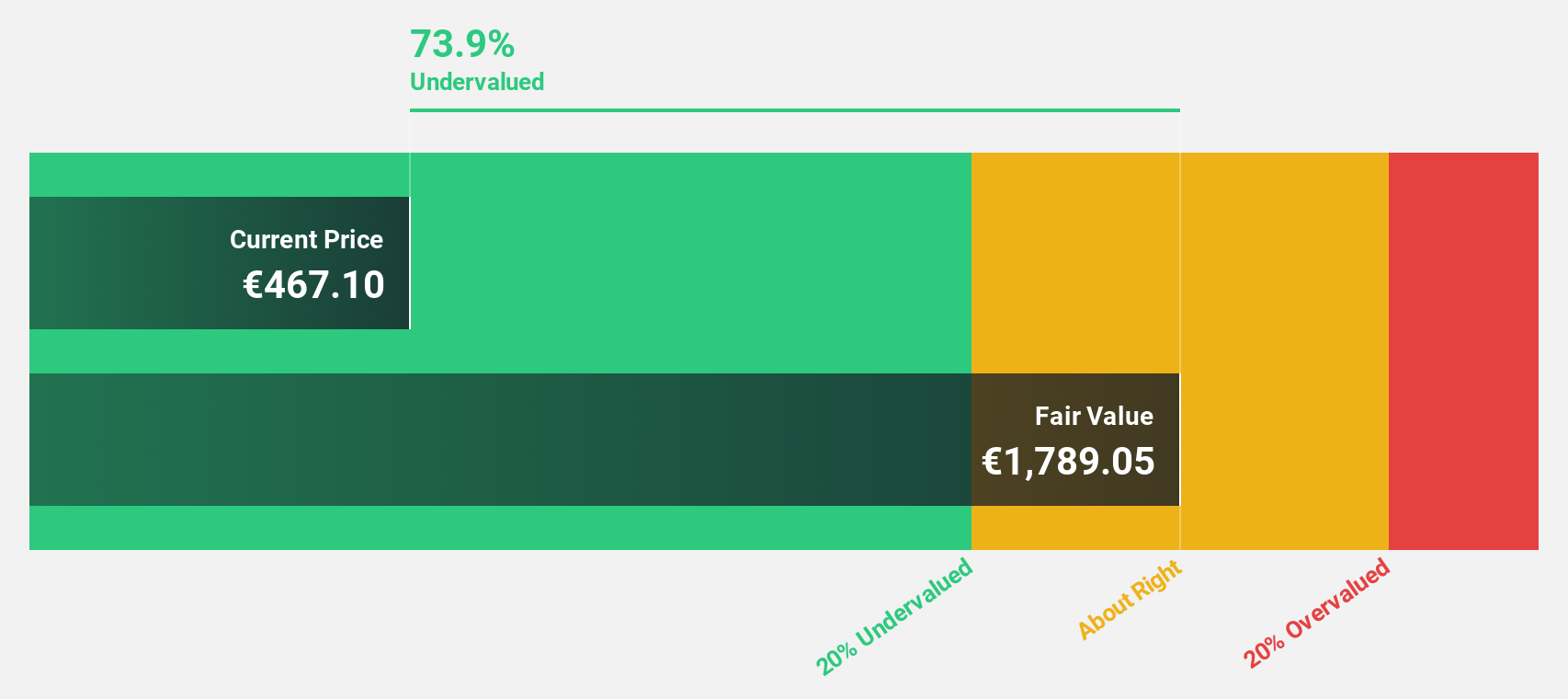

argenx (ENXTBR:ARGX)

Overview: argenx SE is a biotechnology company focused on developing therapies for autoimmune diseases across the United States, Japan, Europe, the Middle East, Africa, and China, with a market cap of €35.60 billion.

Operations: The company's revenue segment is biotechnology, generating $1.91 billion.

Estimated Discount To Fair Value: 35%

argenx is trading at 35% below its estimated fair value, with a projected revenue growth of 25% per year, outpacing the Belgian market. Recent earnings show significant improvement, with US$588.88 million in Q3 revenue and US$91.41 million net income. The company continues to advance its efgartigimod SC development following positive Phase 2 results in myositis treatment studies, potentially enhancing future cash flows and supporting its undervaluation thesis based on discounted cash flow analysis.

- The growth report we've compiled suggests that argenx's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in argenx's balance sheet health report.

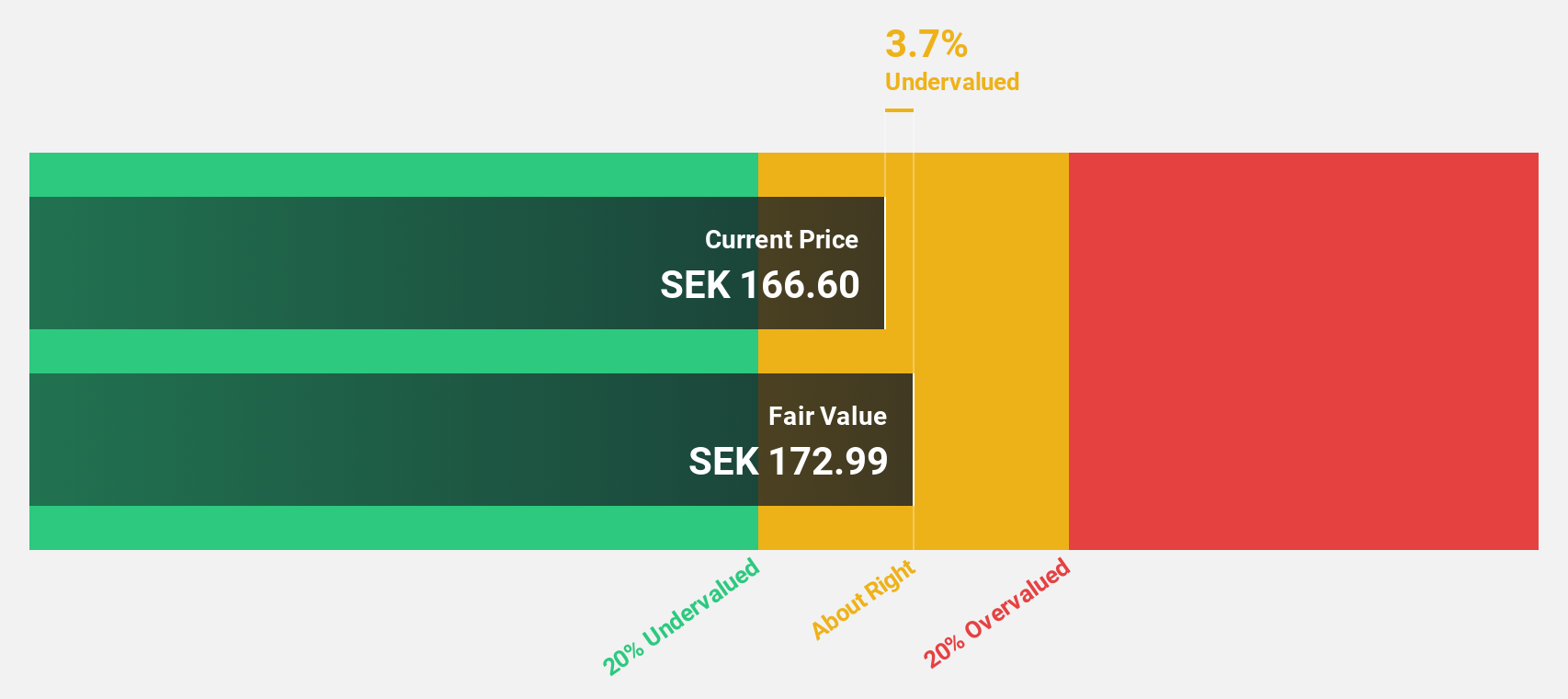

Sweco (OM:SWEC B)

Overview: Sweco AB (publ) offers architecture and engineering consultancy services globally, with a market cap of SEK60.04 billion.

Operations: The company's revenue segments are distributed as follows: Sweco UK with SEK1.48 billion, Sweco Norway at SEK3.48 billion, Sweco Sweden contributing SEK8.88 billion, Sweco Belgium at SEK3.99 billion, Sweco Denmark with SEK3.38 billion, Sweco Finland generating SEK3.62 billion, Sweco Netherlands at SEK3.28 billion, and Sweco Germany & Central Europe providing SEK2.78 billion in revenue.

Estimated Discount To Fair Value: 35.1%

Sweco is trading at SEK167, significantly below its estimated fair value of SEK257.2, suggesting it is undervalued based on discounted cash flow analysis. The company's earnings are forecast to grow by 15.64% annually, outpacing the Swedish market's growth rate. Recent projects like the Kiruna hospital design and Green Turtle battery park could bolster future revenue streams despite a slower projected revenue growth of 5.9% per year compared to industry peers.

- Insights from our recent growth report point to a promising forecast for Sweco's business outlook.

- Click here to discover the nuances of Sweco with our detailed financial health report.

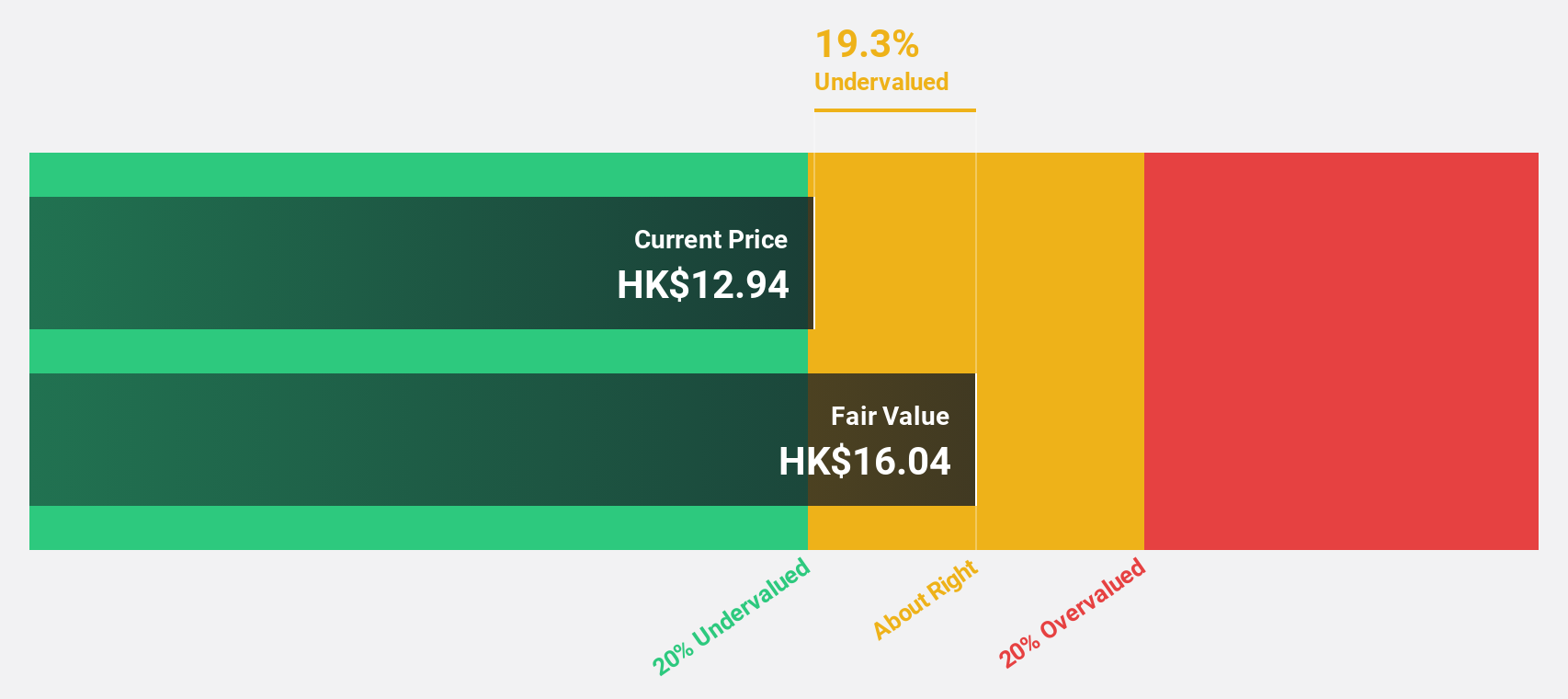

ESR Group (SEHK:1821)

Overview: ESR Group Limited operates in logistics real estate development, leasing, and management across various regions including Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, and Europe with a market cap of HK$48.57 billion.

Operations: The company's revenue segments include Fund Management with $627.98 million and New Economy Development generating $113.33 million.

Estimated Discount To Fair Value: 33.2%

ESR Group is trading at HK$11.44, below its estimated fair value of HK$17.14, highlighting undervaluation based on cash flow analysis. Revenue is expected to grow at 15.5% annually, surpassing the Hong Kong market's growth rate, while earnings are projected to increase significantly by 93.4% per year. Despite a low forecasted return on equity and interest payments not being well covered by earnings, analysts anticipate a 27.8% stock price rise with profitability in three years.

- In light of our recent growth report, it seems possible that ESR Group's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of ESR Group.

Taking Advantage

- Dive into all 900 of the Undervalued Stocks Based On Cash Flows we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ESR Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1821

ESR Group

Engages in the logistics real estate development, leasing, and management activities in Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, Europe, and internationally.

Reasonable growth potential and fair value.