The European market has shown resilience, with the pan-European STOXX Europe 600 Index rising by 1.03% amid expectations of a U.S. Federal Reserve interest rate cut, signaling optimism in the region's economic outlook despite some mixed signals from key economies such as Germany and the UK. In this environment, identifying high growth tech stocks involves looking for companies that are not only innovating but also effectively navigating current macroeconomic challenges and leveraging opportunities like advancements in artificial intelligence to drive future growth.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 31.53% | 46.86% | ★★★★★★ |

| argenx | 21.47% | 26.13% | ★★★★★★ |

| Comet Holding | 10.37% | 35.47% | ★★★★★☆ |

| KebNi | 21.99% | 63.71% | ★★★★★★ |

| Bonesupport Holding | 25.30% | 59.70% | ★★★★★★ |

| Hacksaw | 26.01% | 37.61% | ★★★★★★ |

| CD Projekt | 35.15% | 43.54% | ★★★★★★ |

| Aelis Farma | 79.30% | 106.93% | ★★★★★☆ |

| SyntheticMR | 18.81% | 47.40% | ★★★★★☆ |

| Yubico | 15.46% | 33.06% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

argenx (ENXTBR:ARGX)

Simply Wall St Growth Rating: ★★★★★★

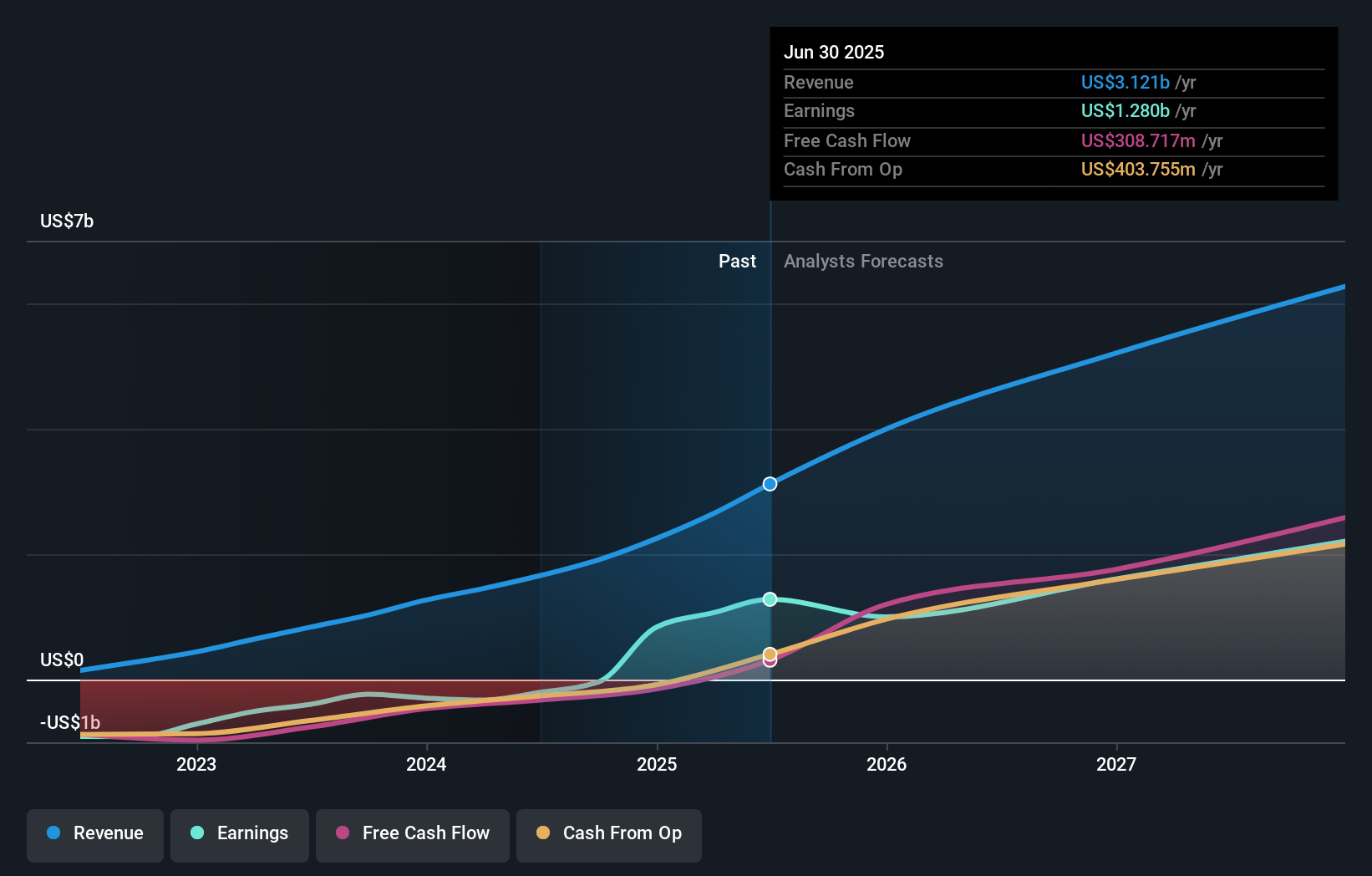

Overview: argenx SE is a commercial-stage biopharmaceutical company focused on developing therapies for autoimmune diseases across multiple regions including the United States, Japan, China, and the Netherlands, with a market capitalization of €37.85 billion.

Operations: argenx SE generates revenue primarily from its biotechnology segment, amounting to $3.12 billion. The company focuses on developing therapies for autoimmune diseases across various international markets.

With a robust annual revenue growth of 21.5% and earnings expected to surge by 26.1% annually, argenx stands out in the European high-growth tech landscape, particularly in the biotechnology sector focused on immunology and rare diseases. Recent pivotal results from the ADAPT SERON study underscore its commitment to innovation, potentially expanding VYVGART's label and enhancing treatment options in myasthenia gravis. Moreover, strategic alliances like the recent one with Unnatural Products Inc., emphasize argenx’s forward-thinking approach by integrating AI-driven platforms for drug discovery, which could revolutionize treatment modalities across various diseases. These developments not only reflect argenx's dynamic R&D strategy but also align with broader industry trends towards personalized medicine and technologically integrated therapeutic solutions.

- Unlock comprehensive insights into our analysis of argenx stock in this health report.

Understand argenx's track record by examining our Past report.

Smartoptics Group (OB:SMOP)

Simply Wall St Growth Rating: ★★★★★☆

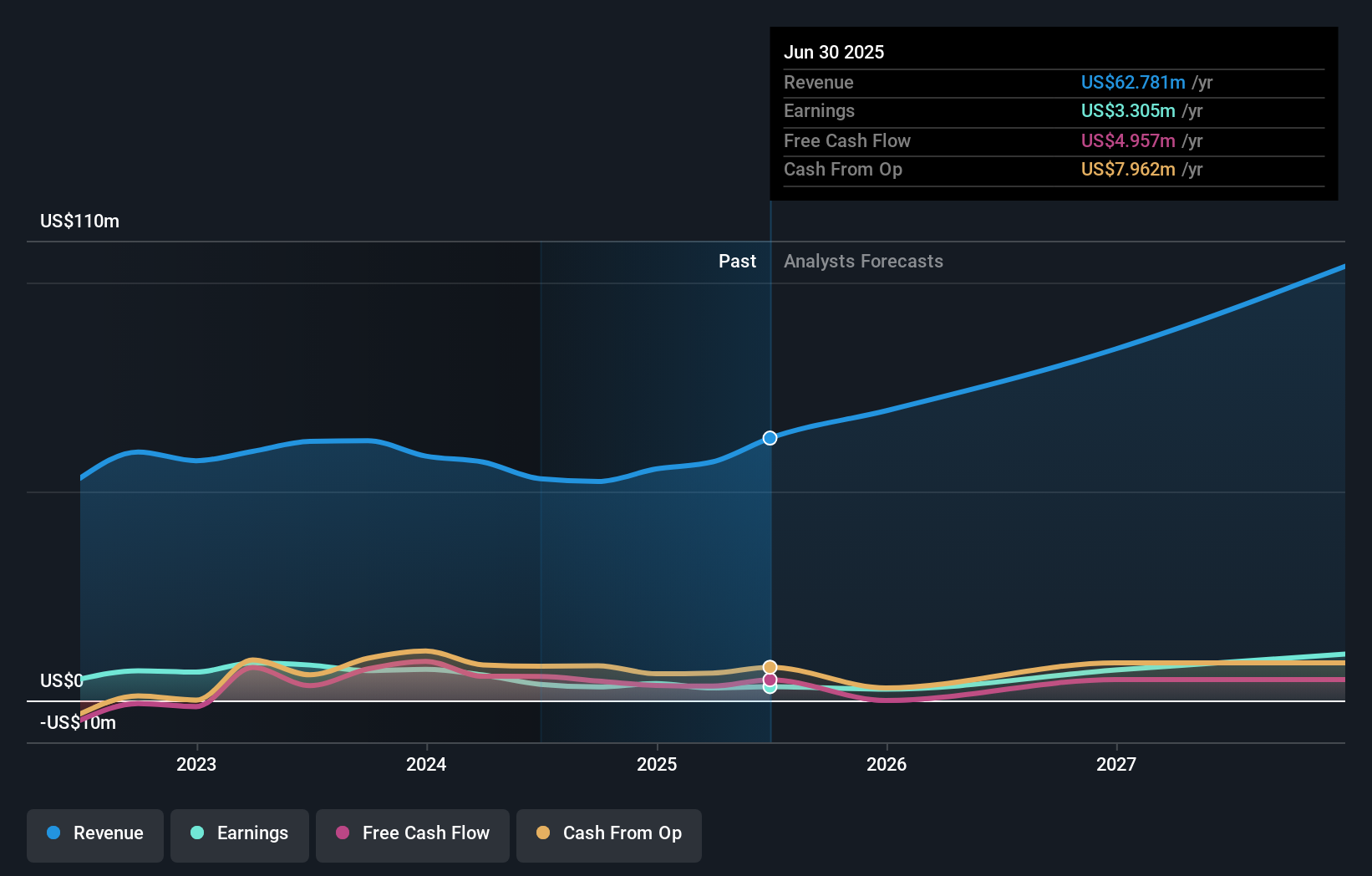

Overview: Smartoptics Group ASA offers optical networking solutions and devices across various global regions, with a market cap of NOK2.47 billion.

Operations: The company generates revenue by providing optical networking solutions and devices across multiple regions, including the Americas, Europe, the Middle East, Africa, and Asia–Pacific.

Smartoptics Group ASA, recently transformed into a public limited liability company, illustrates a promising trajectory in the tech sector with an impressive 20.5% annual revenue growth. Despite a volatile share price, its earnings are projected to expand by 55.9% annually, outpacing the Norwegian market's average significantly. This growth is underscored by recent financial results showing a jump in quarterly sales to $18.67 million from $12.99 million year-over-year and an increase in net income to $0.44 million from $0.121 million in the same period last year, reflecting robust operational performance and market acceptance of their offerings.

- Click to explore a detailed breakdown of our findings in Smartoptics Group's health report.

Explore historical data to track Smartoptics Group's performance over time in our Past section.

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

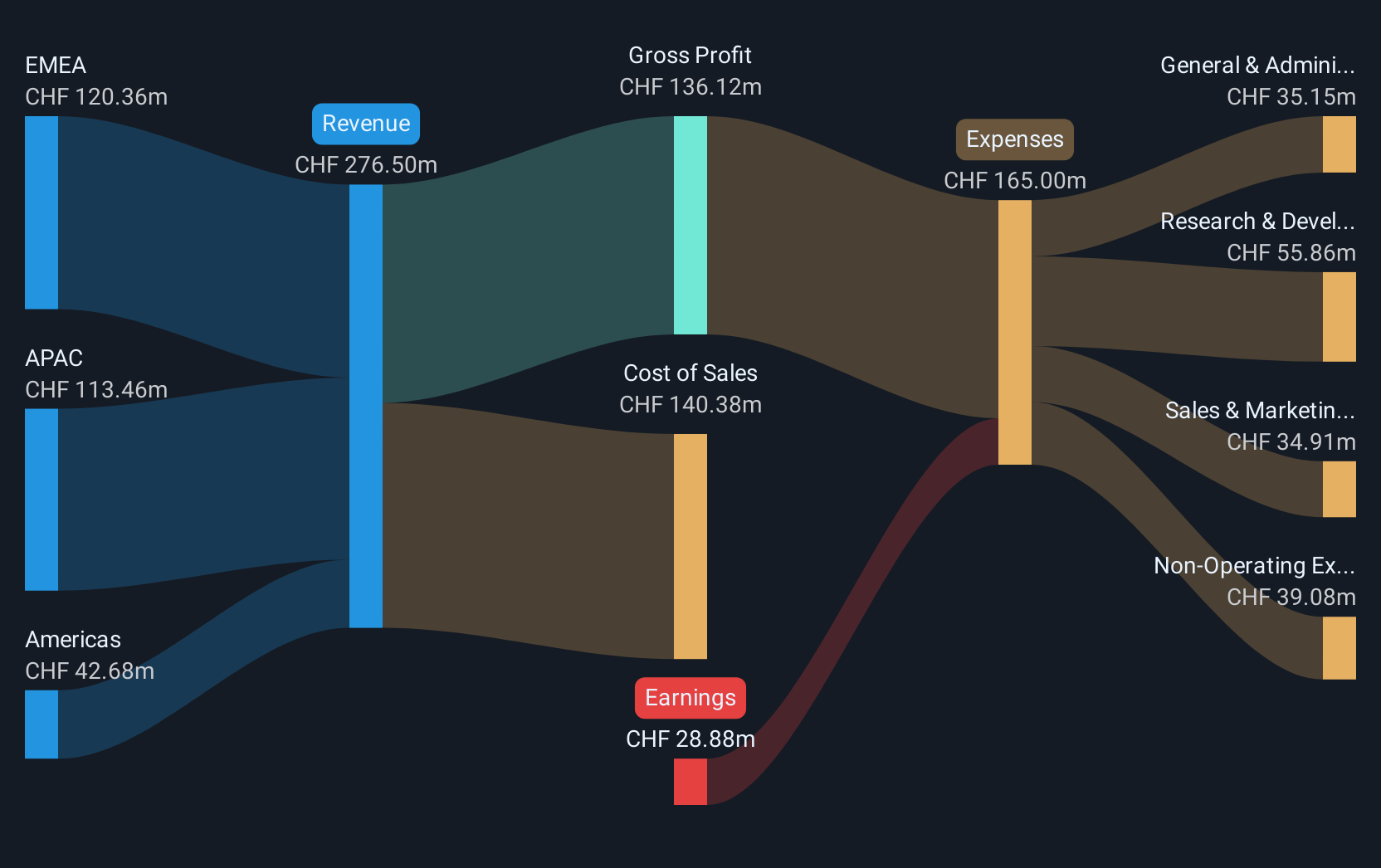

Overview: Sensirion Holding AG is a company that develops, produces, sells, and services sensor systems, modules, and components across various regions including the Asia Pacific, Europe, the Middle East, Africa, and the Americas with a market cap of CHF1.00 billion.

Operations: The company generates revenue primarily from its sensor systems, modules, and components segment, which reported CHF333.08 million.

Sensirion Holding AG, with a notable 30.2% forecasted annual earnings growth, is outperforming the Swiss market's average significantly. This growth trajectory is complemented by its innovative STCC4 sensor, which is revolutionizing CO2 monitoring with its compact design and efficiency, highlighting Sensirion's commitment to leading-edge technology in environmental sensing. Furthermore, the company's recent financial uplifts—projecting a revenue increase to CHF 320 million to CHF 340 million for 2025—demonstrate robust market positioning and operational success amidst dynamic economic conditions.

- Get an in-depth perspective on Sensirion Holding's performance by reading our health report here.

Examine Sensirion Holding's past performance report to understand how it has performed in the past.

Make It Happen

- Reveal the 52 hidden gems among our European High Growth Tech and AI Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:ARGX

argenx

A commercial-stage biopharma company, develops various therapies for the treatment of autoimmune diseases in the United States, Japan, China, the Netherlands, and internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives