- France

- /

- Capital Markets

- /

- ENXTPA:VIL

Exploring Europe's Undiscovered Gems in August 2025

Reviewed by Simply Wall St

As European markets experience a notable upswing, with the STOXX Europe 600 Index rising by 2.11% amid strong corporate earnings and optimism surrounding geopolitical resolutions, investors are increasingly looking toward small-cap stocks for untapped potential. In this environment, identifying promising stocks often involves seeking companies that demonstrate resilience and growth prospects despite broader economic challenges, such as those highlighted by recent industrial struggles in Germany.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Flügger group | 30.11% | 1.55% | -30.01% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Dekpol | 63.20% | 11.99% | 14.08% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

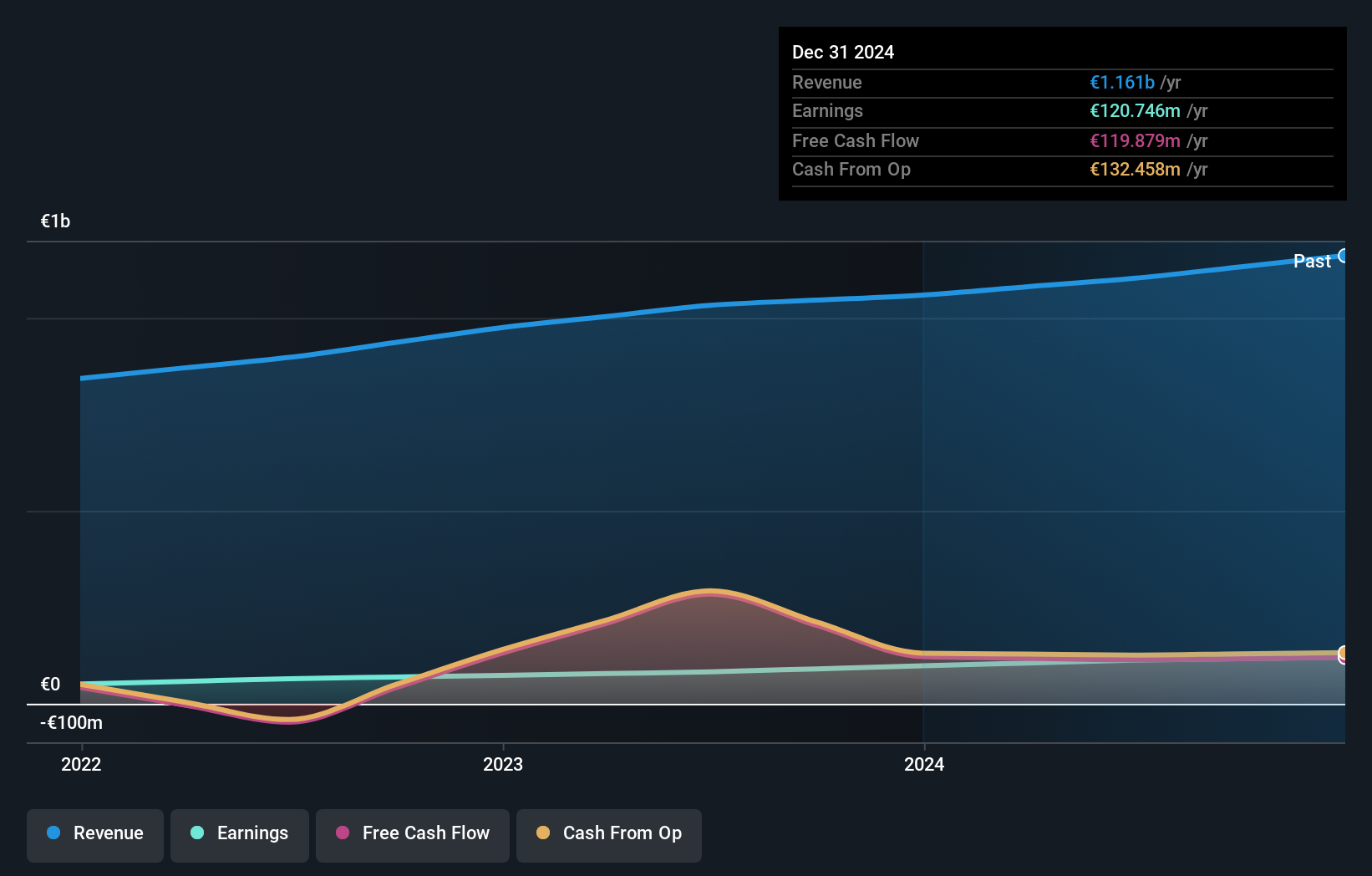

Rosetti Marino (BIT:YRM)

Simply Wall St Value Rating: ★★★★★★

Overview: Rosetti Marino SpA, with a market cap of €406.60 million, operates in the energy, energy transition, and shipbuilding sectors across Italy, the European Union, and internationally.

Operations: Rosetti Marino generates significant revenue from its Oil & Gas Business Unit at €403.62 million, followed by the Renewables and Carbon segment at €172.70 million. The company's gross profit margin trends are not provided, so a focus on net profit margin would be necessary if that data were available for analysis.

With a price-to-earnings ratio of 13.6x, Rosetti Marino stands out in the Italian market, which averages 17.2x. The company boasts high-quality earnings and has seen its earnings surge by 323% over the past year, outpacing the Energy Services industry growth of 11.7%. It efficiently manages debt with interest payments well covered by EBIT at a significant 229x coverage and has reduced its debt-to-equity ratio from 36.2% to 34.6% over five years. Despite recent share price volatility, these financial metrics suggest stability and potential for continued growth in profitability and value creation.

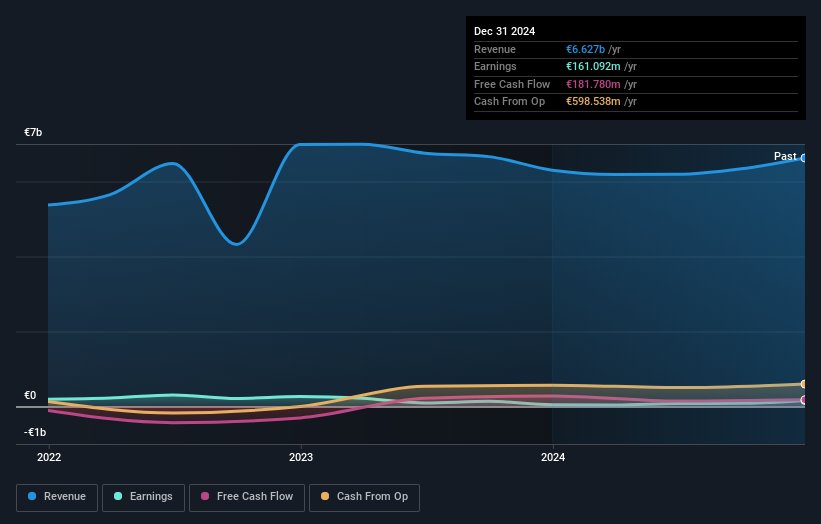

Viohalco (ENXTBR:VIO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Viohalco S.A. is a company that, through its subsidiaries, manufactures and sells aluminium, copper, cables, steel, and steel pipe products with a market capitalization of €1.65 billion.

Operations: Viohalco generates revenue primarily through the sale of aluminium, copper, cables, and steel products. The company's net profit margin is an important metric to evaluate its profitability.

With a robust earnings growth of 336.9% over the past year, Viohalco stands out in the metals and mining sector, significantly outperforming the industry's -1.1%. The company's net debt to equity ratio has improved from 139.5% to 93.5% over five years, although it remains high at 63.9%. Interest coverage by EBIT is limited at 2.8x, which may raise concerns about debt servicing capabilities. Recent quarterly results show sales reaching €930 million with net income climbing to €40 million from €13 million a year ago, suggesting strong operational performance despite financial leverage challenges.

- Unlock comprehensive insights into our analysis of Viohalco stock in this health report.

Understand Viohalco's track record by examining our Past report.

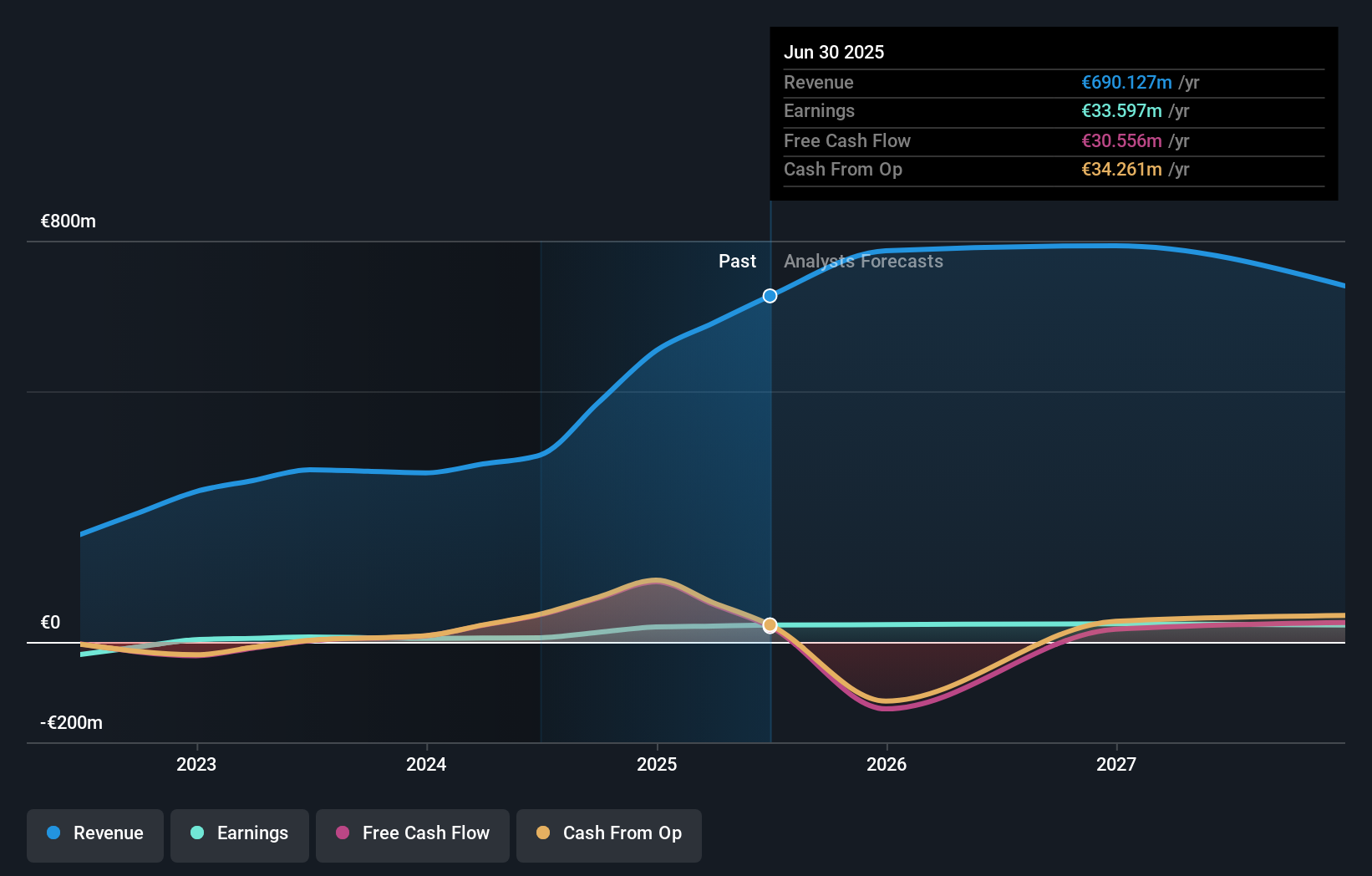

VIEL & Cie société anonyme (ENXTPA:VIL)

Simply Wall St Value Rating: ★★★★★☆

Overview: VIEL & Cie, société anonyme is an investment company that offers interdealer broking, online trading, and private banking services across various regions including Europe, the Middle East, Africa, the Americas, and the Asia-Pacific region with a market cap of approximately €1 billion.

Operations: VIEL & Cie generates revenue primarily from professional intermediation (€1.11 billion) and stock exchange online activities (€74.37 million), with a minor contribution from holdings (€5.40 million). The company's net profit margin shows notable variations over time, reflecting changes in operational efficiency and cost management strategies.

VIL's financial health appears robust, with a debt-to-equity ratio dropping from 98.3% to 63% over the last five years, indicating improved leverage management. The company boasts high-quality earnings and saw a notable earnings growth of 23.1% in the past year, outpacing the Capital Markets industry's 14.1%. Trading at approximately 12.2% below its estimated fair value suggests potential for upside appreciation. With more cash than total debt and positive free cash flow, VIL seems well-positioned financially, though interest coverage by EBIT remains unclear due to insufficient data on interest payments relative to EBIT levels.

Where To Now?

- Explore the 317 names from our European Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VIL

VIEL & Cie société anonyme

An investment company, provides interdealer broking, online trading, and private banking services in France, Europe, the Middle East, Africa, the Americas, and the Asia-Pacific region.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives