Umicore (ENXTBR:UMI): Evaluating Valuation After Sustained Share Price Momentum Without Major News

Reviewed by Simply Wall St

Most Popular Narrative: 3.4% Undervalued

According to the most widely followed narrative, Umicore is currently undervalued by 3.4%. This conclusion is based on future earnings expectations, profit margins, and a discount rate of 8.38%.

The company is strategically realigning its operations and pausing the Battery Materials plant construction in Canada, while consolidating customer contracts in Korea. This decision, alongside a 35% reduction in CapEx for Battery Materials, may have a near-term impact on cash flow but aims to optimize long-term revenue growth and EBITDA through better capacity utilization.

Curious what market forces drive this valuation? The narrative relies on bold profit forecasts, a future margin rarely achieved in this sector, and a sharp financial turnaround. Want to see exactly which key numbers must play out for this price target to become reality? Don’t miss the full breakdown of how analysts are crunching the figures.

Result: Fair Value of €14.02 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, weaker demand for electric vehicles and recent losses in Battery Materials could quickly challenge the outlook and trigger a reassessment of Umicore’s prospects.

Find out about the key risks to this Umicore narrative.Another View

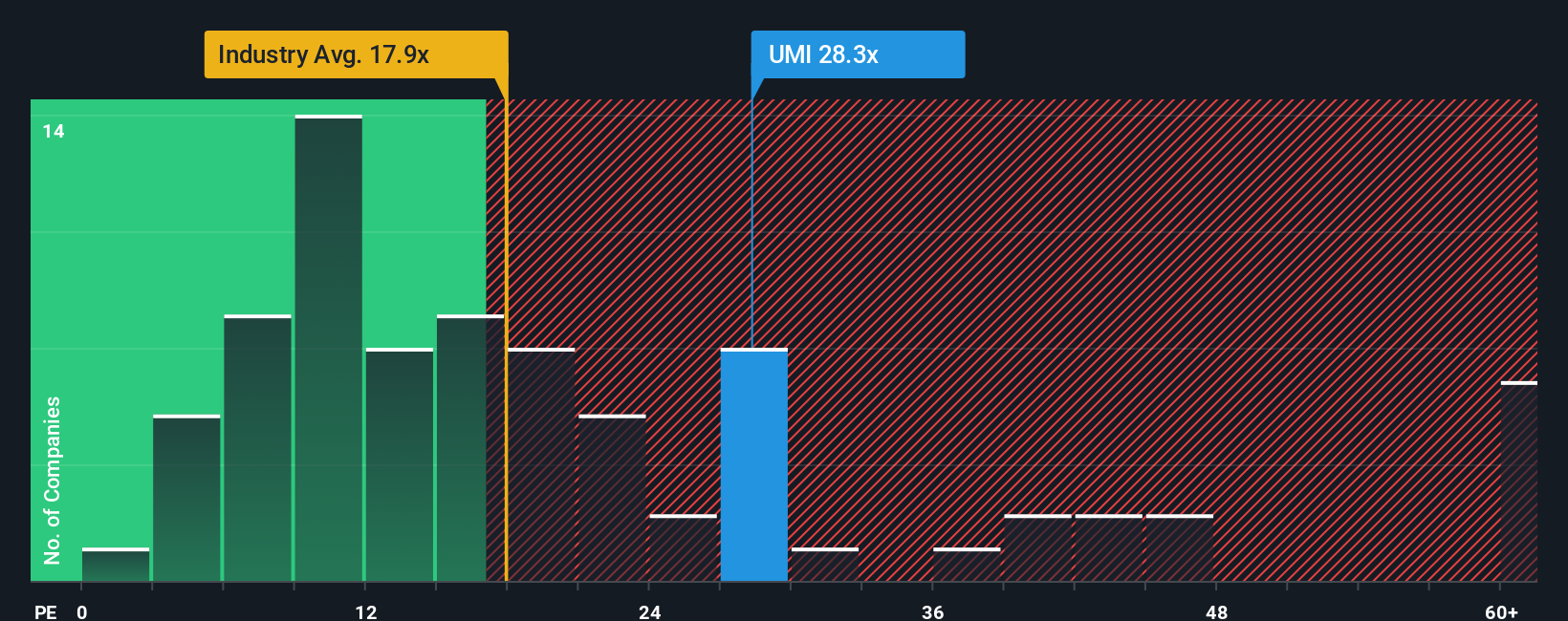

While analysts see Umicore as undervalued based on future earnings, a look at the company's price-to-earnings ratio compared to the wider European Chemicals industry suggests it is more expensive. Which picture tells the real story?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Umicore to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Umicore Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own take on Umicore's outlook in just a few minutes. Do it your way

A great starting point for your Umicore research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Turbocharge your portfolio with handpicked stocks using the Simply Wall Street Screener. Don’t let these unique opportunities pass you by and see what’s possible right now:

- Spot value hidden in plain sight by jumping into undervalued stocks based on cash flows. Pinpoint stocks that look attractive based on strong cash flow fundamentals.

- Accelerate your search for innovation and access AI penny stocks to uncover companies pushing the boundaries of artificial intelligence.

- Fuel your gains with consistent income by targeting dividend stocks with yields > 3% and secure reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTBR:UMI

Umicore

Operates as a materials technology and recycling company in Belgium, Europe, the Asia-Pacific, North America, South America, and Africa.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion