Is Umicore Fairly Priced After Recent Battery Partnerships and a 40% Stock Surge in 2025?

Reviewed by Bailey Pemberton

- Curious if Umicore is a hidden bargain or just along for the ride? You are in the right place to get the facts on its current price versus long-term value.

- The stock has been anything but boring this year, jumping 40.0% year-to-date and 45.1% over the last 12 months. This comes despite some recent short-term dips of -4.1% in the past week and -15.8% over the last month.

- These swings follow headlines about Umicore’s partnerships to secure raw materials for battery production and ongoing investments in clean energy technology. Both have attracted renewed attention from analysts and investors. With energy transition stories continuing to capture market interest, every bit of news seems to have an outsized impact on both risk appetite and growth expectations for the stock.

- If you are wondering how all of this translates into valuation, Umicore earns a 1 out of 6 on our standard value checks. Up next, we will explore what that really means using different valuation methods. Before you make up your mind, be sure to stick around for a fresh perspective on valuation at the end of the article.

Umicore scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Umicore Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by projecting a company's expected future cash flows and then discounting them back to the present value. This helps investors estimate what the business is really worth today, based on its long-term potential to generate cash.

For Umicore, the model starts with its most recent Free Cash Flow (FCF), which was negative at €85.14 million. However, analysts and financial models anticipate a strong turnaround, with FCF expected to reach €213 million by 2028. Looking ahead through 2035, projections (partly from analysts and partly using extrapolation) suggest Umicore's annual cash flows will continue to grow, but all remain below €300 million per year. These estimates reflect both the volatility and the growth opportunities in Umicore’s key markets.

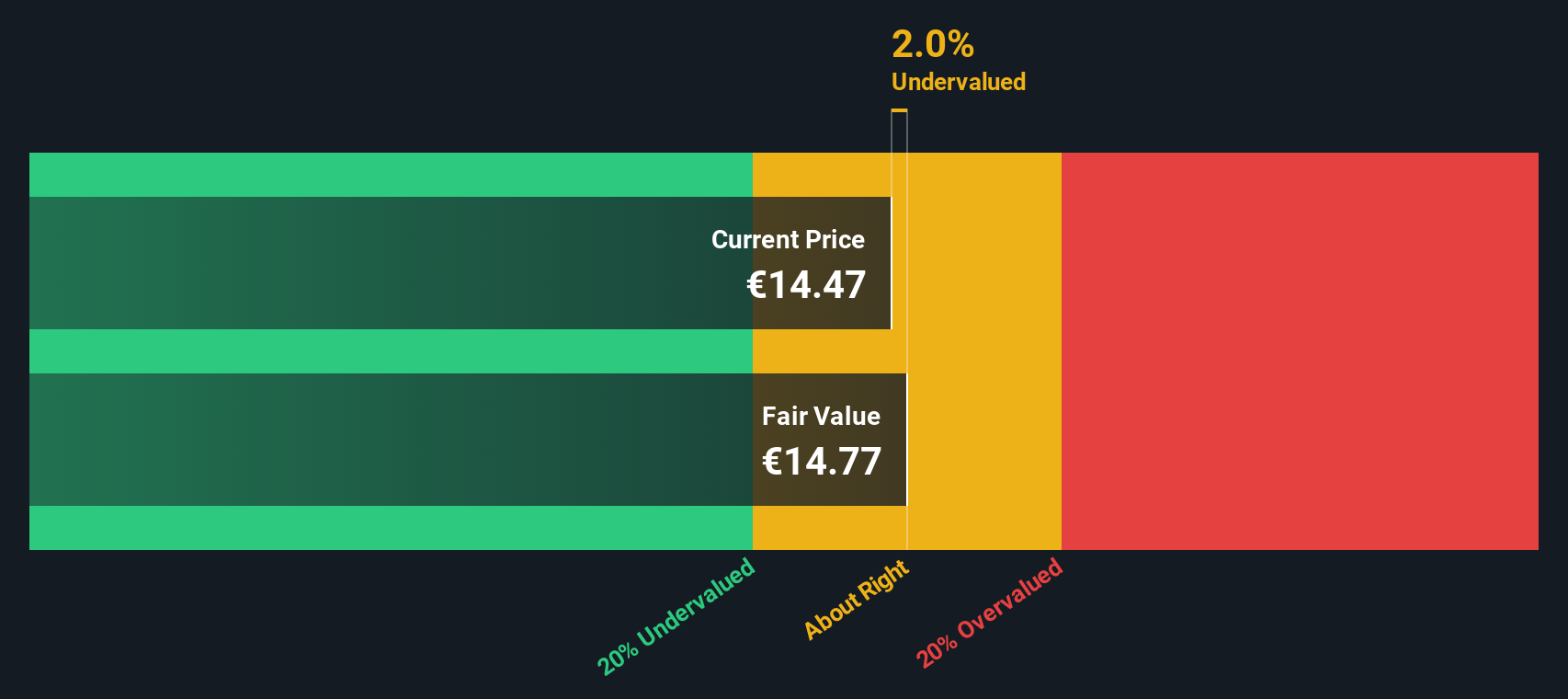

When we sum up and discount all these future cash flows, the intrinsic value per share comes out to €14.71. Compared to the current market price, this implies Umicore is trading at a 3.1% discount to its calculated worth. That small margin suggests the current price is very close to its estimated fair value.

Result: ABOUT RIGHT

Umicore is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Umicore Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used valuation measure for profitable companies because it ties the company’s market value directly to its underlying earnings power. When a company consistently generates profits, the PE ratio becomes a snapshot of how much investors are willing to pay for each euro of those earnings, making it a solid tool for comparison in established businesses.

Higher expected growth and lower risk typically justify a higher "normal" or "fair" PE ratio since investors anticipate stronger future earnings or feel more confident about the company's prospects. Conversely, companies with slower growth or higher uncertainty are usually valued at lower PE ratios relative to their earnings.

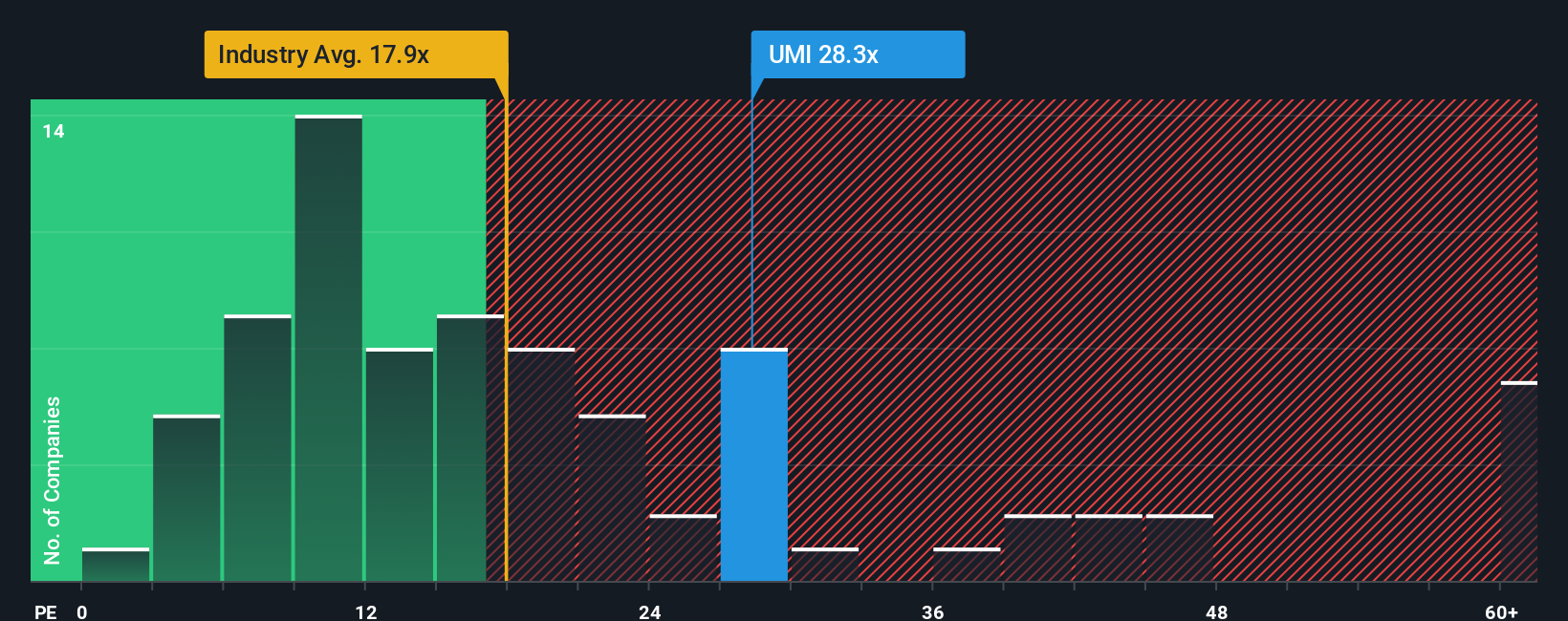

Umicore’s current PE ratio stands at 26.6x, which sits above the Chemicals industry average of 21.0x and the peer average of 17.2x. While these benchmarks provide useful context, they can miss company-specific drivers of value, such as earnings stability, future growth outlook, or unique risks.

This is where the Simply Wall St "Fair Ratio" steps in. It is set at 19.2x for Umicore, reflecting a more tailored multiple that adjusts for the company’s own earnings growth, profitability, market cap, and risk profile. By factoring in these nuanced drivers, the Fair Ratio offers a more accurate assessment of what investors should be willing to pay for Umicore, beyond what simple industry or peer comparisons suggest.

Comparing Umicore’s actual 26.6x to its Fair Ratio of 19.2x, the stock appears to be trading at a premium to its fair earnings-based value, suggesting it may be a bit overvalued at current levels.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Umicore Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal, evidence-backed story about a company, connecting your opinions on its future (like estimated revenues, margins, and fair value) to a clear investment view. Instead of simply relying on a single formula or ratio, Narratives let you spell out the key events, expectations, and catalysts driving your forecast, making your perspective transparent and actionable.

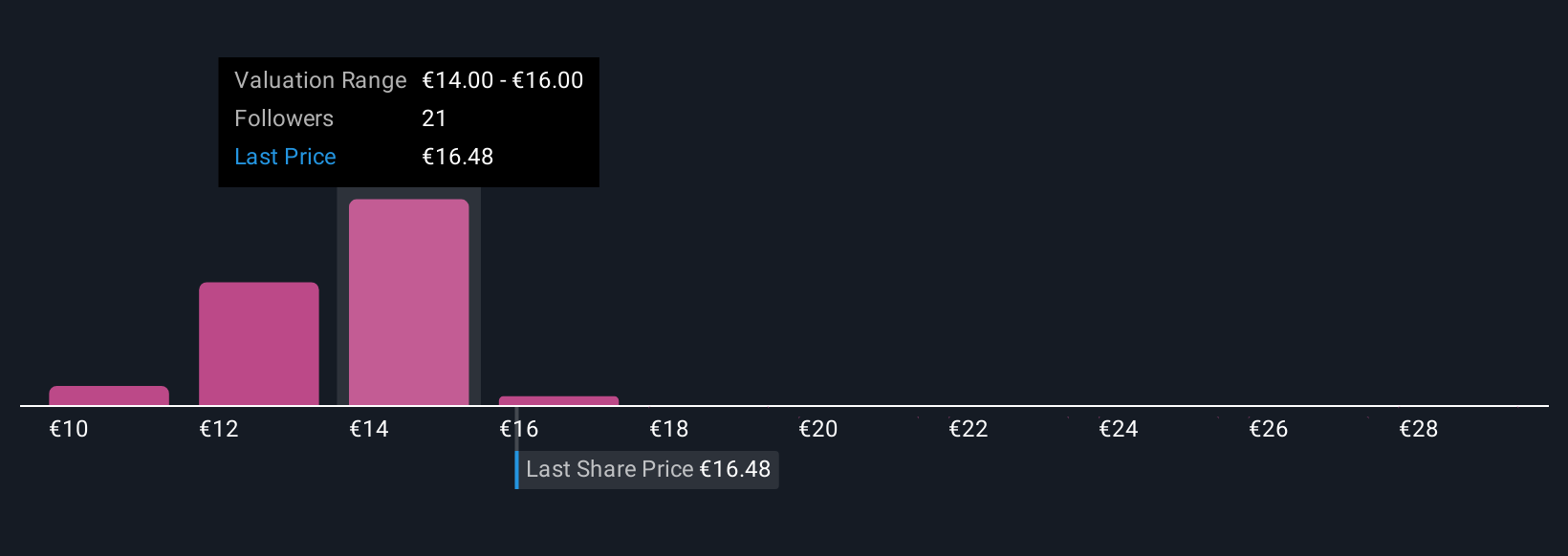

On Simply Wall St’s Community page, millions of investors can easily create, update, and share Narratives that tie together the company’s business story, a justified financial forecast, and a fair value estimate. Narratives help you make smarter buy or sell decisions by comparing your calculated Fair Value with today’s market price. They automatically update as soon as new earnings or news emerge. For Umicore, for example, some investors believe strong cost-saving programs and expanding global reach could push fair value as high as €21.0, while others see declining battery revenues and margin risks driving fair value as low as €10.0. Narratives empower you to see the “why” behind every number and tailor your decisions to what you believe, not just what the market consensus says.

Do you think there's more to the story for Umicore? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:UMI

Umicore

Operates as a materials technology and recycling company in Belgium, Europe, the Asia-Pacific, North America, South America, and Africa.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success