Syensqo (ENXTBR:SYENS): Assessing Valuation After Recent Quiet Share Price Moves

Reviewed by Simply Wall St

Most Popular Narrative: 10.6% Undervalued

According to the most widely followed narrative, Syensqo’s shares are trading at a meaningful discount compared to their estimated fair value. This perspective argues that the current price does not fully reflect future growth opportunities and profitability projections.

"Structural shift towards lightweighting, electrification, and sustainable materials across mobility, aerospace, healthcare, and industrial sectors is increasing Syensqo's addressable market for high-margin specialty polymers and composites. This underpins higher long-term revenue growth and resilience."

Curious what’s fueling this bullish projection for Syensqo? The secret ingredient might be a powerful earnings rebound paired with a surprisingly optimistic margin blueprint. Wondering how analysts reach their calculated fair value amid the industry headwinds? Uncover the key quantitative leaps driving these forecasts and see which bold assumptions put the stock’s future squarely in the growth spotlight.

Result: Fair Value of €83.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing declines in core business volumes and heightened competition could quickly challenge the optimistic outlook for Syensqo’s longer-term growth.

Find out about the key risks to this Syensqo narrative.Another View: Market Ratios Paint a Different Picture

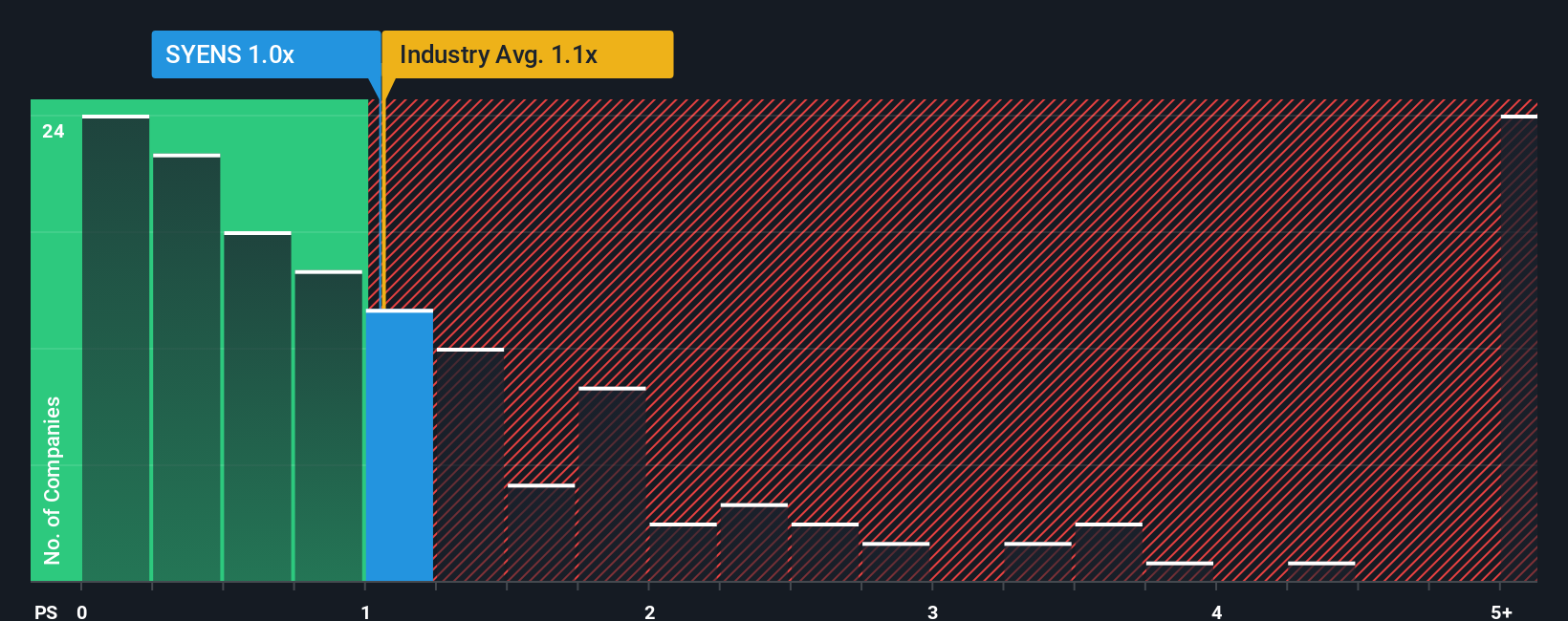

While the earlier fair value estimate suggests upside, looking at the company's key market multiple compared to its European industry tells a less optimistic story. This view argues Syensqo trades at a premium. It raises the question of whether the market is pricing in additional risk or expecting lower growth.

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Syensqo to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Syensqo Narrative

If you see things differently or want to dig into your own research, you can craft your own narrative in just a few minutes. So why not Do it your way?

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Syensqo.

Looking for more investment ideas?

Smart investors never stop at one opportunity. Give yourself an edge by uncovering unique companies shaping the future and see where your next advantage could start.

- Spot strong returns in small packages with potential breakthroughs among penny stocks with strong financials.

- Target market leaders in healthcare's digital transformation by checking out healthcare AI stocks.

- Boost your portfolio’s value with businesses trading below fair value through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTBR:SYENS

Syensqo

Engages in the research, development, and production of advanced materials for industrial and consumer applications worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives