Solvay (ENXTBR:SOLB): Revisiting Valuation Narratives After Recent Share Price Swings

Reviewed by Kshitija Bhandaru

See our latest analysis for Solvay.

After a notably uneven stretch over the past year, Solvay’s recent share price movement suggests momentum remains tepid, with investors appearing cautious as total shareholder return over one year dipped slightly into negative territory. Longer-term holders, though, have seen modest gains. This hints that sentiment may be stabilizing as the company navigates a shifting landscape.

If you’re weighing fresh opportunities beyond Solvay, now is an ideal time to broaden your investing horizons and discover fast growing stocks with high insider ownership

The real question for investors is whether Solvay’s recent price weakness leaves the stock undervalued, or if the market has already factored in any future turnaround. Is this a hidden buying opportunity, or is potential growth already reflected in the current price?

Most Popular Narrative: 6.3% Undervalued

At €29.03 per share, the narrative sees Solvay’s fair value moderately above its last close of €27.20. This reflects optimism for a turnaround. The latest projections rest on catalysts tied to Solvay’s rare earths expansion and energy transition bets.

Growing customer demand for rare earth production capacity outside of China, triggered by Chinese export controls and seeking greater supply chain localization, positions Solvay's La Rochelle plant for potential rapid expansion. This paves the way for incremental high-value revenue streams and improved asset utilization in the coming years.

Curious how much earnings growth and margin boost are being baked into this valuation? There are bold assumptions below the surface, hinting at a future profit mix that could shift the market narrative. Want to uncover what’s driving this relatively optimistic price target? Dive deeper for the surprising calculations backing this view.

Result: Fair Value of $29.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressure or global trade tensions could sharply limit Solvay's recovery potential. This makes even the optimistic outlook vulnerable to setbacks.

Find out about the key risks to this Solvay narrative.

Another View: Multiples Tell a Different Story

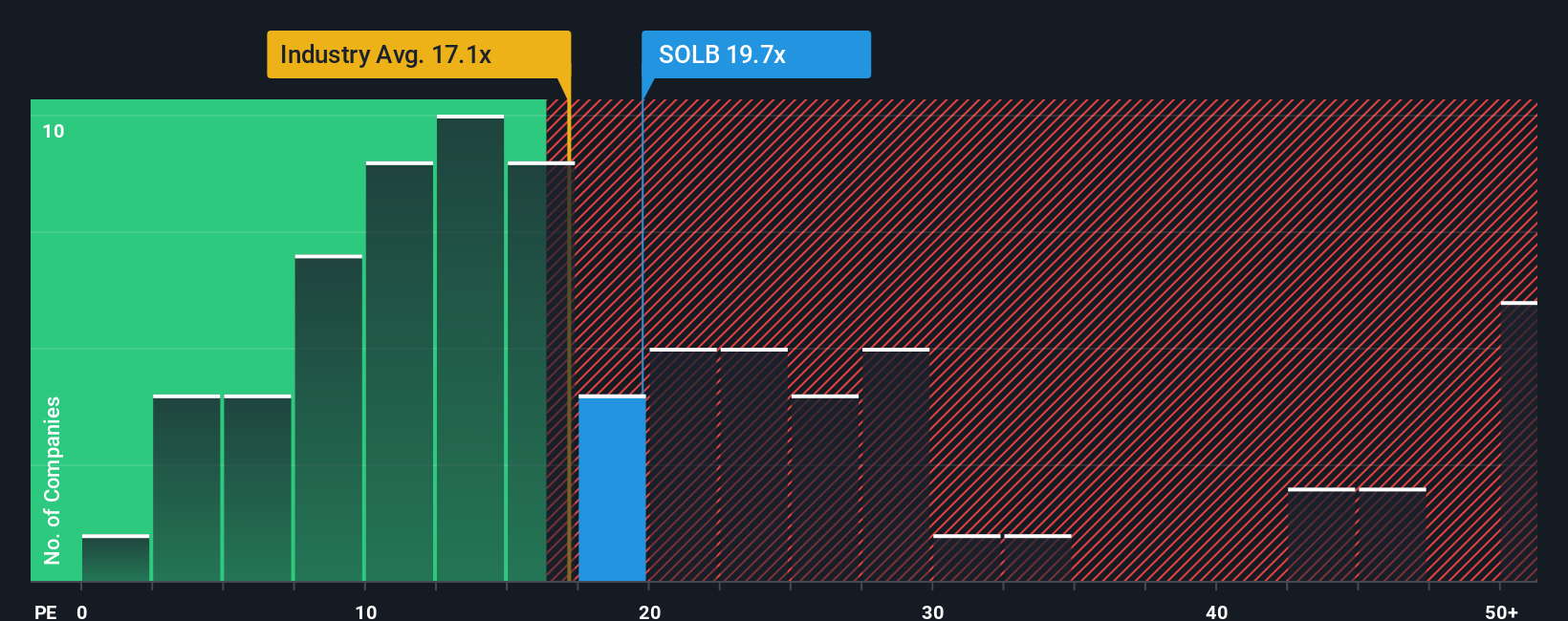

Looking through the lens of valuation multiples, Solvay doesn’t appear as much of a bargain. Its price-to-earnings ratio sits at 20.4x, which is more expensive than both peers and the European Chemicals industry averages. Interestingly, the fair ratio is 21.3x, suggesting the market could potentially re-rate higher. Does this higher multiple signal opportunity, or does it point to valuation risk if market sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Solvay Narrative

Prefer to dig into the numbers and craft your own viewpoint? You can easily build a personalized narrative based on your insights in just minutes, so why not Do it your way

A great starting point for your Solvay research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't miss your chance to get ahead of the curve by checking out powerful stock picks tailored for different strategies and goals, all just a click away.

- Uncover untapped gems with massive potential by targeting these 901 undervalued stocks based on cash flows where today’s price may not reflect tomorrow’s value.

- Enhance your portfolio’s income by searching for compelling high-yield opportunities among these 19 dividend stocks with yields > 3%, which offer consistent payouts over 3%.

- Seize the future by investing early in innovators who are driving breakthroughs in medicine and robotics within these 31 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:SOLB

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives