Today we're going to take a look at the well-established Solvay SA (EBR:SOLB). The company's stock saw a decent share price growth in the teens level on the ENXTBR over the last few months. As a large-cap stock with high coverage by analysts, you could assume any recent changes in the company’s outlook is already priced into the stock. But what if there is still an opportunity to buy? Today I will analyse the most recent data on Solvay’s outlook and valuation to see if the opportunity still exists.

View our latest analysis for Solvay

What's The Opportunity In Solvay?

Good news, investors! Solvay is still a bargain right now. My valuation model shows that the intrinsic value for the stock is €141.55, which is above what the market is valuing the company at the moment. This indicates a potential opportunity to buy low. What’s more interesting is that, Solvay’s share price is quite volatile, which gives us more chances to buy since the share price could sink lower (or rise higher) in the future. This is based on its high beta, which is a good indicator for how much the stock moves relative to the rest of the market.

What does the future of Solvay look like?

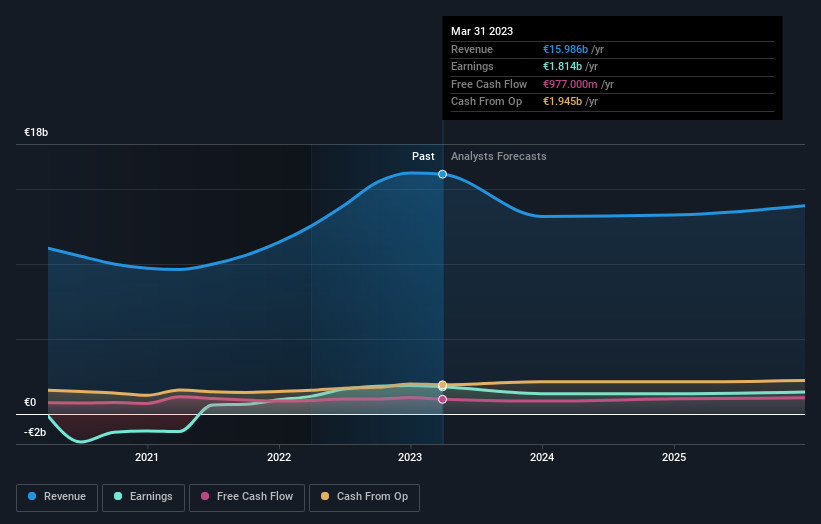

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company's future expectations. Though in the case of Solvay, it is expected to deliver a highly negative earnings growth in the next few years, which doesn’t help build up its investment thesis. It appears that risk of future uncertainty is high, at least in the near term.

What This Means For You

Are you a shareholder? Although SOLB is currently undervalued, the negative outlook does bring on some uncertainty, which equates to higher risk. Consider whether you want to increase your portfolio exposure to SOLB, or whether diversifying into another stock may be a better move for your total risk and return.

Are you a potential investor? If you’ve been keeping an eye on SOLB for a while, but hesitant on making the leap, I recommend you dig deeper into the stock. Given its current undervaluation, now is a great time to make a decision. But keep in mind the risks that come with negative growth prospects in the future.

So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Every company has risks, and we've spotted 1 warning sign for Solvay you should know about.

If you are no longer interested in Solvay, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:SOLB

Solvay

Provides basic and performance chemicals worldwide.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Goldman Sachs Group (GS) The Titan Reclaims Its Crown: Return to Core Excellence

Parker-Hannifin (PH) The Industrial Alchemist: Transforming Motion into Margin

Monolithic Power Systems (MPWR) Powering the Hyperscale Era: The Efficiency Moat

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion