- Israel

- /

- Oil and Gas

- /

- TASE:DLEKG

3 Dividend Stocks Offering Yields Up To 9.8% For Your Income Portfolio

Reviewed by Simply Wall St

As global markets experience a mixed bag of economic indicators, with U.S. consumer confidence dipping and European stocks seeing modest gains, investors are navigating an environment marked by cautious optimism and potential volatility. Amid these shifting dynamics, dividend stocks can offer a stable income stream, making them an attractive option for those looking to balance growth with reliable returns in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.12% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.41% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.71% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.45% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.79% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.37% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.13% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1963 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

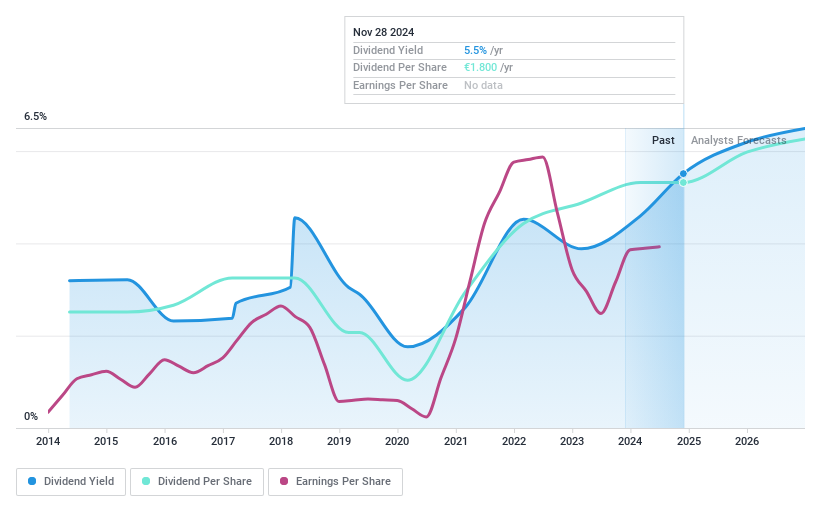

NV Bekaert (ENXTBR:BEKB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NV Bekaert SA is a global provider of steel wire transformation and coating technologies, with a market cap of €1.76 billion.

Operations: NV Bekaert SA generates revenue from several key segments: Rubber Reinforcement (€1.77 billion), Steel Wire Solutions (€1.13 billion), Specialty Businesses (€672.27 million), and Bridon-Bekaert Ropes Group (€548.20 million).

Dividend Yield: 5.4%

NV Bekaert's dividend yield of 5.36% is modest compared to the top Belgian dividend payers, yet its payout ratios indicate sustainability, with earnings and cash flows covering dividends at 37.3% and 52.5%, respectively. Despite a history of volatile dividends, payments have grown over the past decade. The company trades at a significant discount to its estimated fair value and offers good relative value in its industry, though recent sales guidance suggests challenges with lower volumes and pricing affecting revenue near €4 billion.

- Get an in-depth perspective on NV Bekaert's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that NV Bekaert is trading behind its estimated value.

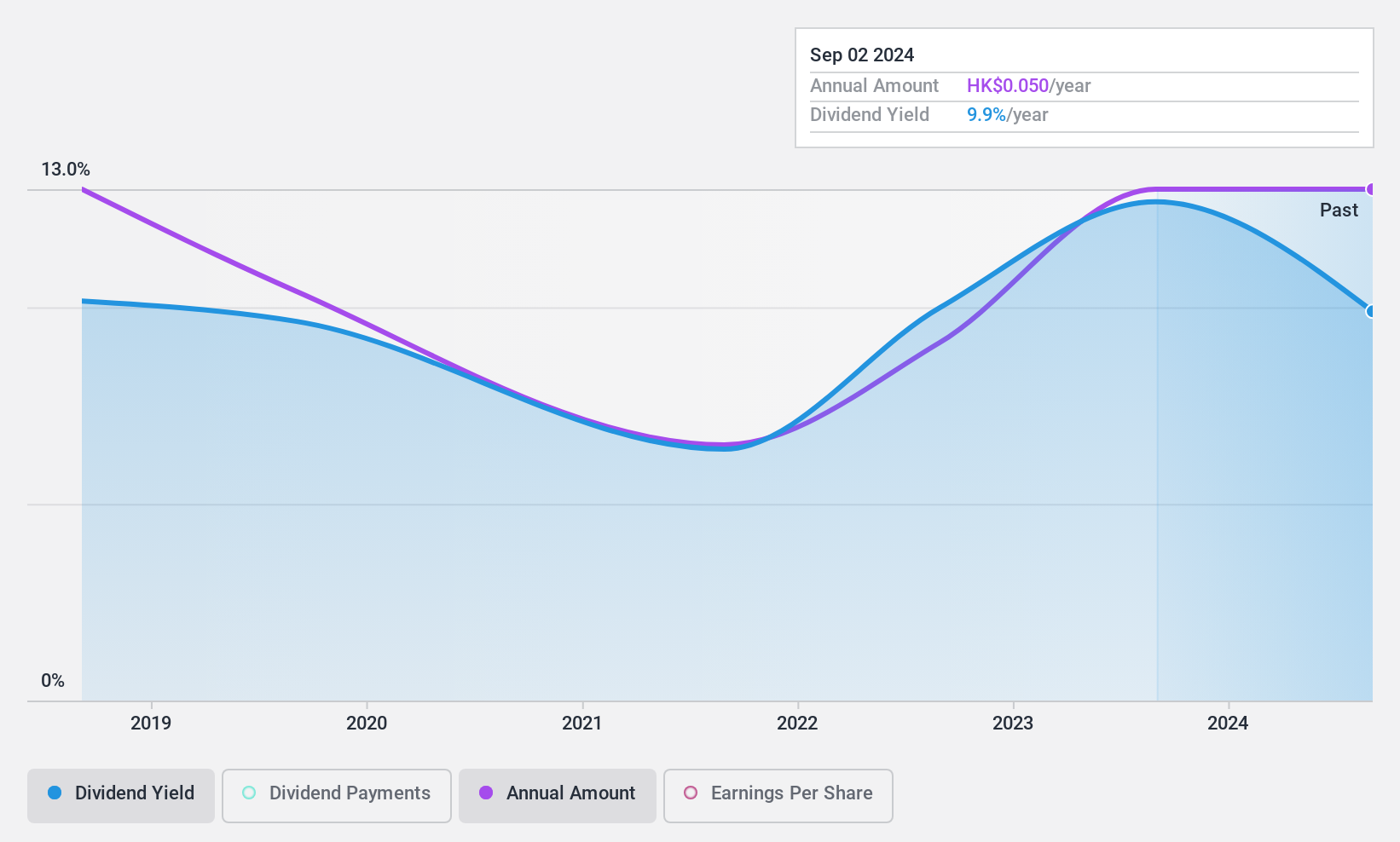

Able Engineering Holdings (SEHK:1627)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Able Engineering Holdings Limited is an investment holding company engaged in the building construction business in Hong Kong, with a market cap of HK$1.12 billion.

Operations: Able Engineering Holdings Limited generates revenue from its building construction business in Hong Kong amounting to HK$6.43 billion.

Dividend Yield: 8.9%

Able Engineering Holdings' dividend yield of 8.93% ranks in the top 25% in Hong Kong, supported by a low payout ratio of 41.2% and cash payout ratio of 14.2%, indicating sustainability from earnings and cash flows. However, its six-year dividend history is marked by volatility and lack of growth, suggesting unreliability. Recent earnings showed significant improvement with sales reaching HK$3.95 billion and net income rising to HK$99.89 million for the half-year ending September 2024.

- Unlock comprehensive insights into our analysis of Able Engineering Holdings stock in this dividend report.

- The analysis detailed in our Able Engineering Holdings valuation report hints at an deflated share price compared to its estimated value.

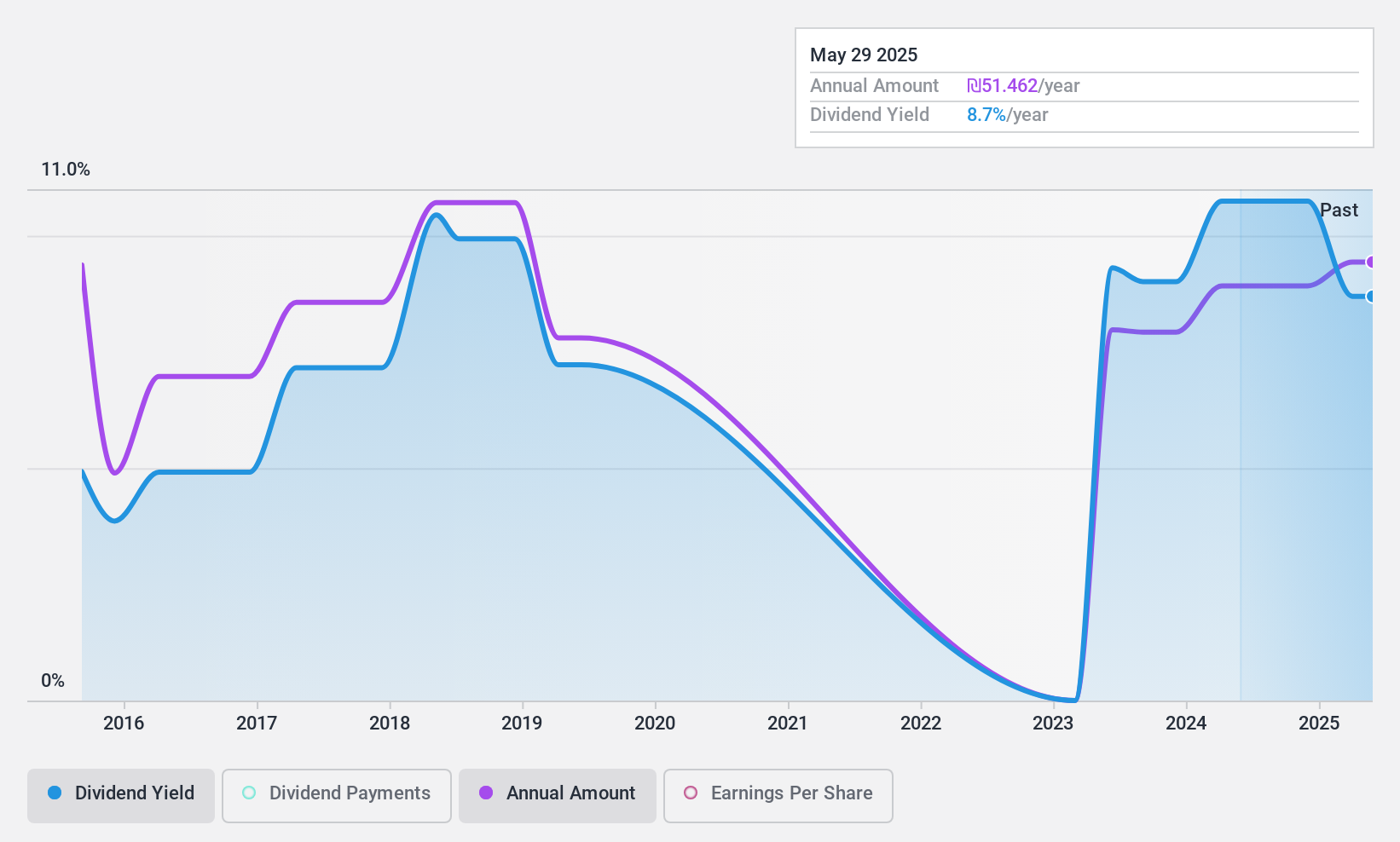

Delek Group (TASE:DLEKG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Delek Group Ltd. is an energy company involved in the exploration, development, production, and marketing of oil and gas both in Israel and internationally, with a market cap of ₪9.10 billion.

Operations: Delek Group's revenue segments include ₪6.45 billion from the development and production of oil and gas assets in the North Sea, and ₪3.74 billion from oil and gas exploration and production in Israel and its surroundings.

Dividend Yield: 9.8%

Delek Group's dividend yield of 9.81% is among the top 25% in Israel, supported by a low cash payout ratio of 24.7%, indicating strong coverage by cash flows despite an 85.4% earnings payout ratio. However, its dividend history is unstable with significant volatility over the past decade, raising concerns about reliability. Recent results show declining sales and net income for Q3 2024 at ILS 2.59 billion and ILS 403 million respectively, compared to last year’s figures.

- Click here and access our complete dividend analysis report to understand the dynamics of Delek Group.

- According our valuation report, there's an indication that Delek Group's share price might be on the cheaper side.

Make It Happen

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1960 more companies for you to explore.Click here to unveil our expertly curated list of 1963 Top Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:DLEKG

Delek Group

An energy company, engages in the exploration, development, production, and marketing of oil and gas in Israel and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives