- Belgium

- /

- Personal Products

- /

- ENXTBR:ONTEX

Shareholders Can Be Confident That Ontex Group's (EBR:ONTEX) Earnings Are High Quality

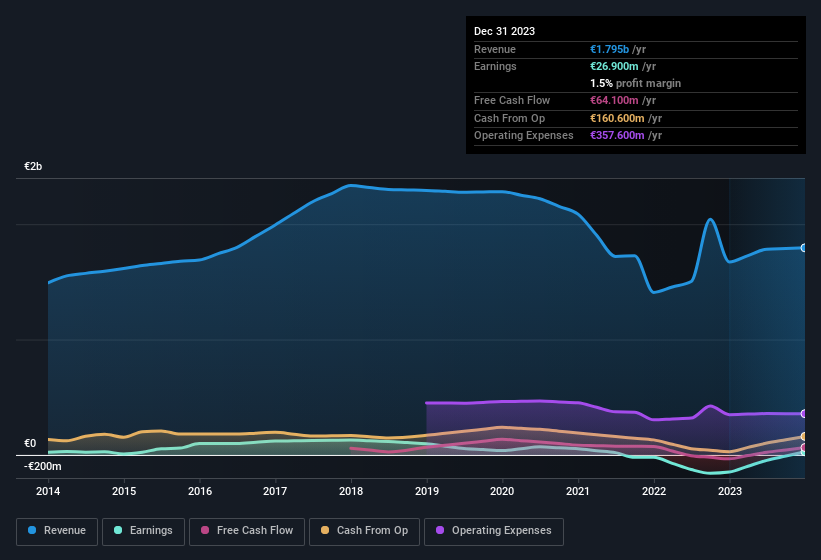

Ontex Group NV's (EBR:ONTEX) strong earnings report was rewarded with a positive stock price move. We have done some analysis, and we found several positive factors beyond the profit numbers.

See our latest analysis for Ontex Group

How Do Unusual Items Influence Profit?

Importantly, our data indicates that Ontex Group's profit was reduced by €15m, due to unusual items, over the last year. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that's hardly a surprise given these line items are considered unusual. Assuming those unusual expenses don't come up again, we'd therefore expect Ontex Group to produce a higher profit next year, all else being equal.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Ontex Group's Profit Performance

Because unusual items detracted from Ontex Group's earnings over the last year, you could argue that we can expect an improved result in the current quarter. Based on this observation, we consider it likely that Ontex Group's statutory profit actually understates its earnings potential! And one can definitely find a positive in the fact that it made a profit this year, despite losing money last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Our analysis shows 2 warning signs for Ontex Group (1 shouldn't be ignored!) and we strongly recommend you look at these before investing.

This note has only looked at a single factor that sheds light on the nature of Ontex Group's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:ONTEX

Ontex Group

Develops, produces, and supplies personal hygiene products and solutions for baby, feminine, and adult care in Belgium, the United Kingdom, Italy, the United States, France, Poland, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Micron Technology will experience a robust 16.5% revenue growth

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion