- Belgium

- /

- Personal Products

- /

- ENXTBR:ONTEX

Ontex Group NV (EBR:ONTEX) Stock Rockets 26% But Many Are Still Ignoring The Company

Ontex Group NV (EBR:ONTEX) shareholders have had their patience rewarded with a 26% share price jump in the last month. Looking further back, the 17% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

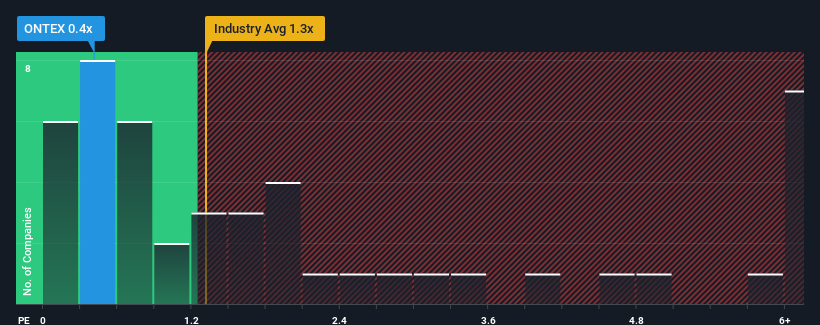

Although its price has surged higher, Ontex Group may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.4x, since almost half of all companies in the Personal Products industry in Belgium have P/S ratios greater than 1.3x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Ontex Group

What Does Ontex Group's Recent Performance Look Like?

Recent times have been advantageous for Ontex Group as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ontex Group.Is There Any Revenue Growth Forecasted For Ontex Group?

Ontex Group's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.3% last year. Still, lamentably revenue has fallen 14% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 3.7% per year over the next three years. That's shaping up to be similar to the 5.6% per year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Ontex Group's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From Ontex Group's P/S?

The latest share price surge wasn't enough to lift Ontex Group's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Ontex Group currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you settle on your opinion, we've discovered 2 warning signs for Ontex Group (1 makes us a bit uncomfortable!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:ONTEX

Ontex Group

Develops, produces, and supplies personal hygiene products and solutions for baby, feminine, and adult care in Belgium, the United Kingdom, Italy, the United States, France, Poland, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives